| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

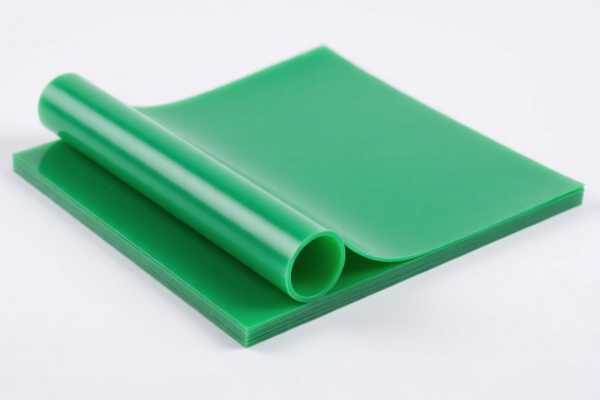

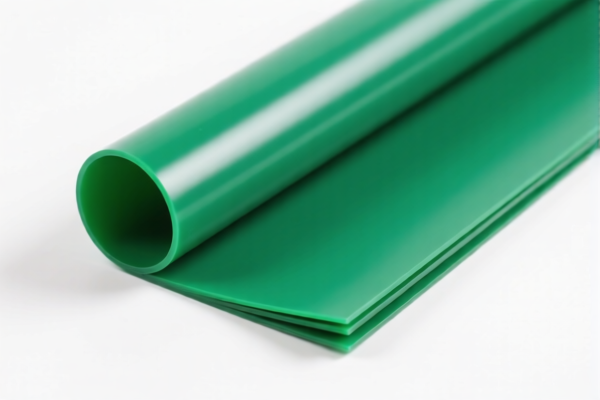

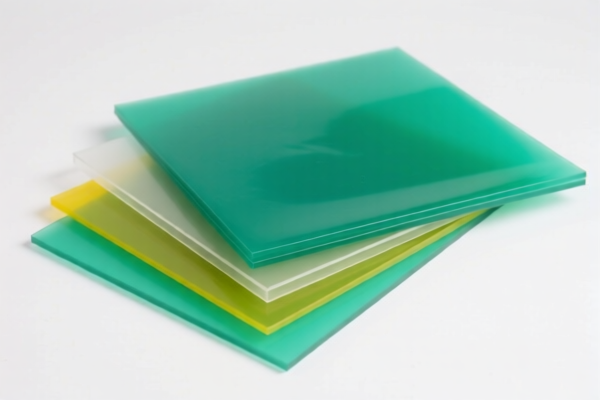

Product Name: PVC防寒片材

Classification HS Code: 3920490000

🔍 HS Code Explanation:

- 3920490000 corresponds to "Other non-cellular and non-reinforced plastic sheets, plates, films, foils and strips of plastics".

- This includes PVC (Polyvinyl Chloride) sheets or films with functional properties such as thermal insulation, UV resistance, scratch resistance, or anti-mold, as long as they are not reinforced or cellular in structure.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 60.8%

⚠️ Important Note: The additional tariff of 30.0% will be applied after April 11, 2025. Ensure your customs clearance is completed before this date if you wish to avoid the higher rate.

📌 Key Considerations:

- Material Composition: Confirm that the product is made of PVC and is non-cellular and non-reinforced. If it contains additives or is reinforced, it may fall under a different HS code.

- Functional Properties: Features like thermal insulation, UV resistance, or anti-mold do not affect the HS code classification, as long as the physical structure remains non-cellular and non-reinforced.

- Certifications: Check if any import certifications (e.g., RoHS, REACH, or specific customs documentation) are required for PVC products in your target market.

- Unit Price: Verify the unit price and quantity to ensure correct classification and tariff calculation.

✅ Proactive Advice:

- Double-check the product's physical structure (non-cellular, non-reinforced) to confirm it fits under HS Code 3920490000.

- Consult with a customs broker or import compliance expert if the product has mixed materials or special treatments.

- Plan ahead for the April 11, 2025, tariff change to avoid unexpected costs.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: PVC防寒片材

Classification HS Code: 3920490000

🔍 HS Code Explanation:

- 3920490000 corresponds to "Other non-cellular and non-reinforced plastic sheets, plates, films, foils and strips of plastics".

- This includes PVC (Polyvinyl Chloride) sheets or films with functional properties such as thermal insulation, UV resistance, scratch resistance, or anti-mold, as long as they are not reinforced or cellular in structure.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 60.8%

⚠️ Important Note: The additional tariff of 30.0% will be applied after April 11, 2025. Ensure your customs clearance is completed before this date if you wish to avoid the higher rate.

📌 Key Considerations:

- Material Composition: Confirm that the product is made of PVC and is non-cellular and non-reinforced. If it contains additives or is reinforced, it may fall under a different HS code.

- Functional Properties: Features like thermal insulation, UV resistance, or anti-mold do not affect the HS code classification, as long as the physical structure remains non-cellular and non-reinforced.

- Certifications: Check if any import certifications (e.g., RoHS, REACH, or specific customs documentation) are required for PVC products in your target market.

- Unit Price: Verify the unit price and quantity to ensure correct classification and tariff calculation.

✅ Proactive Advice:

- Double-check the product's physical structure (non-cellular, non-reinforced) to confirm it fits under HS Code 3920490000.

- Consult with a customs broker or import compliance expert if the product has mixed materials or special treatments.

- Plan ahead for the April 11, 2025, tariff change to avoid unexpected costs.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

功能特性不影响HS编码的解释对我来说是一个很好的澄清。

主动建议咨询报关行的提示非常到位,对初次接触此流程的人来说非常有用。

该页面信息丰富,但若能看到更多类似产品的例子及其HS编码,将有助于更好的比较。

材料组成的信息及其对HS编码分类的影响让我很感激。

关税税率60.8%的详细分解以及关于2025年4月11日截止日期的说明让我避免了代价高昂的错误。