Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3918104010 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

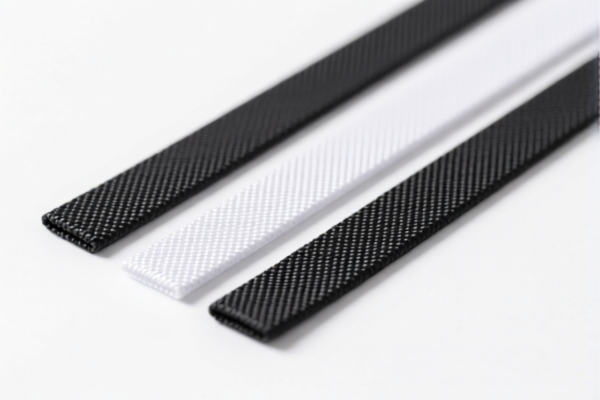

Product Name: PVC Composite Textile Strips

Classification Analysis and Tax Information:

- HS CODE: 3921121950

- Description: PVC foam plastic composite with textile material strips

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921125000

- Description: PVC foam plastic strips

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920490000

- Description: PVC colored strips or transparent strips

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918104010

- Description: PVC textile composite wall fabric

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121100

- Description: PVC textile composite wall fabric, with plastic weight over 70%

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods.

- Material and Certification: Confirm the exact composition (e.g., percentage of PVC vs. textile) and whether any certifications (e.g., REACH, RoHS) are required for import.

✅ Proactive Advice:

- Verify the exact product composition (e.g., whether it's foam, textile composite, or wall fabric) to ensure correct HS code classification.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult with customs brokers or legal advisors if the product is being imported from a country with specific trade agreements or restrictions.

-

Keep updated records of product specifications and documentation to support customs declarations. Product Name: PVC Composite Textile Strips

Classification Analysis and Tax Information: -

HS CODE: 3921121950

- Description: PVC foam plastic composite with textile material strips

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921125000

- Description: PVC foam plastic strips

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920490000

- Description: PVC colored strips or transparent strips

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918104010

- Description: PVC textile composite wall fabric

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121100

- Description: PVC textile composite wall fabric, with plastic weight over 70%

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods.

- Material and Certification: Confirm the exact composition (e.g., percentage of PVC vs. textile) and whether any certifications (e.g., REACH, RoHS) are required for import.

✅ Proactive Advice:

- Verify the exact product composition (e.g., whether it's foam, textile composite, or wall fabric) to ensure correct HS code classification.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult with customs brokers or legal advisors if the product is being imported from a country with specific trade agreements or restrictions.

- Keep updated records of product specifications and documentation to support customs declarations.

Customer Reviews

No reviews yet.