| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

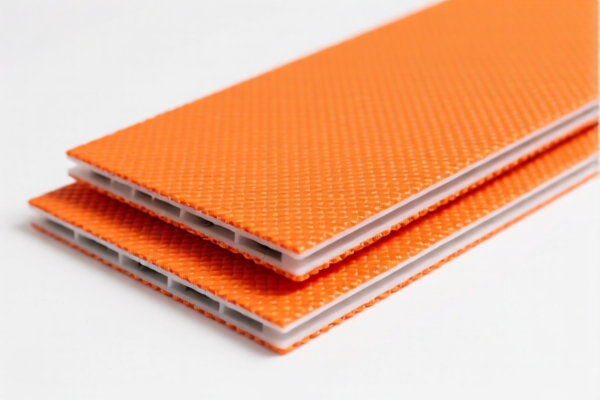

Product Classification: PVC Composite Textile Fire Retardant Boards

Based on the provided HS codes and descriptions, the product falls under several possible classifications depending on its composition and structure. Below is a structured breakdown of the relevant HS codes and associated tariff information:

🔍 HS CODE: 3921.12.19.50

Description: PVC textile composite material, honeycomb structure, combined with textile materials

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is suitable if the product has a honeycomb structure and is combined with textile materials.

🔍 HS CODE: 3921.12.19.10

Description: PVC textile composite material, mainly composed of vegetable fibers

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification applies if the primary component is vegetable fiber.

🔍 HS CODE: 3921.13.11.00

Description: Polyurethane textile composite material, with plastic content exceeding 70%

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polyurethane-based composite materials with plastic content >70%.

🔍 HS CODE: 3918.10.40.50

Description: PVC wall materials

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for PVC-based wall panels, not specifically textile composites.

🔍 HS CODE: 3918.10.50.00

Description: PVC ceiling materials

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PVC-based ceiling panels, not textile composites.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if the product is subject to anti-dumping or countervailing duties based on the country of origin.

- Certifications: Ensure the product meets fire retardant standards and any customs documentation requirements (e.g., material composition, safety certifications).

✅ Proactive Advice:

- Verify the exact composition of the product (e.g., whether it is PVC-based, polyurethane-based, or contains vegetable fibers).

- Check the unit price and material breakdown to ensure correct HS code selection.

- Confirm required certifications (e.g., fire resistance, environmental compliance) for customs clearance.

- Monitor the April 11, 2025 deadline to avoid unexpected cost increases.

Let me know if you need help selecting the most accurate HS code based on your product's full specification.

Product Classification: PVC Composite Textile Fire Retardant Boards

Based on the provided HS codes and descriptions, the product falls under several possible classifications depending on its composition and structure. Below is a structured breakdown of the relevant HS codes and associated tariff information:

🔍 HS CODE: 3921.12.19.50

Description: PVC textile composite material, honeycomb structure, combined with textile materials

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is suitable if the product has a honeycomb structure and is combined with textile materials.

🔍 HS CODE: 3921.12.19.10

Description: PVC textile composite material, mainly composed of vegetable fibers

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification applies if the primary component is vegetable fiber.

🔍 HS CODE: 3921.13.11.00

Description: Polyurethane textile composite material, with plastic content exceeding 70%

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polyurethane-based composite materials with plastic content >70%.

🔍 HS CODE: 3918.10.40.50

Description: PVC wall materials

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for PVC-based wall panels, not specifically textile composites.

🔍 HS CODE: 3918.10.50.00

Description: PVC ceiling materials

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PVC-based ceiling panels, not textile composites.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if the product is subject to anti-dumping or countervailing duties based on the country of origin.

- Certifications: Ensure the product meets fire retardant standards and any customs documentation requirements (e.g., material composition, safety certifications).

✅ Proactive Advice:

- Verify the exact composition of the product (e.g., whether it is PVC-based, polyurethane-based, or contains vegetable fibers).

- Check the unit price and material breakdown to ensure correct HS code selection.

- Confirm required certifications (e.g., fire resistance, environmental compliance) for customs clearance.

- Monitor the April 11, 2025 deadline to avoid unexpected cost increases.

Let me know if you need help selecting the most accurate HS code based on your product's full specification.

Customer Reviews

No reviews yet.