| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

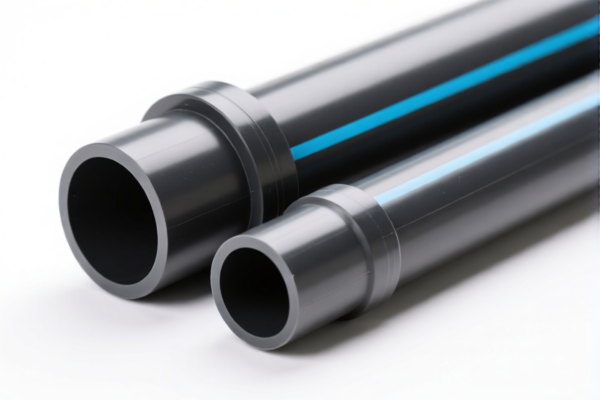

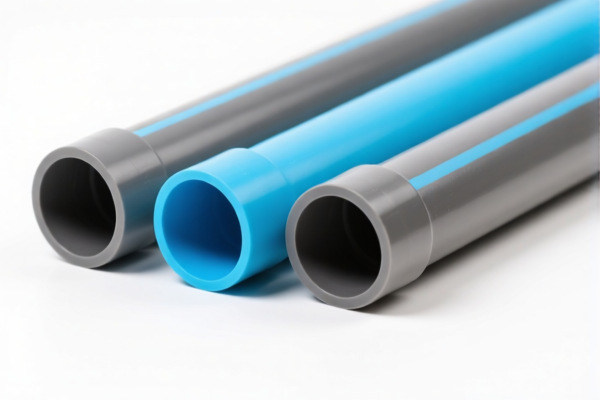

Product Name: PVC输水管 (PVC Water Supply Pipe)

Classification: Plastic pipes and fittings, made of PVC (Polyvinyl Chloride)

✅ HS CODE Classification Overview

Below are the HS CODEs and corresponding tax details for PVC输水管. Please note that the classification depends on the specific product description, material, and intended use.

🔢 HS CODE Details and Tax Rates

1. HS CODE: 3917320050

- Description: Plastic pipes, including those made of PVC.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general PVC pipes used in water supply systems.

2. HS CODE: 3917320010

- Description: PVC pipes (specifically for water supply).

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more specific and may be preferred if the product is clearly defined as PVC water supply pipes.

3. HS CODE: 3917390020

- Description: Plastic pipes and fittings made of PVC.

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be more favorable if the product is classified under a broader category of PVC fittings or pipes.

4. HS CODE: 3904220000

- Description: PVC (polyvinyl chloride) in primary form.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for raw PVC material, not finished products like pipes. Not suitable for finished PVC water supply pipes.

5. HS CODE: 3917230000

- Description: Hard plastic pipes, including PVC.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for hard plastic pipes, which may include PVC water supply pipes.

⚠️ Important Notes and Recommendations

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS CODEs after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

If the product is imported from countries under anti-dumping investigations, additional duties may apply. Confirm with customs or a trade compliance expert. -

Certifications Required:

Ensure the product meets safety and quality standards (e.g., ISO, GB, or local regulations) and has the necessary certifications for import. -

Material and Unit Price Verification:

Confirm the exact material composition (e.g., is it 100% PVC or mixed with other materials?) and unit price to ensure correct classification and tax calculation.

📌 Proactive Advice

- Double-check the product description to ensure it matches the HS CODE description.

- Consult customs or a compliance expert if the product is used in specific applications (e.g., medical, industrial, or agricultural).

- Keep records of product specifications, certifications, and invoices for customs audits.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: PVC输水管 (PVC Water Supply Pipe)

Classification: Plastic pipes and fittings, made of PVC (Polyvinyl Chloride)

✅ HS CODE Classification Overview

Below are the HS CODEs and corresponding tax details for PVC输水管. Please note that the classification depends on the specific product description, material, and intended use.

🔢 HS CODE Details and Tax Rates

1. HS CODE: 3917320050

- Description: Plastic pipes, including those made of PVC.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general PVC pipes used in water supply systems.

2. HS CODE: 3917320010

- Description: PVC pipes (specifically for water supply).

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more specific and may be preferred if the product is clearly defined as PVC water supply pipes.

3. HS CODE: 3917390020

- Description: Plastic pipes and fittings made of PVC.

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be more favorable if the product is classified under a broader category of PVC fittings or pipes.

4. HS CODE: 3904220000

- Description: PVC (polyvinyl chloride) in primary form.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for raw PVC material, not finished products like pipes. Not suitable for finished PVC water supply pipes.

5. HS CODE: 3917230000

- Description: Hard plastic pipes, including PVC.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for hard plastic pipes, which may include PVC water supply pipes.

⚠️ Important Notes and Recommendations

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS CODEs after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

If the product is imported from countries under anti-dumping investigations, additional duties may apply. Confirm with customs or a trade compliance expert. -

Certifications Required:

Ensure the product meets safety and quality standards (e.g., ISO, GB, or local regulations) and has the necessary certifications for import. -

Material and Unit Price Verification:

Confirm the exact material composition (e.g., is it 100% PVC or mixed with other materials?) and unit price to ensure correct classification and tax calculation.

📌 Proactive Advice

- Double-check the product description to ensure it matches the HS CODE description.

- Consult customs or a compliance expert if the product is used in specific applications (e.g., medical, industrial, or agricultural).

- Keep records of product specifications, certifications, and invoices for customs audits.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

PVC供水管的图片是一个不错的点缀。它帮助我可视化产品,不过我希望有关于如何应用HS编码的更多细节。

HS编码3917390020的关税税率分解非常有用。我不知道它有较低的税率,这使它更适合我的产品。

2025年4月11日之后30%的特殊关税的详细解释对于我的进口计划至关重要。这个网站使理解时效性政策变得容易。

HS编码3917320050和3917320010之间的比较非常清晰。现在我知道哪个更适用于PVC供水管,这正是我需要的。

该页面包含很多有用的信息,但我希望HS编码是按关税税率排序而不是仅仅列出。尽管如此,这些细节还是很有帮助。