Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

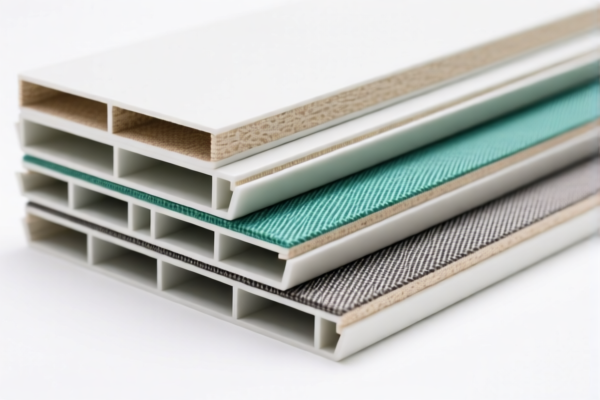

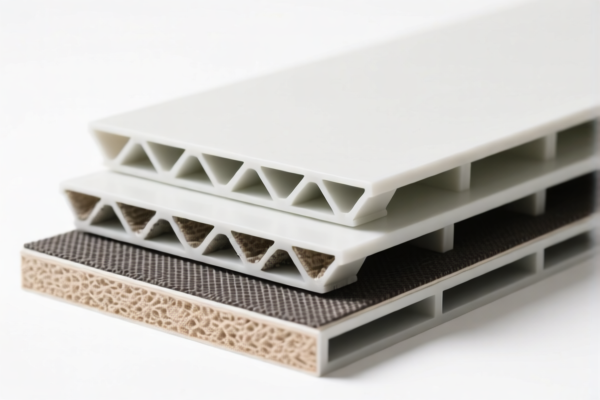

Product Name: PVC Composite Textile Moisture Proof Boards

Classification HS Codes and Tax Details:

- HS CODE: 3921.12.19.50

- Description: Other plastic sheets, plates, films, foils and strips, cellular, made of polyvinyl chloride polymers, combined with textile materials, other, other products

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS CODE: 3921.12.19.10

- Description: Other plastic sheets, plates, films, foils and strips, cellular, made of polyvinyl chloride polymers, combined with textile materials, other, other products

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS CODE: 3918.10.50.00

- Description: Wall or ceiling materials, made of polyvinyl chloride polymers

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

📌 Key Notes:

- April 2, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not specifically mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods.

- Material and Certification: Ensure the product is correctly classified based on its composition (PVC + textile) and confirm if any certifications (e.g., fire resistance, environmental compliance) are required for import.

✅ Proactive Advice:

- Verify the exact composition of the product (e.g., percentage of PVC vs. textile) to ensure correct HS code classification.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult customs authorities or a customs broker for confirmation, especially if the product is close to the boundary of multiple classifications.

-

Keep records of product specifications and certifications to support customs declarations and avoid delays. Product Name: PVC Composite Textile Moisture Proof Boards

Classification HS Codes and Tax Details: -

HS CODE: 3921.12.19.50

- Description: Other plastic sheets, plates, films, foils and strips, cellular, made of polyvinyl chloride polymers, combined with textile materials, other, other products

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS CODE: 3921.12.19.10

- Description: Other plastic sheets, plates, films, foils and strips, cellular, made of polyvinyl chloride polymers, combined with textile materials, other, other products

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS CODE: 3918.10.50.00

- Description: Wall or ceiling materials, made of polyvinyl chloride polymers

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

📌 Key Notes:

- April 2, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not specifically mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods.

- Material and Certification: Ensure the product is correctly classified based on its composition (PVC + textile) and confirm if any certifications (e.g., fire resistance, environmental compliance) are required for import.

✅ Proactive Advice:

- Verify the exact composition of the product (e.g., percentage of PVC vs. textile) to ensure correct HS code classification.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult customs authorities or a customs broker for confirmation, especially if the product is close to the boundary of multiple classifications.

- Keep records of product specifications and certifications to support customs declarations and avoid delays.

Customer Reviews

No reviews yet.