| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

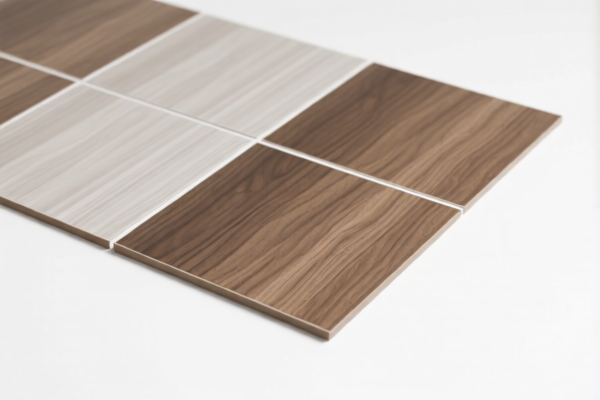

Product Classification: PVC Commercial Floor Tile

HS CODE: 3918101020, 3918101030, 3918101040, 3918102000 (multiple codes may apply depending on specific product details)

🔍 Classification Summary:

- These HS codes classify PVC-based floor tiles and related floor coverings, including vinyl tiles, rigid foam core tiles, and flooring in sheet or tile form.

- The product must be made of polyvinyl chloride (PVC) polymer or rigid foam polymer core as specified in the HS code descriptions.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 2, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Note: The 30.0% additional tariff applies after April 2, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations:

- Material Verification: Confirm that the product is PVC-based and not made from other polymers (e.g., polyethylene or polypropylene), as this could affect classification.

- Form and Use: Ensure the product is flooring (not wall or ceiling covering) if using 3918101020 or 3918101030.

- Certifications: Some countries may require product certifications (e.g., fire resistance, VOC emissions) for commercial flooring.

- Unit Price: Tariff calculations may depend on FOB or CIF value, so verify the unit price and total value of the shipment.

🛑 Proactive Advice:

- Double-check the HS code based on the exact product description (e.g., rigid foam core, self-adhesive, etc.).

- Consult customs brokers or trade compliance experts for real-time tariff updates and document preparation.

- Monitor policy changes after April 2, 2025, as the 30.0% additional tariff may significantly impact costs.

Let me know if you need help determining the correct HS code for your specific product or assistance with customs documentation.

Product Classification: PVC Commercial Floor Tile

HS CODE: 3918101020, 3918101030, 3918101040, 3918102000 (multiple codes may apply depending on specific product details)

🔍 Classification Summary:

- These HS codes classify PVC-based floor tiles and related floor coverings, including vinyl tiles, rigid foam core tiles, and flooring in sheet or tile form.

- The product must be made of polyvinyl chloride (PVC) polymer or rigid foam polymer core as specified in the HS code descriptions.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 2, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Note: The 30.0% additional tariff applies after April 2, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations:

- Material Verification: Confirm that the product is PVC-based and not made from other polymers (e.g., polyethylene or polypropylene), as this could affect classification.

- Form and Use: Ensure the product is flooring (not wall or ceiling covering) if using 3918101020 or 3918101030.

- Certifications: Some countries may require product certifications (e.g., fire resistance, VOC emissions) for commercial flooring.

- Unit Price: Tariff calculations may depend on FOB or CIF value, so verify the unit price and total value of the shipment.

🛑 Proactive Advice:

- Double-check the HS code based on the exact product description (e.g., rigid foam core, self-adhesive, etc.).

- Consult customs brokers or trade compliance experts for real-time tariff updates and document preparation.

- Monitor policy changes after April 2, 2025, as the 30.0% additional tariff may significantly impact costs.

Let me know if you need help determining the correct HS code for your specific product or assistance with customs documentation.

Customer Reviews

No reviews yet.