| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

Product Classification and Customs Duty Analysis for PVC Food-Grade Sheets

Based on the provided HS codes and tax details

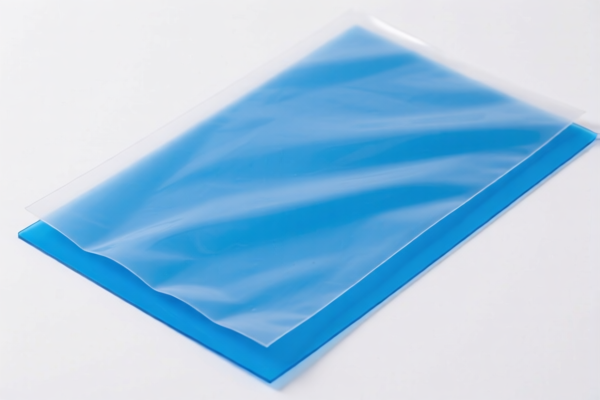

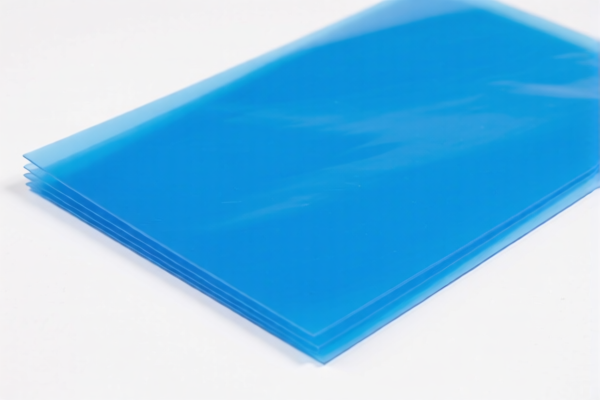

✅ HS CODE: 3921125000

Product Description: PVC Food-Grade Sheets

Classification: Other plastic sheets, plates, films, foils, and strips (HS Code 3921)

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This is the most applicable HS code for PVC food-grade sheets.

📌 Proactive Advice for Users:

- Verify Material Composition: Ensure the product is indeed made of PVC and is certified as food-grade (e.g., FDA, GB standards).

- Check Unit Price and Packaging: Customs may require detailed documentation on the product's use and intended market.

- Certifications Required: Confirm if any specific certifications (e.g., food contact material compliance) are needed for import.

- Monitor Tariff Changes: The 30.0% additional tariff after April 11, 2025, will significantly increase the total cost. Plan accordingly.

📌 Other Related HS Codes for Reference:

1. HS CODE: 3917320010

Product Description: PVC Food-Grade Pipes

Total Tax Rate: 58.1%

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Applicable for PVC pipes, not sheets.

2. HS CODE: 3917330000

Product Description: Other Plastic Pipes and Fittings

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower tax rate, but only for non-PVC plastic pipes.

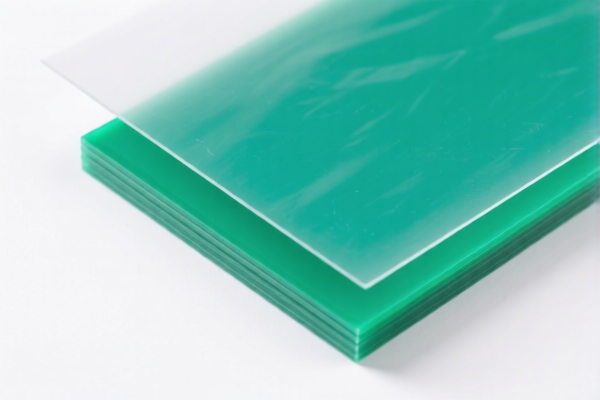

3. HS CODE: 3920632000

Product Description: Polycarbonate Food-Grade Sheets

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: For polycarbonate sheets, not PVC.

4. HS CODE: 3920610000

Product Description: Polycarbonate Food-Grade Sheets

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same as above, but may differ in specific product details.

📌 Summary of Key Tax Rate Changes (April 11, 2025):

- All products listed above will face an additional 30.0% tariff after April 11, 2025.

- This is a critical date for importers to consider in cost planning and compliance.

📌 Final Recommendation:

- Confirm the exact HS code based on the product's material and use.

- Review documentation for food-grade compliance and certifications.

- Plan for increased costs due to the April 11, 2025 tariff increase.

Product Classification and Customs Duty Analysis for PVC Food-Grade Sheets

Based on the provided HS codes and tax details

✅ HS CODE: 3921125000

Product Description: PVC Food-Grade Sheets

Classification: Other plastic sheets, plates, films, foils, and strips (HS Code 3921)

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Note: This is the most applicable HS code for PVC food-grade sheets.

📌 Proactive Advice for Users:

- Verify Material Composition: Ensure the product is indeed made of PVC and is certified as food-grade (e.g., FDA, GB standards).

- Check Unit Price and Packaging: Customs may require detailed documentation on the product's use and intended market.

- Certifications Required: Confirm if any specific certifications (e.g., food contact material compliance) are needed for import.

- Monitor Tariff Changes: The 30.0% additional tariff after April 11, 2025, will significantly increase the total cost. Plan accordingly.

📌 Other Related HS Codes for Reference:

1. HS CODE: 3917320010

Product Description: PVC Food-Grade Pipes

Total Tax Rate: 58.1%

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Applicable for PVC pipes, not sheets.

2. HS CODE: 3917330000

Product Description: Other Plastic Pipes and Fittings

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower tax rate, but only for non-PVC plastic pipes.

3. HS CODE: 3920632000

Product Description: Polycarbonate Food-Grade Sheets

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: For polycarbonate sheets, not PVC.

4. HS CODE: 3920610000

Product Description: Polycarbonate Food-Grade Sheets

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same as above, but may differ in specific product details.

📌 Summary of Key Tax Rate Changes (April 11, 2025):

- All products listed above will face an additional 30.0% tariff after April 11, 2025.

- This is a critical date for importers to consider in cost planning and compliance.

📌 Final Recommendation:

- Confirm the exact HS code based on the product's material and use.

- Review documentation for food-grade compliance and certifications.

- Plan for increased costs due to the April 11, 2025 tariff increase.

Customer Reviews

No reviews yet.