| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

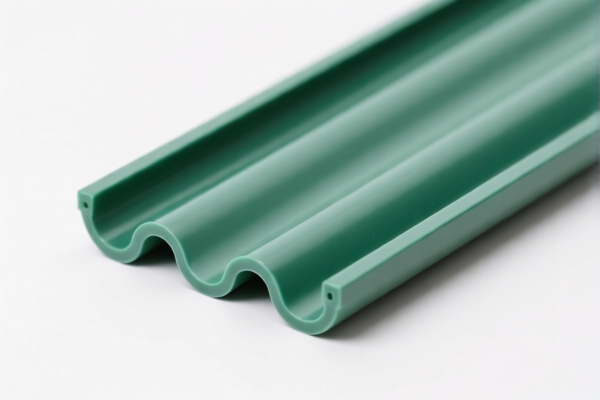

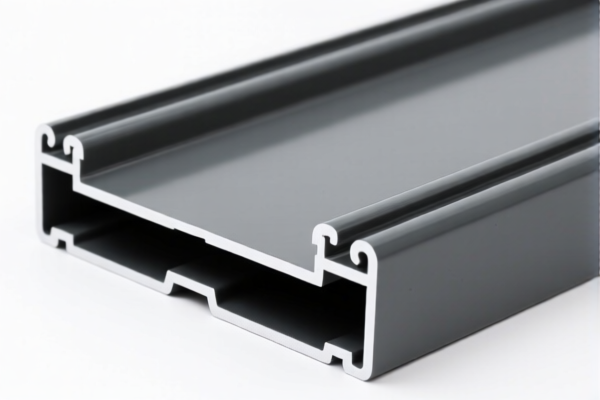

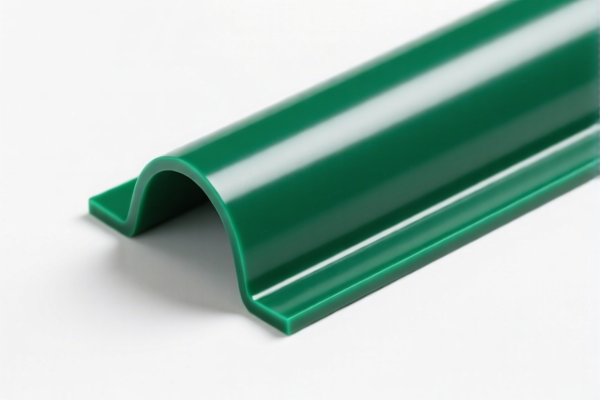

Product Name: PVC耐候管 (PVC Weather-resistant Pipe)

Classification HS CODEs and Tax Details:

✅ HS CODE: 3917320010

Description: PVC耐候管 (PVC Weather-resistant Pipe)

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

- Notes:

- This code is for PVC pipes designed for weather resistance.

- High total tax rate due to both base and additional tariffs.

- Proactive Advice: Confirm the product is not classified under a lower tax rate code (e.g., 3917390020).

✅ HS CODE: 3917390020

Description: PVC耐压管 (PVC Pressure-resistant Pipe)

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 33.1%

- Notes:

- This code is for general-purpose PVC pipes, not specifically weather-resistant.

- Lower tax rate due to no additional tariff before April 11, 2025.

- Proactive Advice: Ensure the product is not misclassified as "weather-resistant" if it is not.

✅ HS CODE: 3917230000

Description: PVC耐压管 (PVC Pressure-resistant Pipe)

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

- Notes:

- This code is for rigid PVC pipes used in pressure applications.

- High tax rate due to additional tariffs.

- Proactive Advice: Verify if the product is rigid or flexible, as this affects classification.

