| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

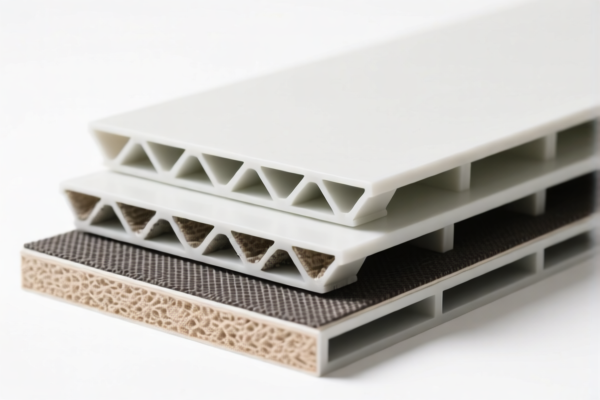

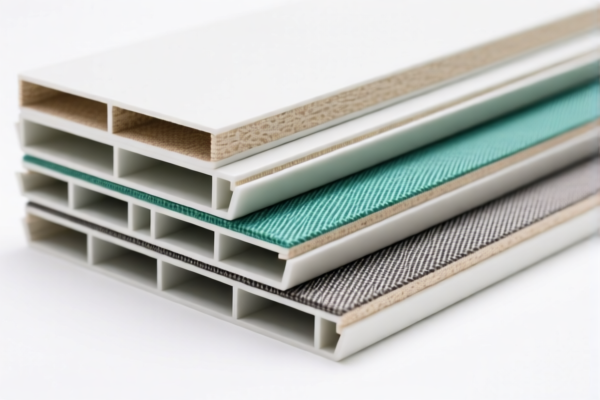

Product Name: PVC Composite Textile Structural Boards

Classification HS Code:

- 3921121950 – PVC textile composite foam boards

- 3921902510 – Composite textile plastic structural boards

🔍 HS Code Classification Overview

- 3921121950

- Description: PVC foam plastic textile composite boards

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

3921902510

- Description: Composite textile plastic structural boards

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes (April 11, 2025 onwards)

- Both HS codes will see an increase in total tax rate by 5% (from 55.3% to 60.3% for 3921121950, and from 56.5% to 61.5% for 3921902510).

- This is due to the special tariff imposed after April 11, 2025, which is 30.0% for both classifications.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed a composite of PVC and textile materials, as misclassification can lead to penalties.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Monitor Tariff Updates: Stay informed about any changes in customs policies, especially around the April 11, 2025 deadline.

- Consult Customs Broker: For accurate classification and to avoid delays in customs clearance.

📊 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3921121950 | PVC textile composite foam boards | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921902510 | Composite textile plastic boards | 6.5% | 25.0% | 30.0% | 61.5% |

If you need further assistance with customs documentation or classification confirmation, feel free to provide more product details.

Product Name: PVC Composite Textile Structural Boards

Classification HS Code:

- 3921121950 – PVC textile composite foam boards

- 3921902510 – Composite textile plastic structural boards

🔍 HS Code Classification Overview

- 3921121950

- Description: PVC foam plastic textile composite boards

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

3921902510

- Description: Composite textile plastic structural boards

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes (April 11, 2025 onwards)

- Both HS codes will see an increase in total tax rate by 5% (from 55.3% to 60.3% for 3921121950, and from 56.5% to 61.5% for 3921902510).

- This is due to the special tariff imposed after April 11, 2025, which is 30.0% for both classifications.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed a composite of PVC and textile materials, as misclassification can lead to penalties.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import.

- Monitor Tariff Updates: Stay informed about any changes in customs policies, especially around the April 11, 2025 deadline.

- Consult Customs Broker: For accurate classification and to avoid delays in customs clearance.

📊 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3921121950 | PVC textile composite foam boards | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921902510 | Composite textile plastic boards | 6.5% | 25.0% | 30.0% | 61.5% |

If you need further assistance with customs documentation or classification confirmation, feel free to provide more product details.

Customer Reviews

No reviews yet.