| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

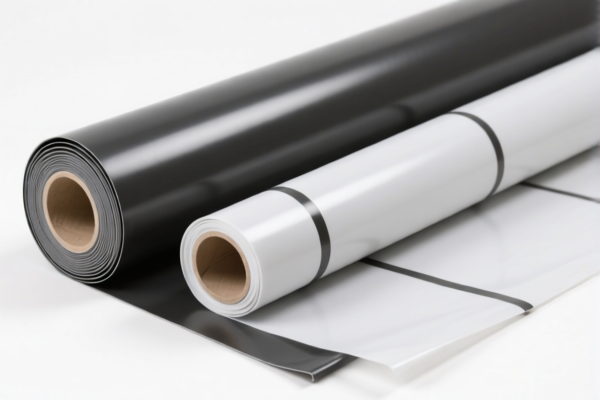

Here is the structured classification and tariff information for the PVC Commercial Floor Covering Rolls based on the provided HS codes and tax details:

📦 Product Classification Overview: PVC Commercial Floor Covering Rolls

🔢 HS CODE: 3918905000

Product Description: PVC Floor Sticker Rolls

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

🔢 HS CODE: 3918101040

Product Description: PVC Floor Tiles (in Rolls)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔢 HS CODE: 3918901000

Product Description:

- Building Use Plastic Floor Rolls

- Residential PVC Floor Roll Material

- Plastic Floor Mosaic Rolls

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📌 Key Notes and Recommendations

-

Tariff Increase Alert:

A special tariff of 30.0% will be applied after April 11, 2025, which is significantly higher than the standard additional tariff of 25.0%. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the exact composition of the PVC floor covering (e.g., whether it contains additives, is reinforced, or has special surface treatments), as this may affect classification. -

Certifications Required:

Check if certifications (e.g., fire resistance, environmental compliance, or safety standards) are required for import into the destination country. -

Unit Price and Classification:

The HS code may vary based on the unit price and intended use (e.g., commercial vs. residential). Ensure the product description aligns with the correct classification. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for PVC floor coverings in this context, but always verify with the latest customs updates or consult a customs broker for confirmation.

✅ Proactive Advice Summary

- Plan import dates carefully to avoid the April 11, 2025, tariff increase.

- Verify product composition and intended use to ensure correct HS code classification.

- Check for required certifications before shipping.

- Consult a customs expert for complex or high-value shipments.

Let me know if you need help with HS code selection or tariff calculation for a specific product. Here is the structured classification and tariff information for the PVC Commercial Floor Covering Rolls based on the provided HS codes and tax details:

📦 Product Classification Overview: PVC Commercial Floor Covering Rolls

🔢 HS CODE: 3918905000

Product Description: PVC Floor Sticker Rolls

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

🔢 HS CODE: 3918101040

Product Description: PVC Floor Tiles (in Rolls)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔢 HS CODE: 3918901000

Product Description:

- Building Use Plastic Floor Rolls

- Residential PVC Floor Roll Material

- Plastic Floor Mosaic Rolls

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📌 Key Notes and Recommendations

-

Tariff Increase Alert:

A special tariff of 30.0% will be applied after April 11, 2025, which is significantly higher than the standard additional tariff of 25.0%. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the exact composition of the PVC floor covering (e.g., whether it contains additives, is reinforced, or has special surface treatments), as this may affect classification. -

Certifications Required:

Check if certifications (e.g., fire resistance, environmental compliance, or safety standards) are required for import into the destination country. -

Unit Price and Classification:

The HS code may vary based on the unit price and intended use (e.g., commercial vs. residential). Ensure the product description aligns with the correct classification. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for PVC floor coverings in this context, but always verify with the latest customs updates or consult a customs broker for confirmation.

✅ Proactive Advice Summary

- Plan import dates carefully to avoid the April 11, 2025, tariff increase.

- Verify product composition and intended use to ensure correct HS code classification.

- Check for required certifications before shipping.

- Consult a customs expert for complex or high-value shipments.

Let me know if you need help with HS code selection or tariff calculation for a specific product.

Customer Reviews

No reviews yet.