| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

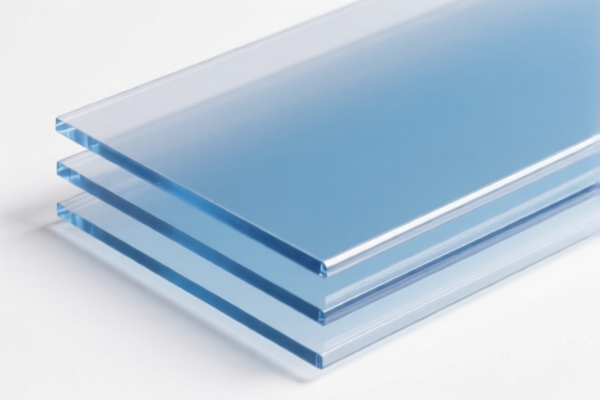

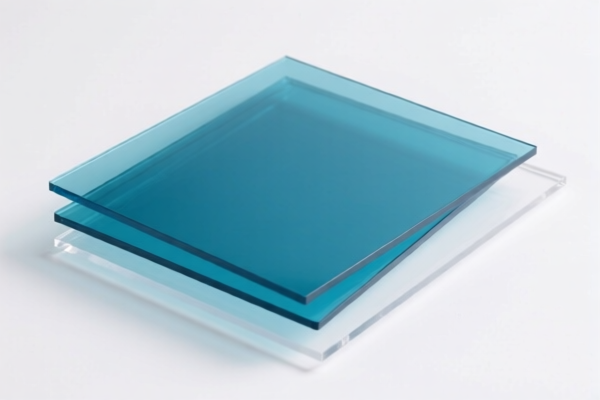

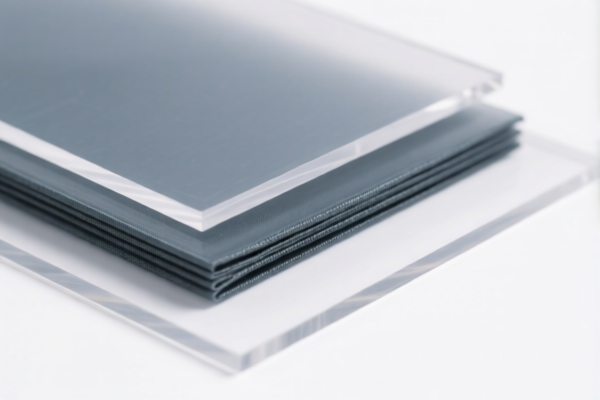

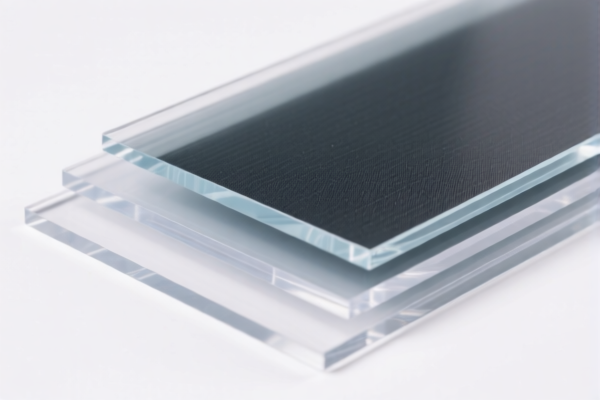

Product Classification: PVC Composite Textile Translucent Boards

Based on the provided HS codes and descriptions, the product PVC Composite Textile Translucent Boards can be classified under the following HS codes:

✅ HS CODE: 3921121950

Description:

- PVC foam plastic composite boards with textile materials, honeycomb structure, made of polyvinyl chloride polymer, combined with textile materials, other products.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921902900

Description:

- Semi-transparent textile plastic boards, other plastic sheets, films, foils, and strips, composite with other materials, with a weight exceeding 1.492 kg/m².

Tariff Summary:

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.4%

⚠️ Important Notes and Recommendations:

-

April 2, 2025, Special Tariff:

A 30.0% additional tariff will be imposed on all products classified under these HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning and customs declarations. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, additional anti-dumping duties may apply. Verify the composition of the product and consult with customs or a trade compliance expert. -

Material and Certification Verification:

- Confirm the exact composition of the board (e.g., type of PVC, textile material used, foam structure, weight per square meter).

-

Check if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

-

Unit Price and Classification Consistency:

Ensure that the declared unit price aligns with the HS code classification. Misclassification can lead to penalties or delays in customs clearance.

📌 Proactive Advice:

- Consult a customs broker or trade compliance expert to confirm the most accurate HS code based on your product’s exact specifications.

- Keep documentation (e.g., material certificates, product samples, technical data sheets) ready for customs inspection.

- Monitor policy updates related to tariffs and trade agreements, especially after April 2, 2025.

Let me know if you need help with a specific product specification or customs declaration form.

Product Classification: PVC Composite Textile Translucent Boards

Based on the provided HS codes and descriptions, the product PVC Composite Textile Translucent Boards can be classified under the following HS codes:

✅ HS CODE: 3921121950

Description:

- PVC foam plastic composite boards with textile materials, honeycomb structure, made of polyvinyl chloride polymer, combined with textile materials, other products.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921902900

Description:

- Semi-transparent textile plastic boards, other plastic sheets, films, foils, and strips, composite with other materials, with a weight exceeding 1.492 kg/m².

Tariff Summary:

- Base Tariff Rate: 4.4%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.4%

⚠️ Important Notes and Recommendations:

-

April 2, 2025, Special Tariff:

A 30.0% additional tariff will be imposed on all products classified under these HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning and customs declarations. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, additional anti-dumping duties may apply. Verify the composition of the product and consult with customs or a trade compliance expert. -

Material and Certification Verification:

- Confirm the exact composition of the board (e.g., type of PVC, textile material used, foam structure, weight per square meter).

-

Check if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

-

Unit Price and Classification Consistency:

Ensure that the declared unit price aligns with the HS code classification. Misclassification can lead to penalties or delays in customs clearance.

📌 Proactive Advice:

- Consult a customs broker or trade compliance expert to confirm the most accurate HS code based on your product’s exact specifications.

- Keep documentation (e.g., material certificates, product samples, technical data sheets) ready for customs inspection.

- Monitor policy updates related to tariffs and trade agreements, especially after April 2, 2025.

Let me know if you need help with a specific product specification or customs declaration form.

Customer Reviews

No reviews yet.