| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

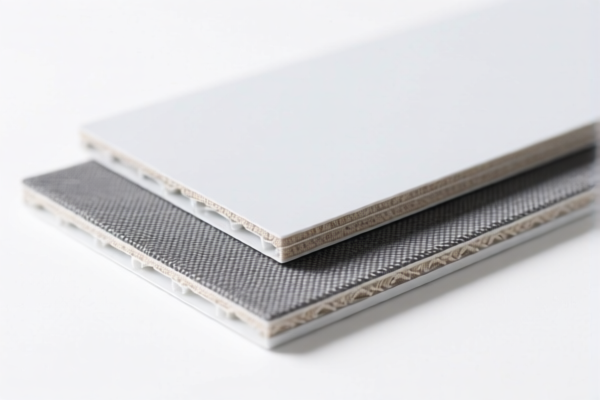

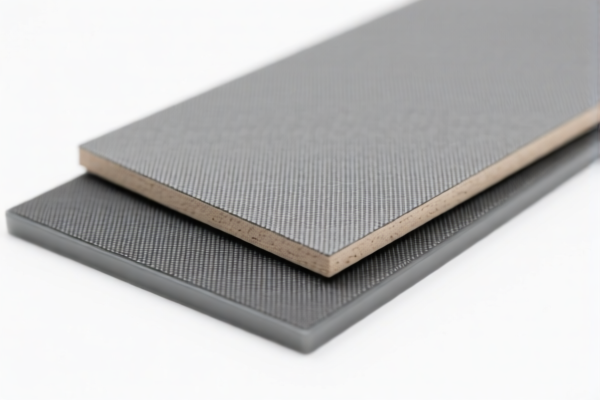

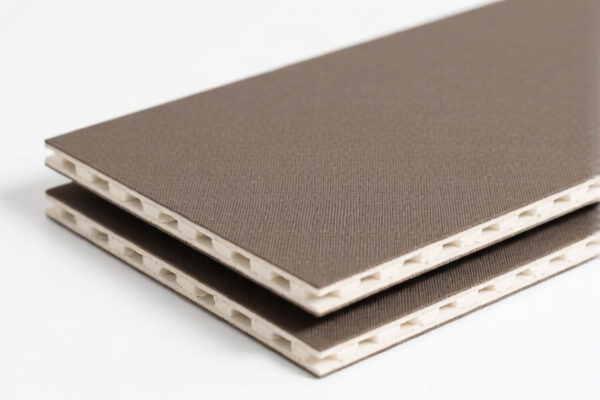

Product Name: PVC Composite Textile Case Boards

Classification HS Codes and Tax Details:

- HS CODE: 3921121950

- Description: PVC textile composite foam plastic boards, other plastic sheets, films, foils, and strips, honeycomb structure, made of polyvinyl chloride polymer combined with textile materials, other, other products.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is repeated for different product descriptions (e.g., packaging bags, foam boards, etc.), but the tax structure remains the same.

-

HS CODE: 3921121100

- Description: PVC textile composite storage boxes, other plastic sheets, films, foils, and strips, honeycomb structure, made of polyvinyl chloride polymer combined with textile materials, other, other products.

-

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121910

- Description: PVC plastic composite board with plant fiber textile materials, other plastic sheets, films, foils, and strips, honeycomb structure, made of polyvinyl chloride polymer combined with textile materials, other, other products.

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

-

Tariff Changes After April 11, 2025:

A 30.0% additional tariff will be imposed on all the above HS codes. This is a time-sensitive policy, so ensure your customs declarations are updated accordingly. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category. However, always verify if your product is subject to any ongoing anti-dumping or countervailing duties based on the country of origin. -

Material and Certification Requirements:

- Confirm the exact composition of the product (e.g., type of textile material, PVC content, foam structure).

- Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination market.

-

Ensure accurate unit pricing is provided for customs valuation purposes.

-

Classification Accuracy:

The HS code depends heavily on the product structure and use (e.g., storage box vs. foam board). Double-check the classification with a customs expert or using the official HS code database to avoid misclassification penalties.

✅ Proactive Advice:

- Verify the product description to match the correct HS code (e.g., "foam board" vs. "storage box").

- Track the April 11, 2025, deadline for the special tariff and plan your import schedule accordingly.

-

Consult with a customs broker or trade compliance officer to ensure full compliance with local and international regulations. Product Name: PVC Composite Textile Case Boards

Classification HS Codes and Tax Details: -

HS CODE: 3921121950

- Description: PVC textile composite foam plastic boards, other plastic sheets, films, foils, and strips, honeycomb structure, made of polyvinyl chloride polymer combined with textile materials, other, other products.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is repeated for different product descriptions (e.g., packaging bags, foam boards, etc.), but the tax structure remains the same.

-

HS CODE: 3921121100

- Description: PVC textile composite storage boxes, other plastic sheets, films, foils, and strips, honeycomb structure, made of polyvinyl chloride polymer combined with textile materials, other, other products.

-

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121910

- Description: PVC plastic composite board with plant fiber textile materials, other plastic sheets, films, foils, and strips, honeycomb structure, made of polyvinyl chloride polymer combined with textile materials, other, other products.

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

-

Tariff Changes After April 11, 2025:

A 30.0% additional tariff will be imposed on all the above HS codes. This is a time-sensitive policy, so ensure your customs declarations are updated accordingly. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category. However, always verify if your product is subject to any ongoing anti-dumping or countervailing duties based on the country of origin. -

Material and Certification Requirements:

- Confirm the exact composition of the product (e.g., type of textile material, PVC content, foam structure).

- Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination market.

-

Ensure accurate unit pricing is provided for customs valuation purposes.

-

Classification Accuracy:

The HS code depends heavily on the product structure and use (e.g., storage box vs. foam board). Double-check the classification with a customs expert or using the official HS code database to avoid misclassification penalties.

✅ Proactive Advice:

- Verify the product description to match the correct HS code (e.g., "foam board" vs. "storage box").

- Track the April 11, 2025, deadline for the special tariff and plan your import schedule accordingly.

- Consult with a customs broker or trade compliance officer to ensure full compliance with local and international regulations.

Customer Reviews

No reviews yet.