| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

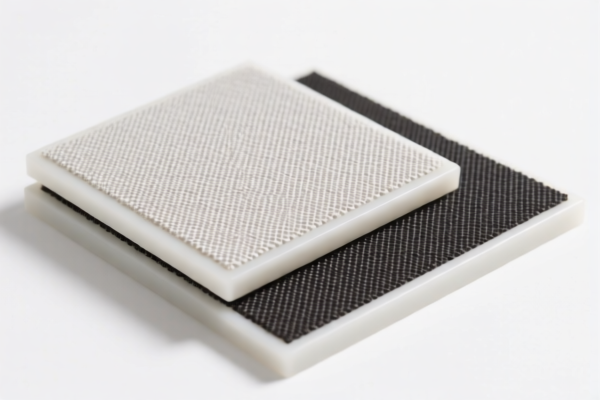

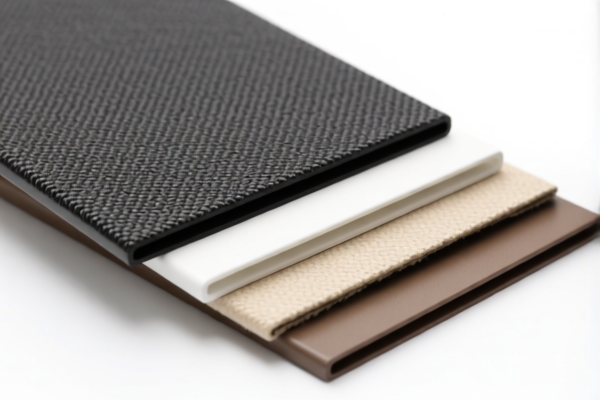

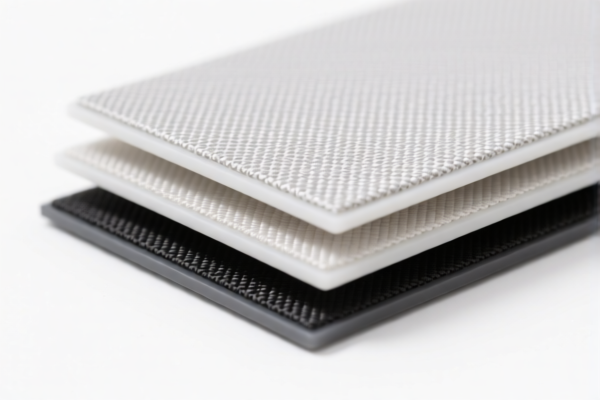

Product Name: PVC Composite Textile Plates

Classification HS Codes and Tax Details:

- HS CODE: 3921121950

- Description: PVC textile composite foam boards, PVC foam textile composite boards, PVC foam textile composite material boards, etc.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to products that are a composite of PVC foam and textile materials.

-

HS CODE: 3921121910

- Description: Composite boards of PVC plastic and plant fiber textile materials

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for products combining PVC plastic with plant fiber-based textile materials.

-

HS CODE: 3921902900

- Description: Textile composite plastic boards (general category)

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category for textile-composite plastic boards not specifically covered by other codes.

📌 Important Notes and Recommendations:

- Time-sensitive Policy Alert:

-

Additional tariffs of 30.0% will be imposed after April 11, 2025. Ensure your import timeline accounts for this change.

-

Anti-dumping duties:

-

No specific anti-dumping duties are mentioned for this product category in the provided data. However, always verify with customs or a trade compliance expert if your product is subject to any ongoing investigations.

-

Proactive Actions Required:

- Verify the exact composition of your product (e.g., whether it is foam-based, plant fiber-based, or other materials) to ensure correct HS code classification.

- Check the unit price and material specifications to determine if any additional duties or certifications (e.g., REACH, RoHS) apply.

- Consult with customs or a compliance expert if your product is being imported in large quantities or under special trade agreements.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: PVC Composite Textile Plates

Classification HS Codes and Tax Details:

- HS CODE: 3921121950

- Description: PVC textile composite foam boards, PVC foam textile composite boards, PVC foam textile composite material boards, etc.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to products that are a composite of PVC foam and textile materials.

-

HS CODE: 3921121910

- Description: Composite boards of PVC plastic and plant fiber textile materials

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for products combining PVC plastic with plant fiber-based textile materials.

-

HS CODE: 3921902900

- Description: Textile composite plastic boards (general category)

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category for textile-composite plastic boards not specifically covered by other codes.

📌 Important Notes and Recommendations:

- Time-sensitive Policy Alert:

-

Additional tariffs of 30.0% will be imposed after April 11, 2025. Ensure your import timeline accounts for this change.

-

Anti-dumping duties:

-

No specific anti-dumping duties are mentioned for this product category in the provided data. However, always verify with customs or a trade compliance expert if your product is subject to any ongoing investigations.

-

Proactive Actions Required:

- Verify the exact composition of your product (e.g., whether it is foam-based, plant fiber-based, or other materials) to ensure correct HS code classification.

- Check the unit price and material specifications to determine if any additional duties or certifications (e.g., REACH, RoHS) apply.

- Consult with customs or a compliance expert if your product is being imported in large quantities or under special trade agreements.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.