| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3916200010 | Doc | 60.8% | CN | US | 2025-05-12 |

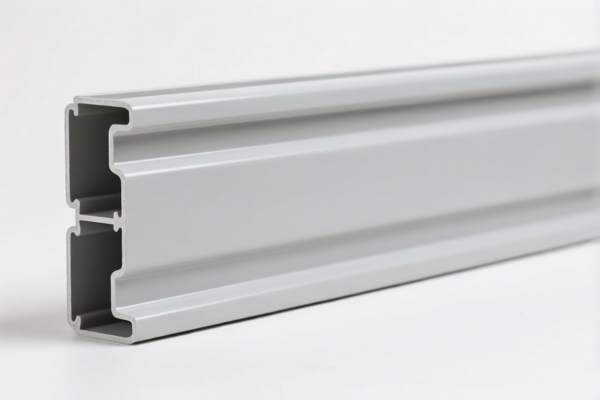

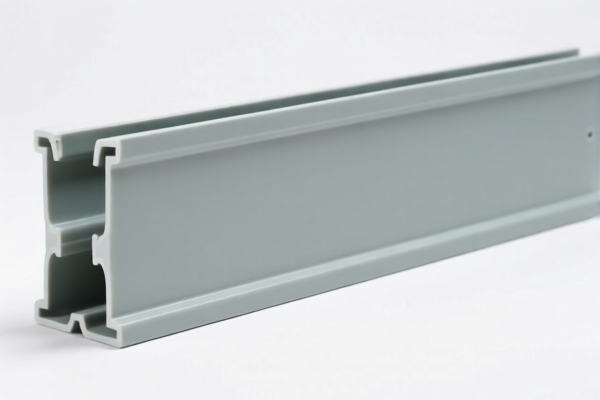

Product Name: PVC Waterproof Wall Decorative Panels

Classification: Plastic Wall Coverings (PVC-based)

✅ HS CODE Classification Overview

Below are the HS codes and associated tariff details for PVC waterproof wall decorative panels. These classifications are based on the product's material (PVC) and intended use (wall covering).

📦 HS CODE Details and Tax Rates

- HS CODE: 3918105000

- Description: PVC waterproof wall decorative panels made from polyvinyl chloride (PVC) polymer.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most favorable rate among the listed options.

-

HS CODE: 3918104050

- Description: PVC wall decorative panels made of plastic.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918103210

- Description: Plastic wall coverings, including PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Highest tax rate among the options.

-

HS CODE: 3918102000

- Description: Plastic wall coverings, including PVC.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3916200010

- Description: PVC building wall decorative panels, including exterior wall panels.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for PVC products unless specifically targeted by anti-dumping investigations (not indicated in this case). -

Material and Certification Verification:

Ensure the product is 100% PVC and not mixed with other materials (e.g., wood, metal), as this may affect classification.

Confirm if certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

📌 Proactive Advice for Importers

- Verify the exact composition of the product (e.g., PVC content, additives, thickness).

- Check the unit of measurement (e.g., per square meter or per panel) to ensure correct tariff application.

- Review the destination country’s import regulations for any additional requirements (e.g., labeling, safety standards).

- Consider the April 11, 2025 deadline for tariff planning and cost estimation.

Let me know if you need help determining the most suitable HS code for your specific product or if you need assistance with customs documentation.

Product Name: PVC Waterproof Wall Decorative Panels

Classification: Plastic Wall Coverings (PVC-based)

✅ HS CODE Classification Overview

Below are the HS codes and associated tariff details for PVC waterproof wall decorative panels. These classifications are based on the product's material (PVC) and intended use (wall covering).

📦 HS CODE Details and Tax Rates

- HS CODE: 3918105000

- Description: PVC waterproof wall decorative panels made from polyvinyl chloride (PVC) polymer.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most favorable rate among the listed options.

-

HS CODE: 3918104050

- Description: PVC wall decorative panels made of plastic.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918103210

- Description: Plastic wall coverings, including PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Highest tax rate among the options.

-

HS CODE: 3918102000

- Description: Plastic wall coverings, including PVC.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3916200010

- Description: PVC building wall decorative panels, including exterior wall panels.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for PVC products unless specifically targeted by anti-dumping investigations (not indicated in this case). -

Material and Certification Verification:

Ensure the product is 100% PVC and not mixed with other materials (e.g., wood, metal), as this may affect classification.

Confirm if certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

📌 Proactive Advice for Importers

- Verify the exact composition of the product (e.g., PVC content, additives, thickness).

- Check the unit of measurement (e.g., per square meter or per panel) to ensure correct tariff application.

- Review the destination country’s import regulations for any additional requirements (e.g., labeling, safety standards).

- Consider the April 11, 2025 deadline for tariff planning and cost estimation.

Let me know if you need help determining the most suitable HS code for your specific product or if you need assistance with customs documentation.

Customer Reviews

这个页面内容非常详细,但一开始让我感到有点不知所措。关于2025年4月11日关税的信息是一个提前规划的好提醒。

我需要PVC装饰板的HS编码,并且很快找到了。关税分解和特殊关税的解释非常清晰。强烈推荐这个页面。

这个页面有很多有用的信息,但HS编码的重复细节使内容有点难以理解。不过,我还是找到了我产品的正确HS编码。

PVC防水墙板的图片帮助我更好地可视化了产品。结合HS编码的详细信息,这是一份非常有用的资源。

关于验证产品成分和认证的信息非常有用。我之前没有意识到在出口前需要检查这些。