| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3916200010 | Doc | 60.8% | CN | US | 2025-05-12 |

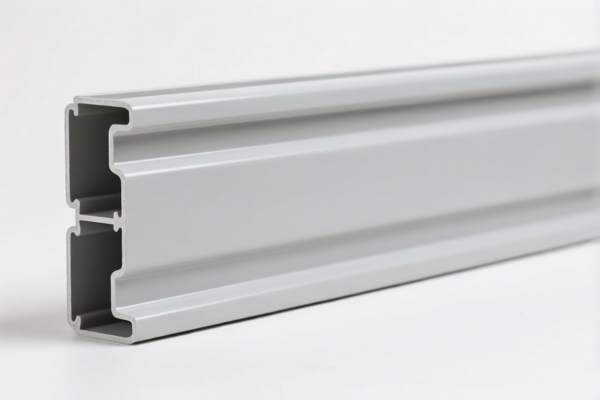

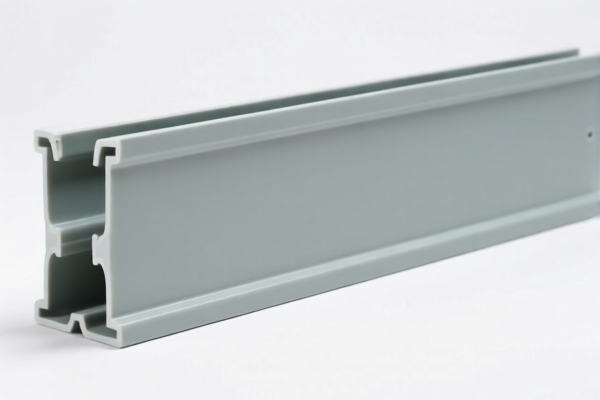

Product Name: PVC防火墙面装饰板 (PVC Fire-Resistant Wall Decorative Panels)

Classification: Based on the provided HS codes, the product falls under several possible classifications depending on specific attributes such as material composition, design, and intended use. Below is a structured breakdown of the HS codes and associated tariffs:

🔍 HS CODE Classification Overview

| HS CODE | Description | Total Tax Rate | Tax Breakdown |

|---|---|---|---|

| 3918105000 | PVC防火墙面装饰板 (PVC Fire-Resistant Wall Decorative Panels) | 59.2% | - Base Tariff: 4.2% - Additional Tariff: 25.0% - April 11, 2025+: 30.0% |

| 3918104050 | PVC墙面防火板 (PVC Fire-Resistant Wall Panels) | 60.3% | - Base Tariff: 5.3% - Additional Tariff: 25.0% - April 11, 2025+: 30.0% |

| 3918103210 | PVC墙面装饰板 (PVC Wall Decorative Panels) | 61.5% | - Base Tariff: 6.5% - Additional Tariff: 25.0% - April 11, 2025+: 30.0% |

| 3918102000 | PVC墙面装饰板 (PVC Wall Decorative Panels) | 60.3% | - Base Tariff: 5.3% - Additional Tariff: 25.0% - April 11, 2025+: 30.0% |

| 3916200010 | PVC建筑墙面装饰板 (PVC Building Wall Decorative Panels) | 60.8% | - Base Tariff: 5.8% - Additional Tariff: 25.0% - April 11, 2025+: 30.0% |

⚠️ Key Tariff Notes

- Additional Tariffs: All HS codes listed include an additional 25.0% tariff, which is likely a standard import surcharge.

- April 11, 2025+ Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied to all these HS codes. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- No Anti-Dumping Duties Mentioned: Based on the provided data, no specific anti-dumping duties on iron or aluminum are applicable to these PVC products.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC (Polyvinyl Chloride) and not a composite or mixed material, as this can affect classification.

- Check Unit Price and Certification: Confirm whether fire-resistant certification or other safety standards are required for import into the destination country.

- Review HS Code Specificity: The correct HS code depends on product design, thickness, and intended use (e.g., interior vs. exterior use).

- Plan for Tariff Increases: With the April 11, 2025 tariff increase, consider adjusting pricing or sourcing strategies in advance.

✅ Summary

- PVC防火墙面装饰板 is classified under several HS codes (e.g., 3918105000, 3918104050, etc.).

- Tariff rates range from 59.2% to 61.5%, with a 30.0% additional tariff after April 11, 2025.

- Importers must confirm product details and prepare for higher costs post-April 2025.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: PVC防火墙面装饰板 (PVC Fire-Resistant Wall Decorative Panels)

Classification: Based on the provided HS codes, the product falls under several possible classifications depending on specific attributes such as material composition, design, and intended use. Below is a structured breakdown of the HS codes and associated tariffs:

🔍 HS CODE Classification Overview

| HS CODE | Description | Total Tax Rate | Tax Breakdown |

|---|---|---|---|

| 3918105000 | PVC防火墙面装饰板 (PVC Fire-Resistant Wall Decorative Panels) | 59.2% | - Base Tariff: 4.2% - Additional Tariff: 25.0% - April 11, 2025+: 30.0% |

| 3918104050 | PVC墙面防火板 (PVC Fire-Resistant Wall Panels) | 60.3% | - Base Tariff: 5.3% - Additional Tariff: 25.0% - April 11, 2025+: 30.0% |

| 3918103210 | PVC墙面装饰板 (PVC Wall Decorative Panels) | 61.5% | - Base Tariff: 6.5% - Additional Tariff: 25.0% - April 11, 2025+: 30.0% |

| 3918102000 | PVC墙面装饰板 (PVC Wall Decorative Panels) | 60.3% | - Base Tariff: 5.3% - Additional Tariff: 25.0% - April 11, 2025+: 30.0% |

| 3916200010 | PVC建筑墙面装饰板 (PVC Building Wall Decorative Panels) | 60.8% | - Base Tariff: 5.8% - Additional Tariff: 25.0% - April 11, 2025+: 30.0% |

⚠️ Key Tariff Notes

- Additional Tariffs: All HS codes listed include an additional 25.0% tariff, which is likely a standard import surcharge.

- April 11, 2025+ Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied to all these HS codes. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- No Anti-Dumping Duties Mentioned: Based on the provided data, no specific anti-dumping duties on iron or aluminum are applicable to these PVC products.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC (Polyvinyl Chloride) and not a composite or mixed material, as this can affect classification.

- Check Unit Price and Certification: Confirm whether fire-resistant certification or other safety standards are required for import into the destination country.

- Review HS Code Specificity: The correct HS code depends on product design, thickness, and intended use (e.g., interior vs. exterior use).

- Plan for Tariff Increases: With the April 11, 2025 tariff increase, consider adjusting pricing or sourcing strategies in advance.

✅ Summary

- PVC防火墙面装饰板 is classified under several HS codes (e.g., 3918105000, 3918104050, etc.).

- Tariff rates range from 59.2% to 61.5%, with a 30.0% additional tariff after April 11, 2025.

- Importers must confirm product details and prepare for higher costs post-April 2025.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

HS编码3918103210的税收分解非常有用。61.5%的税率和额外的25%关税使我可以更容易地计算我的进口成本。

我非常赞赏对不同HS编码及其如何适用于各种PVC墙板设计的清晰解释。它帮助我为我的产品选择合适的编码。

该页面有很多有用的数据,但我希望有更多的类似产品的例子来帮助选择HS编码。这将为我节省一些时间。

关于验证材料成分的部分非常有用。它提醒我要再次检查我的产品是否为100% PVC或复合材料,这会影响HS编码的分类。

我正在寻找HS编码3916200010,并在这里找到了60.8%的关税率。详细的税收分解使我很容易理解我项目的总成本。