Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

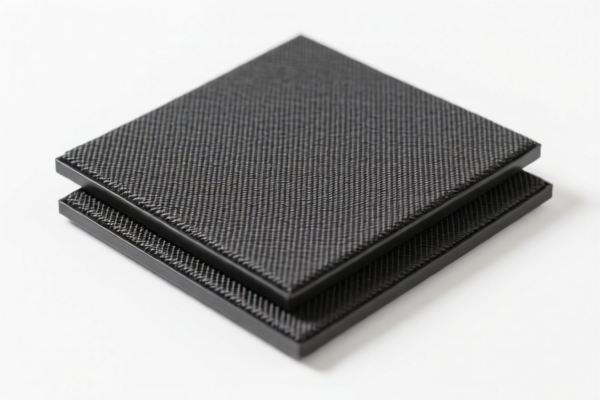

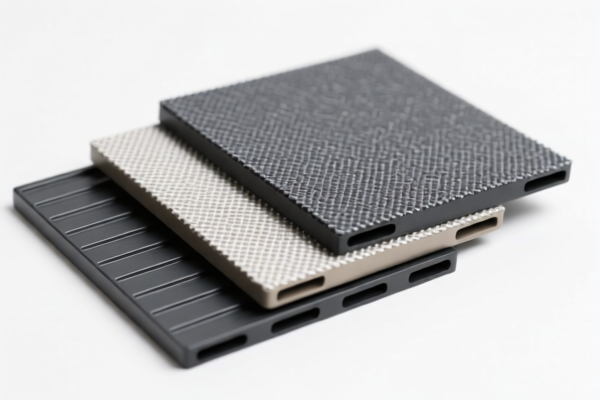

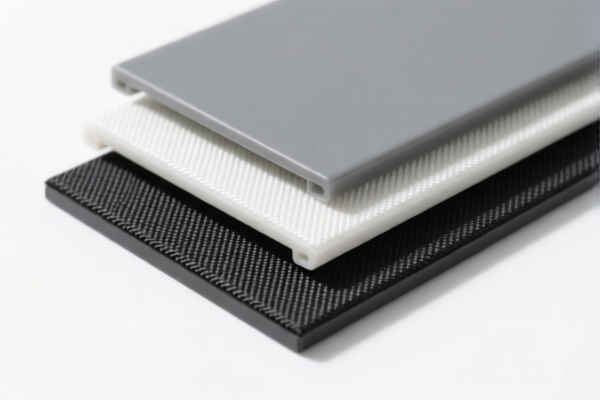

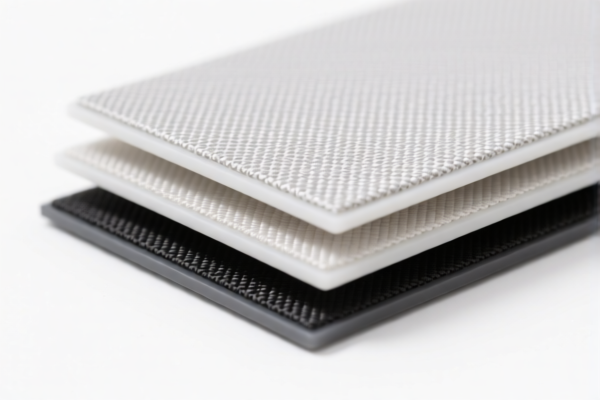

Product Classification: PVC Composite Textile Customized Plates

HS CODE: 3921121950 (and related codes as listed)

🔍 Classification Summary:

- Product Type: Plastic sheets, plates, films, foils, and strips made of polyvinyl chloride (PVC) polymer, combined with textile materials, in a honeycomb structure, or other composite forms.

- Key Features: Composite of PVC and textile materials, possibly in honeycomb or layered structures.

📊 Tariff Breakdown (as of current data):

- Base Tariff Rate: 5.3% (for 3921121950) or 6.5% (for other codes like 3921902550)

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 60.3% or 61.5% depending on the specific HS code

⚠️ Time-Sensitive Policies:

- April 2, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after this date. This is a critical date for importers to consider when planning shipments.

- No Anti-Dumping Duties Listed: No specific anti-dumping duties for iron or aluminum are currently applicable to this product category.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed a composite of PVC and textile materials, and confirm the structure (e.g., honeycomb, layered).

- Check Unit Price and Weight: For codes like 3921902550, the weight threshold (1.492 kg/m²) is critical for classification.

- Certifications Required: Confirm if any certifications (e.g., textile or plastic compliance, environmental standards) are needed for import.

- Consult Customs Broker: Due to the complexity of composite materials and tariff changes, it's advisable to work with a customs broker or compliance expert.

🧾 Summary Table for Reference:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.2) | Total Tax |

|---|---|---|---|---|---|

| 3921121950 | PVC + Textile, Honeycomb | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921131500 | Polyurethane + Textile | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921131950 | Polyurethane Honeycomb + Textile | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921902550 | Other Plastic + Textile (≥1.492 kg/m²) | 6.5% | 25.0% | 30.0% | 61.5% |

If you have specific product details or need help with documentation, feel free to provide more information.

Product Classification: PVC Composite Textile Customized Plates

HS CODE: 3921121950 (and related codes as listed)

🔍 Classification Summary:

- Product Type: Plastic sheets, plates, films, foils, and strips made of polyvinyl chloride (PVC) polymer, combined with textile materials, in a honeycomb structure, or other composite forms.

- Key Features: Composite of PVC and textile materials, possibly in honeycomb or layered structures.

📊 Tariff Breakdown (as of current data):

- Base Tariff Rate: 5.3% (for 3921121950) or 6.5% (for other codes like 3921902550)

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 60.3% or 61.5% depending on the specific HS code

⚠️ Time-Sensitive Policies:

- April 2, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after this date. This is a critical date for importers to consider when planning shipments.

- No Anti-Dumping Duties Listed: No specific anti-dumping duties for iron or aluminum are currently applicable to this product category.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed a composite of PVC and textile materials, and confirm the structure (e.g., honeycomb, layered).

- Check Unit Price and Weight: For codes like 3921902550, the weight threshold (1.492 kg/m²) is critical for classification.

- Certifications Required: Confirm if any certifications (e.g., textile or plastic compliance, environmental standards) are needed for import.

- Consult Customs Broker: Due to the complexity of composite materials and tariff changes, it's advisable to work with a customs broker or compliance expert.

🧾 Summary Table for Reference:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (After 2025.4.2) | Total Tax |

|---|---|---|---|---|---|

| 3921121950 | PVC + Textile, Honeycomb | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921131500 | Polyurethane + Textile | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921131950 | Polyurethane Honeycomb + Textile | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921902550 | Other Plastic + Textile (≥1.492 kg/m²) | 6.5% | 25.0% | 30.0% | 61.5% |

If you have specific product details or need help with documentation, feel free to provide more information.

Customer Reviews

No reviews yet.