| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

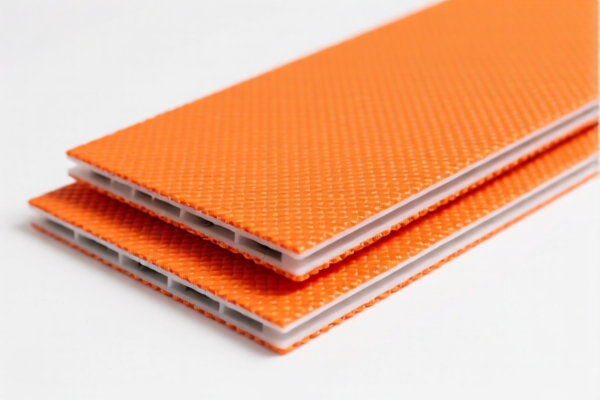

Here is the structured classification and tariff information for PVC Composite Textile Flame Retardant Boards, based on the provided HS codes and tax details:

✅ HS CODE: 3921121910

Product Description: PVC textile composite flame retardant fabric

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to textile composite products, not solid boards.

✅ HS CODE: 3904220000

Product Description: PVC flame retardant board

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC flame retardant boards in general, not textile-based.

✅ HS CODE: 3921125000

Product Description: PVC flame retardant board

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC composite textile products, but not specifically for fabric.

✅ HS CODE: 3921121500

Product Description: PVC textile coated flame retardant board

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for textile-coated PVC flame retardant boards.

✅ HS CODE: 3921131950

Product Description: Polyurethane textile composite flame retardant board

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyurethane-based textile composite flame retardant boards, not PVC.

🔍 Key Considerations for Classification:

- Material Composition: Ensure the product is PVC-based and not polyurethane or other materials.

- Structure: Determine if it is a textile composite (e.g., fabric with PVC coating) or a solid board.

- Certifications: Confirm if flame retardant certification or safety compliance documents are required for import.

- Unit Price: Verify the unit price to ensure it aligns with the HS code classification criteria.

- Tariff Changes: Be aware that additional tariffs of 30% will apply after April 11, 2025 for all these codes.

📌 Proactive Advice:

- Double-check the product composition (e.g., is it a textile composite or a solid board?).

- Confirm the exact material (PVC vs. polyurethane) to avoid misclassification.

- Review the latest customs regulations and tariff updates before shipment.

- Consult a customs broker or classification expert if the product is complex or borderline between categories.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured classification and tariff information for PVC Composite Textile Flame Retardant Boards, based on the provided HS codes and tax details:

✅ HS CODE: 3921121910

Product Description: PVC textile composite flame retardant fabric

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to textile composite products, not solid boards.

✅ HS CODE: 3904220000

Product Description: PVC flame retardant board

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC flame retardant boards in general, not textile-based.

✅ HS CODE: 3921125000

Product Description: PVC flame retardant board

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC composite textile products, but not specifically for fabric.

✅ HS CODE: 3921121500

Product Description: PVC textile coated flame retardant board

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for textile-coated PVC flame retardant boards.

✅ HS CODE: 3921131950

Product Description: Polyurethane textile composite flame retardant board

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyurethane-based textile composite flame retardant boards, not PVC.

🔍 Key Considerations for Classification:

- Material Composition: Ensure the product is PVC-based and not polyurethane or other materials.

- Structure: Determine if it is a textile composite (e.g., fabric with PVC coating) or a solid board.

- Certifications: Confirm if flame retardant certification or safety compliance documents are required for import.

- Unit Price: Verify the unit price to ensure it aligns with the HS code classification criteria.

- Tariff Changes: Be aware that additional tariffs of 30% will apply after April 11, 2025 for all these codes.

📌 Proactive Advice:

- Double-check the product composition (e.g., is it a textile composite or a solid board?).

- Confirm the exact material (PVC vs. polyurethane) to avoid misclassification.

- Review the latest customs regulations and tariff updates before shipment.

- Consult a customs broker or classification expert if the product is complex or borderline between categories.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.