| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

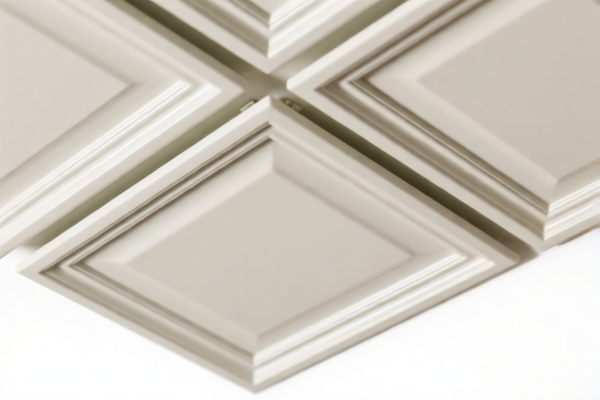

Product Name: PVC Ceiling Decorative Panel

Classification HS Code: Multiple options based on product specifics

🔍 HS Code Classification Overview

Below are the HS codes and corresponding tax details for PVC ceiling decorative panels. The classification depends on the product's specific description, material, and intended use.

📌 HS Code 3918103250

Description: PVC ceiling decorative material, classified under HS 3918, which includes plastic floor coverings and wall/ceiling coverings.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general PVC ceiling materials, not specifically for panels.

📌 HS Code 3918105000

Description: PVC ceiling panels, clearly defined as made from polyvinyl chloride (PVC) polymer for walls or ceilings.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more specific code for PVC ceiling panels.

📌 HS Code 3921125000

Description: PVC ceiling panels classified under HS 3921, which includes other plastic sheets, films, foils, and strips.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is broader and may apply to non-specific plastic panels.

📌 HS Code 3918102000

Description: PVC ceiling panels classified under HS 3918102000, which includes plastic carpets, floor coverings, or wall/ceiling coverings.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC panels used as ceiling coverings.

📌 HS Code 3918901000

Description: PVC ceiling panels classified under HS 3918901000, which includes plastic wall or ceiling coverings.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general plastic ceiling coverings.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: All listed codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is 100% PVC or contains other additives).

- Certifications: Check if any certifications (e.g., fire resistance, environmental compliance) are required for import.

- Unit Price: Verify the unit price and whether it affects the classification or tax calculation.

- Customs Declaration: Accurate product description is crucial to avoid misclassification and additional penalties.

✅ Proactive Advice

- Double-check the product description to match the most accurate HS code.

- Consult with customs brokers or local customs authorities for the latest updates on tariff policies.

- Keep records of product specifications, invoices, and certifications for customs compliance.

Let me know if you need help determining the most suitable HS code for your specific product.

Product Name: PVC Ceiling Decorative Panel

Classification HS Code: Multiple options based on product specifics

🔍 HS Code Classification Overview

Below are the HS codes and corresponding tax details for PVC ceiling decorative panels. The classification depends on the product's specific description, material, and intended use.

📌 HS Code 3918103250

Description: PVC ceiling decorative material, classified under HS 3918, which includes plastic floor coverings and wall/ceiling coverings.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general PVC ceiling materials, not specifically for panels.

📌 HS Code 3918105000

Description: PVC ceiling panels, clearly defined as made from polyvinyl chloride (PVC) polymer for walls or ceilings.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more specific code for PVC ceiling panels.

📌 HS Code 3921125000

Description: PVC ceiling panels classified under HS 3921, which includes other plastic sheets, films, foils, and strips.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is broader and may apply to non-specific plastic panels.

📌 HS Code 3918102000

Description: PVC ceiling panels classified under HS 3918102000, which includes plastic carpets, floor coverings, or wall/ceiling coverings.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC panels used as ceiling coverings.

📌 HS Code 3918901000

Description: PVC ceiling panels classified under HS 3918901000, which includes plastic wall or ceiling coverings.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general plastic ceiling coverings.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: All listed codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is 100% PVC or contains other additives).

- Certifications: Check if any certifications (e.g., fire resistance, environmental compliance) are required for import.

- Unit Price: Verify the unit price and whether it affects the classification or tax calculation.

- Customs Declaration: Accurate product description is crucial to avoid misclassification and additional penalties.

✅ Proactive Advice

- Double-check the product description to match the most accurate HS code.

- Consult with customs brokers or local customs authorities for the latest updates on tariff policies.

- Keep records of product specifications, invoices, and certifications for customs compliance.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.