| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

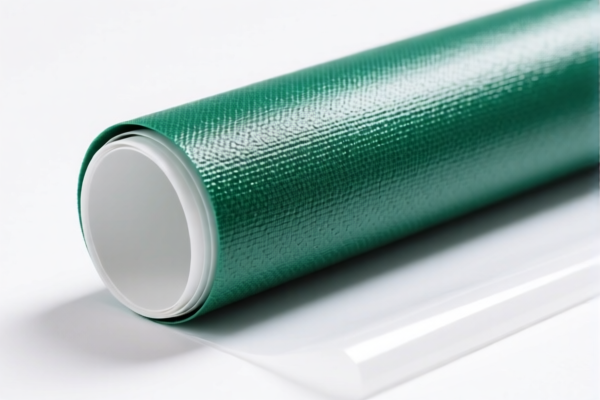

Product Name: PVC Composite Textile Film

Classification HS Codes and Tax Details:

- HS CODE: 3921121950

- Description: PVC Textile Composite Foam Plastic Film

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121910

- Description: PVC Plastic Composite Film with Plant Fiber Textile Material

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3904400000

- Description: PVC Film

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3904220000

- Description: PVC Film

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921125000

- Description: PVC Film

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921902900

- Description: Plastic Textile Composite Film

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to confirm with customs or a trade compliance expert if the product is subject to any ongoing anti-dumping investigations. -

Certifications and Documentation:

- Verify the material composition and unit price to ensure correct classification.

- Confirm if certifications (e.g., REACH, RoHS, or other relevant standards) are required for import into the destination country.

- Ensure product specifications align with the HS code description to avoid misclassification penalties.

Proactive Advice:

- Double-check the product description to ensure it matches the HS code used.

- Consult with customs brokers or trade compliance experts for the most up-to-date tariff information and documentation requirements.

-

Monitor policy updates after April 11, 2025, as the additional tariff may affect your import costs significantly. Product Name: PVC Composite Textile Film

Classification HS Codes and Tax Details: -

HS CODE: 3921121950

- Description: PVC Textile Composite Foam Plastic Film

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121910

- Description: PVC Plastic Composite Film with Plant Fiber Textile Material

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3904400000

- Description: PVC Film

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3904220000

- Description: PVC Film

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921125000

- Description: PVC Film

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921902900

- Description: Plastic Textile Composite Film

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to confirm with customs or a trade compliance expert if the product is subject to any ongoing anti-dumping investigations. -

Certifications and Documentation:

- Verify the material composition and unit price to ensure correct classification.

- Confirm if certifications (e.g., REACH, RoHS, or other relevant standards) are required for import into the destination country.

- Ensure product specifications align with the HS code description to avoid misclassification penalties.

Proactive Advice:

- Double-check the product description to ensure it matches the HS code used.

- Consult with customs brokers or trade compliance experts for the most up-to-date tariff information and documentation requirements.

- Monitor policy updates after April 11, 2025, as the additional tariff may affect your import costs significantly.

Customer Reviews

No reviews yet.