| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

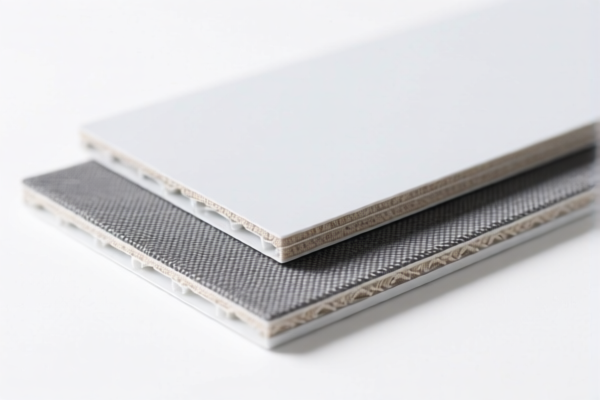

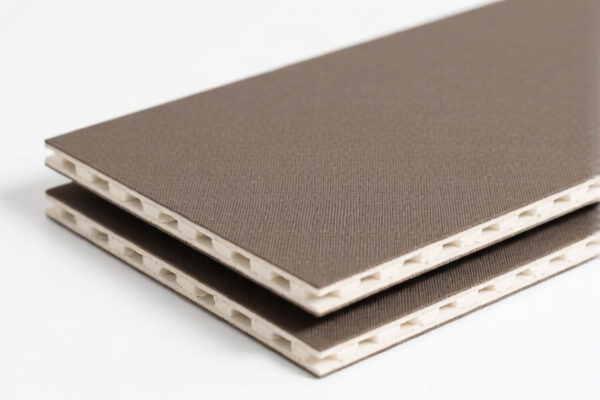

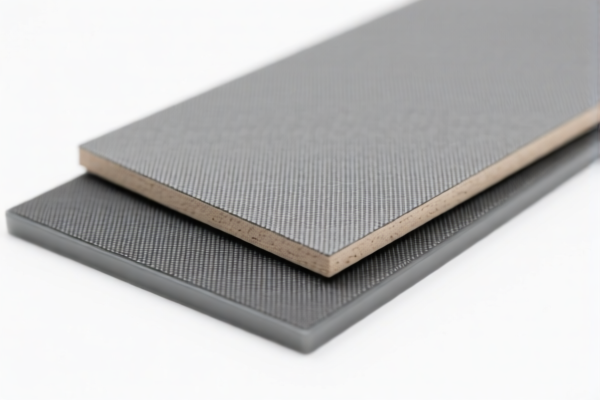

Product Name: PVC Composite Textile Packaging Boards

Classification HS Codes and Tax Details:

- HS CODE: 3921121950

- Description: PVC textile composite foam plastic boards, other plastic sheets, films, foils, and strips, honeycomb structure, made of polyvinyl chloride polymer, combined with textile materials, other, other products.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921125000

- Description: PVC packaging boards, falling under the category of plastic sheets, consistent with HS CODE 3921.

-

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121100

- Description: PVC textile composite packaging bags, honeycomb plastic, made of polyvinyl chloride polymer, combined with textile materials, where synthetic fiber weight exceeds any other single textile fiber, and plastic weight accounts for more than 70%.

-

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131950

- Description: Polyurethane textile composite packaging boards, honeycomb polyurethane plastic sheets, films, foils, and strips, combined with textile materials, without restrictions on plant fiber weight percentage.

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be imposed after April 11, 2025, which is a significant increase. Ensure your import timeline aligns with this policy change.

-

Material Composition Matters:

-

The plastic content percentage (e.g., over 70%) and textile fiber type (e.g., synthetic fiber dominance) are critical for accurate HS code classification. Verify these details to avoid misclassification and additional penalties.

-

Certifications and Documentation:

-

Confirm if certifications (e.g., material safety, environmental compliance) are required for import. This may vary by country and product type.

-

Unit Price and Tax Calculation:

-

Verify the unit price of the product, as customs may use this to determine if additional duties (e.g., anti-dumping duties) apply.

-

Anti-Dumping Duty Consideration:

- While not explicitly mentioned in the data, anti-dumping duties may apply to products containing iron or aluminum. Confirm if your product includes such materials.

Proactive Advice:

- Double-check the product composition (e.g., plastic vs. textile ratio, fiber type) to ensure the correct HS code is used.

- Consult with customs brokers or legal advisors to confirm compliance with local regulations and avoid delays in customs clearance.

-

Monitor the April 11, 2025, deadline for the special tariff and plan accordingly for cost adjustments. Product Name: PVC Composite Textile Packaging Boards

Classification HS Codes and Tax Details: -

HS CODE: 3921121950

- Description: PVC textile composite foam plastic boards, other plastic sheets, films, foils, and strips, honeycomb structure, made of polyvinyl chloride polymer, combined with textile materials, other, other products.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921125000

- Description: PVC packaging boards, falling under the category of plastic sheets, consistent with HS CODE 3921.

-

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121100

- Description: PVC textile composite packaging bags, honeycomb plastic, made of polyvinyl chloride polymer, combined with textile materials, where synthetic fiber weight exceeds any other single textile fiber, and plastic weight accounts for more than 70%.

-

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131950

- Description: Polyurethane textile composite packaging boards, honeycomb polyurethane plastic sheets, films, foils, and strips, combined with textile materials, without restrictions on plant fiber weight percentage.

- Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be imposed after April 11, 2025, which is a significant increase. Ensure your import timeline aligns with this policy change.

-

Material Composition Matters:

-

The plastic content percentage (e.g., over 70%) and textile fiber type (e.g., synthetic fiber dominance) are critical for accurate HS code classification. Verify these details to avoid misclassification and additional penalties.

-

Certifications and Documentation:

-

Confirm if certifications (e.g., material safety, environmental compliance) are required for import. This may vary by country and product type.

-

Unit Price and Tax Calculation:

-

Verify the unit price of the product, as customs may use this to determine if additional duties (e.g., anti-dumping duties) apply.

-

Anti-Dumping Duty Consideration:

- While not explicitly mentioned in the data, anti-dumping duties may apply to products containing iron or aluminum. Confirm if your product includes such materials.

Proactive Advice:

- Double-check the product composition (e.g., plastic vs. textile ratio, fiber type) to ensure the correct HS code is used.

- Consult with customs brokers or legal advisors to confirm compliance with local regulations and avoid delays in customs clearance.

- Monitor the April 11, 2025, deadline for the special tariff and plan accordingly for cost adjustments.

Customer Reviews

No reviews yet.