| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3916200010 | Doc | 60.8% | CN | US | 2025-05-12 |

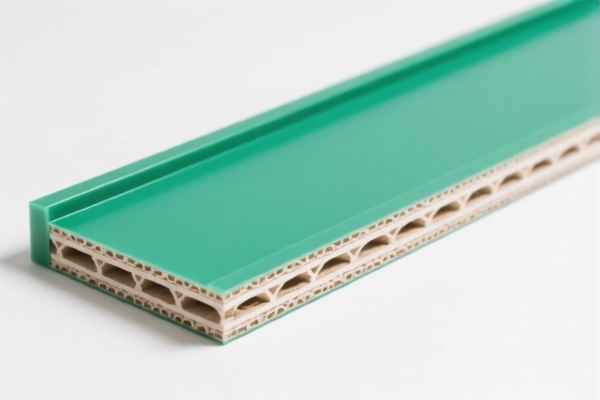

Product Name: PVC覆膜板 (PVC Film-Coated Panels)

Classification HS CODEs and Tax Details:

- HS CODE: 3921125000

- Description: Other plastic sheets, plates, films, foils, and strips based on polyvinyl chloride (PVC) polymers.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is for general PVC film-coated panels not specifically for wall or ceiling use.

-

HS CODE: 3918105000

- Description: Wall or ceiling materials made of polyvinyl chloride (PVC) polymers.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for PVC panels specifically used as wall or ceiling materials.

-

HS CODE: 3918103210

- Description: Plastic wall coverings based on polyvinyl chloride (PVC) polymers.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is for PVC wall coverings, possibly including decorative or protective panels.

-

HS CODE: 3918104050

- Description: Wall or ceiling materials made of polyvinyl chloride (PVC) polymers.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for PVC sheets or films used as wall or ceiling coverings.

-

HS CODE: 3916200010

- Description: Exterior wall panels made of polyvinyl chloride (PVC) polymers for buildings.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for PVC panels used as exterior wall cladding.

📌 Important Notes and Recommendations:

- Tariff Increase Alert:

-

Starting April 11, 2025, an additional 30% tariff will be applied to all the above HS codes. Ensure your import timeline accounts for this change.

-

Material Verification:

-

Confirm the exact composition of the PVC film-coated panels (e.g., whether it contains additives, is rigid or flexible, or used for interior vs. exterior applications). This will help in selecting the correct HS code.

-

Certifications Required:

-

Check if import permits, product certifications, or environmental compliance documents are required for PVC products in your destination country.

-

Unit Price and Classification:

-

The tax rate can vary depending on the unit price and classification (e.g., whether it's considered a "sheet" or "panel"). Ensure your product description aligns with the HS code.

-

Anti-Dumping Duty:

- If the product is imported from countries under anti-dumping duty measures (e.g., China), additional duties may apply. Verify with customs or a trade compliance expert.

If you provide more details about the specific use (e.g., interior wall, exterior cladding, decorative panel), material composition, or country of origin, I can help you further narrow down the most accurate HS code and tax calculation.

Product Name: PVC覆膜板 (PVC Film-Coated Panels)

Classification HS CODEs and Tax Details:

- HS CODE: 3921125000

- Description: Other plastic sheets, plates, films, foils, and strips based on polyvinyl chloride (PVC) polymers.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is for general PVC film-coated panels not specifically for wall or ceiling use.

-

HS CODE: 3918105000

- Description: Wall or ceiling materials made of polyvinyl chloride (PVC) polymers.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for PVC panels specifically used as wall or ceiling materials.

-

HS CODE: 3918103210

- Description: Plastic wall coverings based on polyvinyl chloride (PVC) polymers.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is for PVC wall coverings, possibly including decorative or protective panels.

-

HS CODE: 3918104050

- Description: Wall or ceiling materials made of polyvinyl chloride (PVC) polymers.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for PVC sheets or films used as wall or ceiling coverings.

-

HS CODE: 3916200010

- Description: Exterior wall panels made of polyvinyl chloride (PVC) polymers for buildings.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for PVC panels used as exterior wall cladding.

📌 Important Notes and Recommendations:

- Tariff Increase Alert:

-

Starting April 11, 2025, an additional 30% tariff will be applied to all the above HS codes. Ensure your import timeline accounts for this change.

-

Material Verification:

-

Confirm the exact composition of the PVC film-coated panels (e.g., whether it contains additives, is rigid or flexible, or used for interior vs. exterior applications). This will help in selecting the correct HS code.

-

Certifications Required:

-

Check if import permits, product certifications, or environmental compliance documents are required for PVC products in your destination country.

-

Unit Price and Classification:

-

The tax rate can vary depending on the unit price and classification (e.g., whether it's considered a "sheet" or "panel"). Ensure your product description aligns with the HS code.

-

Anti-Dumping Duty:

- If the product is imported from countries under anti-dumping duty measures (e.g., China), additional duties may apply. Verify with customs or a trade compliance expert.

If you provide more details about the specific use (e.g., interior wall, exterior cladding, decorative panel), material composition, or country of origin, I can help you further narrow down the most accurate HS code and tax calculation.

Customer Reviews

No reviews yet.