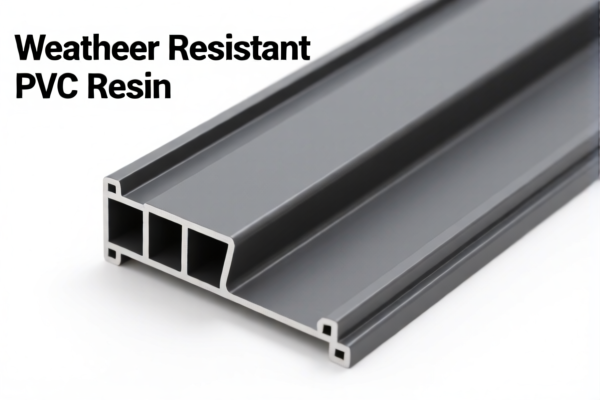

✅ HS CODE: 3904100000

Description: PVC树脂(耐候) (PVC Resin, Weather-resistant)

- Base Tariff Rate: 6.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for raw PVC resin, not finished products.

- High tax rate due to additional tariffs.

- Proactive Advice: If importing raw materials, ensure the product is not misclassified as a finished product.

✅ HS CODE: 3918104050

Description: PVC墙面耐候贴膜 (PVC Weather-resistant Wall Film)

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is for PVC wall coverings, not pipes.

- High tax rate due to additional tariffs.

- Proactive Advice: Confirm the product is not a wall film if it is intended for pipe use.

📌 Key Policy Alert: April 11, 2025 Tariff Increase

- All listed HS codes are subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy and may significantly increase import costs.

- Action Required: Review your import schedule and consider adjusting it if possible.

📌 Proactive Advice Summary

- Verify the product's exact specifications (e.g., whether it is weather-resistant, pressure-resistant, rigid, or flexible).

- Check the unit price and material composition to ensure correct classification.

- Confirm required certifications (e.g., RoHS, REACH, or other local regulations).

- Review the April 11, 2025 tariff change and its impact on your total cost.

Let me know if you need help with HS code verification or customs documentation.

Product Name: PVC耐候管 (PVC Weather-resistant Pipe)

Classification HS CODEs and Tax Details:

✅ HS CODE: 3917320010

Description: PVC耐候管 (PVC Weather-resistant Pipe)

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

- Notes:

- This code is for PVC pipes designed for weather resistance.

- High total tax rate due to both base and additional tariffs.

- Proactive Advice: Confirm the product is not classified under a lower tax rate code (e.g., 3917390020).

✅ HS CODE: 3917390020

Description: PVC耐压管 (PVC Pressure-resistant Pipe)

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 33.1%

- Notes:

- This code is for general-purpose PVC pipes, not specifically weather-resistant.

- Lower tax rate due to no additional tariff before April 11, 2025.

- Proactive Advice: Ensure the product is not misclassified as "weather-resistant" if it is not.

✅ HS CODE: 3917230000

Description: PVC耐压管 (PVC Pressure-resistant Pipe)

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

- Notes:

- This code is for rigid PVC pipes used in pressure applications.

- High tax rate due to additional tariffs.

- Proactive Advice: Verify if the product is rigid or flexible, as this affects classification.

✅ HS CODE: 3904100000

Description: PVC树脂(耐候) (PVC Resin, Weather-resistant)

- Base Tariff Rate: 6.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for raw PVC resin, not finished products.

- High tax rate due to additional tariffs.

- Proactive Advice: If importing raw materials, ensure the product is not misclassified as a finished product.

✅ HS CODE: 3918104050

Description: PVC墙面耐候贴膜 (PVC Weather-resistant Wall Film)

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is for PVC wall coverings, not pipes.

- High tax rate due to additional tariffs.

- Proactive Advice: Confirm the product is not a wall film if it is intended for pipe use.

📌 Key Policy Alert: April 11, 2025 Tariff Increase

- All listed HS codes are subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy and may significantly increase import costs.

- Action Required: Review your import schedule and consider adjusting it if possible.

📌 Proactive Advice Summary

- Verify the product's exact specifications (e.g., whether it is weather-resistant, pressure-resistant, rigid, or flexible).

- Check the unit price and material composition to ensure correct classification.

- Confirm required certifications (e.g., RoHS, REACH, or other local regulations).

- Review the April 11, 2025 tariff change and its impact on your total cost.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.