| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

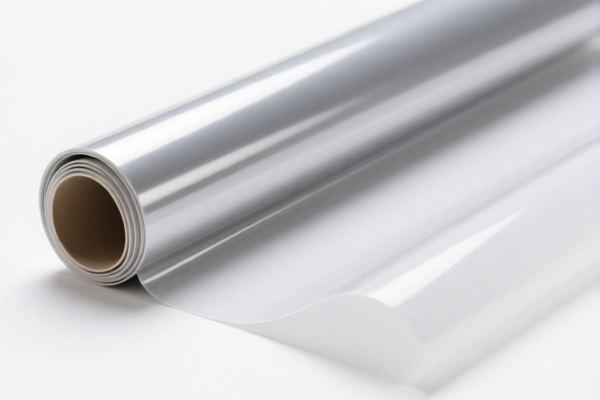

Product Classification: PVC静电膜 (PVC Static Cling Film)

HS CODE: 3920490000, 3920435000, 3918104050, 3918103250, 3920690000

🔍 Classification Overview

PVC静电膜 is a type of plastic film made from polyvinyl chloride (PVC) polymer, often containing plasticizers to enhance flexibility. It is commonly used for decorative or protective purposes, such as wall coverings or static cling applications.

📊 Tariff Summary (as of now)

- Base Tariff Rate: Varies between 4.2% and 6.5%, depending on the specific HS code.

- Additional Tariff (General): 25.0% (applies to all listed HS codes).

- Special Tariff (April 11, 2025 onwards): 30.0% (applies to all listed HS codes).

- Anti-dumping duties on iron and aluminum: Not applicable for PVC products.

📌 Key Tax Rate Changes (April 11, 2025 onwards)

- All listed HS codes will face an additional 30.0% tariff, increasing the total tax rate significantly.

- This is a time-sensitive policy, so it is crucial to plan your import schedule accordingly.

📌 Tariff Breakdown by HS Code

| HS CODE | Base Tariff | Additional Tariff | April 11 Special Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3920490000 | 5.8% | 25.0% | 30.0% | 60.8% |

| 3920435000 | 4.2% | 25.0% | 30.0% | 59.2% |

| 3918104050 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918103250 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920690000 | 4.2% | 25.0% | 30.0% | 59.2% |

⚠️ Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed PVC-based and not a composite or modified material that may fall under a different HS code.

- Check Unit Price and Packaging: Tariff rates may vary based on the product's form (e.g., film vs. sheet) and whether it is pre-printed or finished.

- Confirm Required Certifications: Some products may require specific documentation (e.g., Material Safety Data Sheets, compliance certificates).

- Plan for April 11, 2025 Tariff Increase: If you are importing in the near future, consider the impact of the 30% additional tariff on your cost structure.

- Consult a Customs Broker: For complex or high-value shipments, professional assistance can help avoid misclassification and penalties.

📌 Conclusion

PVC静电膜 is classified under several HS codes depending on its specific use and composition. The total tax rate ranges from 59.2% to 61.5%, with a 30% additional tariff to be applied after April 11, 2025. Be sure to confirm the exact HS code and prepare for the upcoming tariff increase.

Product Classification: PVC静电膜 (PVC Static Cling Film)

HS CODE: 3920490000, 3920435000, 3918104050, 3918103250, 3920690000

🔍 Classification Overview

PVC静电膜 is a type of plastic film made from polyvinyl chloride (PVC) polymer, often containing plasticizers to enhance flexibility. It is commonly used for decorative or protective purposes, such as wall coverings or static cling applications.

📊 Tariff Summary (as of now)

- Base Tariff Rate: Varies between 4.2% and 6.5%, depending on the specific HS code.

- Additional Tariff (General): 25.0% (applies to all listed HS codes).

- Special Tariff (April 11, 2025 onwards): 30.0% (applies to all listed HS codes).

- Anti-dumping duties on iron and aluminum: Not applicable for PVC products.

📌 Key Tax Rate Changes (April 11, 2025 onwards)

- All listed HS codes will face an additional 30.0% tariff, increasing the total tax rate significantly.

- This is a time-sensitive policy, so it is crucial to plan your import schedule accordingly.

📌 Tariff Breakdown by HS Code

| HS CODE | Base Tariff | Additional Tariff | April 11 Special Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3920490000 | 5.8% | 25.0% | 30.0% | 60.8% |

| 3920435000 | 4.2% | 25.0% | 30.0% | 59.2% |

| 3918104050 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918103250 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920690000 | 4.2% | 25.0% | 30.0% | 59.2% |

⚠️ Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed PVC-based and not a composite or modified material that may fall under a different HS code.

- Check Unit Price and Packaging: Tariff rates may vary based on the product's form (e.g., film vs. sheet) and whether it is pre-printed or finished.

- Confirm Required Certifications: Some products may require specific documentation (e.g., Material Safety Data Sheets, compliance certificates).

- Plan for April 11, 2025 Tariff Increase: If you are importing in the near future, consider the impact of the 30% additional tariff on your cost structure.

- Consult a Customs Broker: For complex or high-value shipments, professional assistance can help avoid misclassification and penalties.

📌 Conclusion

PVC静电膜 is classified under several HS codes depending on its specific use and composition. The total tax rate ranges from 59.2% to 61.5%, with a 30% additional tariff to be applied after April 11, 2025. Be sure to confirm the exact HS code and prepare for the upcoming tariff increase.

Customer Reviews

该网站通过提供PVC静电吸附膜的确切HS编码和关税率为我节省了时间。强烈推荐给出口商。

分类概述清晰简洁。我现在明白了为什么PVC静电吸附膜被归类到多个HS编码下。

我发现3920435000的关税摘要非常有帮助。59.2%的税率正是我进口计划所需要的。

信息是准确的,但我希望有关于如何为不同类型的PVC薄膜选择正确HS编码的更多细节。

查找PVC静电吸附膜正确HS编码的绝佳资源。4月11日的附加关税信息简直是救星。