| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

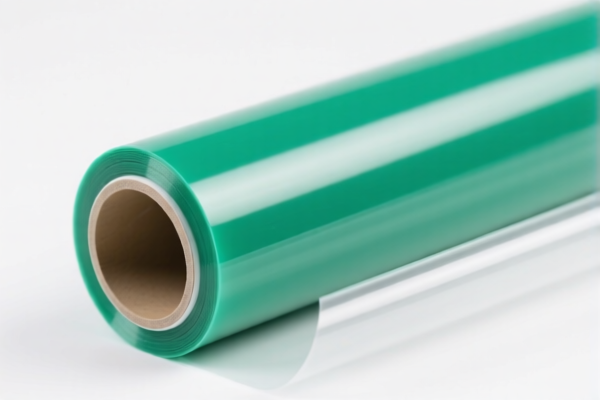

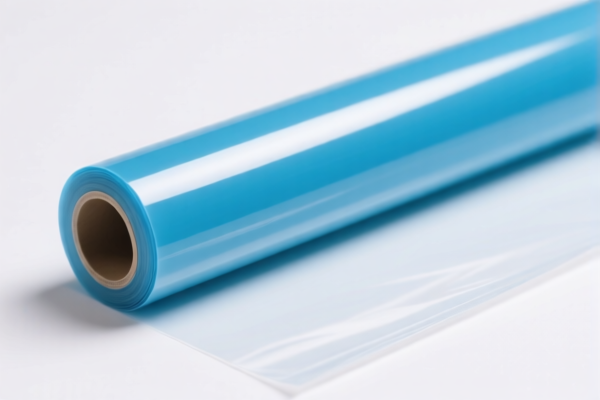

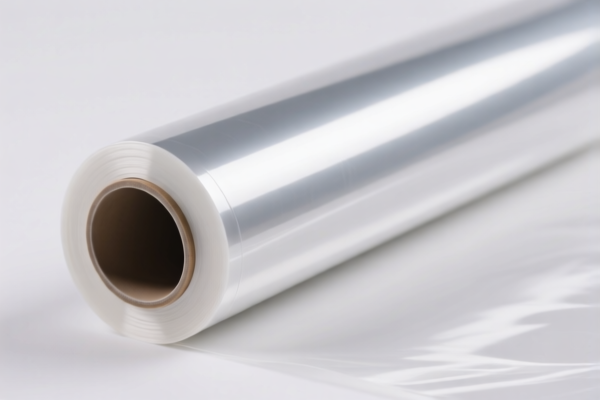

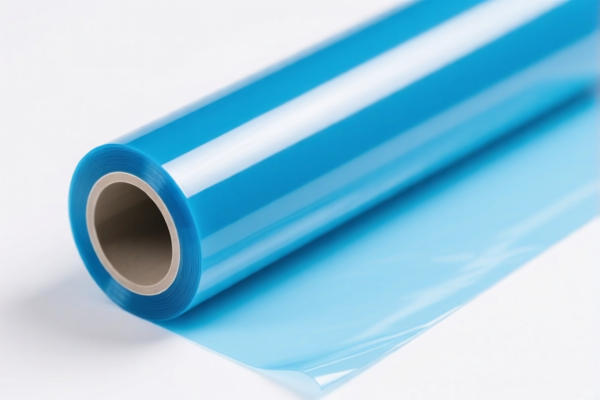

Product Name: PVC高塑化汽车C柱贴膜

HS CODE: 3920431000

🔍 Product Classification Summary:

- The product is classified under HS CODE 3920431000, which falls under the category of plastic sheets, films, foils, and strips.

- It is described as a PVC high-plasticized automotive C-pillar film, which is a type of synthetic leather-like product or layered plastic product.

📊 Tariff Breakdown (as of latest data):

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

⚠️ Important Notes on Tariff Changes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025, increasing the total tax rate to 58.1%.

This is a time-sensitive policy, so importers must plan accordingly. -

No Anti-Dumping Duties Mentioned:

As of now, no specific anti-dumping duties on iron or aluminum are applicable to this product.

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the product is indeed PVC-based and not a composite with other materials that might change the HS classification. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether certifications (e.g., RoHS, REACH, or customs documentation) are required for import compliance. -

Monitor Tariff Updates:

Stay updated on tariff changes, especially the April 11, 2025 deadline, to avoid unexpected costs. -

Consult Customs Broker:

For complex classifications or large shipments, it is advisable to consult a customs broker or compliance expert to ensure accurate classification and tax calculation.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: PVC高塑化汽车C柱贴膜

HS CODE: 3920431000

🔍 Product Classification Summary:

- The product is classified under HS CODE 3920431000, which falls under the category of plastic sheets, films, foils, and strips.

- It is described as a PVC high-plasticized automotive C-pillar film, which is a type of synthetic leather-like product or layered plastic product.

📊 Tariff Breakdown (as of latest data):

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

⚠️ Important Notes on Tariff Changes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025, increasing the total tax rate to 58.1%.

This is a time-sensitive policy, so importers must plan accordingly. -

No Anti-Dumping Duties Mentioned:

As of now, no specific anti-dumping duties on iron or aluminum are applicable to this product.

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the product is indeed PVC-based and not a composite with other materials that might change the HS classification. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether certifications (e.g., RoHS, REACH, or customs documentation) are required for import compliance. -

Monitor Tariff Updates:

Stay updated on tariff changes, especially the April 11, 2025 deadline, to avoid unexpected costs. -

Consult Customs Broker:

For complex classifications or large shipments, it is advisable to consult a customs broker or compliance expert to ensure accurate classification and tax calculation.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.