Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

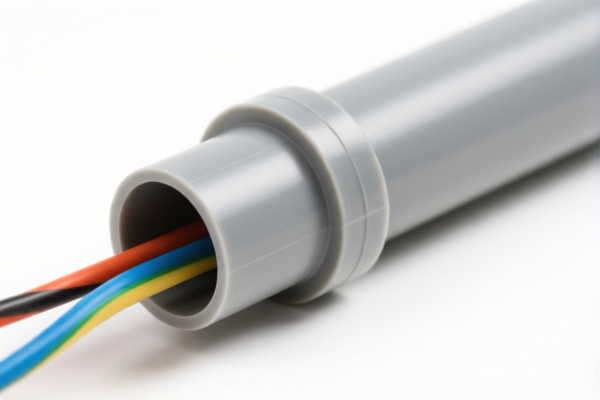

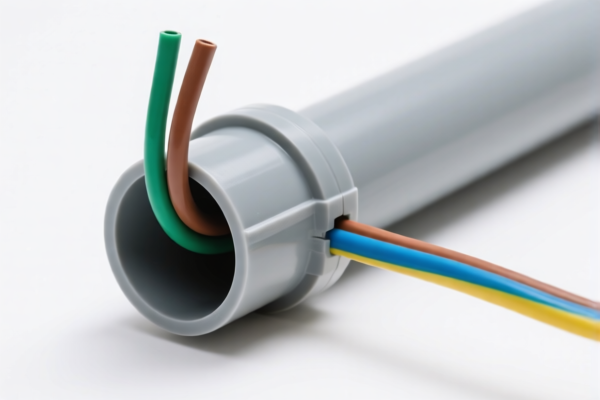

Product Classification: PVC Conduit Pipes for Electrical Wiring

HS CODEs and Tax Information Summary (April 2025 Update):

✅ HS CODE: 3917230000

- Description: PVC (Polyvinyl Chloride) electrical conduit pipes, made of rigid plastic.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to rigid PVC conduits without reinforcement or combination with other materials.

✅ HS CODE: 3917390020

- Description: PVC electrical conduit pipes, made of plastic, not reinforced with metal.

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is suitable for standard PVC conduits without metal components.

✅ HS CODE: 3926909987

- Description: Rigid plastic tubes or pipes for use as electrical conduits, made of PVC.

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is for other rigid plastic conduits not covered under more specific categories.

✅ HS CODE: 3917320010

- Description: PVC plastic pipes and fittings, not reinforced or combined with other materials, without fittings.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to PVC pipes without fittings or reinforcement.

✅ HS CODE: 3920490000

- Description: PVC electrical conduit pipes, classified under plastic sheets, films, or strips, non-cellular and non-reinforced.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code may apply if the conduit is classified as a sheet or strip rather than a pipe.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: Applies to all the above HS codes, adding 30.0% to the total tax rate. This is a time-sensitive policy and must be accounted for in customs declarations.

- Material Verification: Confirm the exact material (e.g., PVC, not other plastics) and whether the conduit is reinforced or combined with other materials.

- Certifications: Check if any certifications (e.g., CE, UL, RoHS) are required for import or local compliance.

- Unit Price: Verify the unit price and quantity to ensure correct classification and tax calculation.

- Customs Declaration: Ensure the product description in the customs declaration matches the HS code selected.

Pro Tip: If the conduit is reinforced with metal or combined with other materials, it may fall under a different HS code (e.g., 7306 for metal conduit). Always confirm the product's exact composition and structure.

Product Classification: PVC Conduit Pipes for Electrical Wiring

HS CODEs and Tax Information Summary (April 2025 Update):

✅ HS CODE: 3917230000

- Description: PVC (Polyvinyl Chloride) electrical conduit pipes, made of rigid plastic.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to rigid PVC conduits without reinforcement or combination with other materials.

✅ HS CODE: 3917390020

- Description: PVC electrical conduit pipes, made of plastic, not reinforced with metal.

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is suitable for standard PVC conduits without metal components.

✅ HS CODE: 3926909987

- Description: Rigid plastic tubes or pipes for use as electrical conduits, made of PVC.

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is for other rigid plastic conduits not covered under more specific categories.

✅ HS CODE: 3917320010

- Description: PVC plastic pipes and fittings, not reinforced or combined with other materials, without fittings.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to PVC pipes without fittings or reinforcement.

✅ HS CODE: 3920490000

- Description: PVC electrical conduit pipes, classified under plastic sheets, films, or strips, non-cellular and non-reinforced.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code may apply if the conduit is classified as a sheet or strip rather than a pipe.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: Applies to all the above HS codes, adding 30.0% to the total tax rate. This is a time-sensitive policy and must be accounted for in customs declarations.

- Material Verification: Confirm the exact material (e.g., PVC, not other plastics) and whether the conduit is reinforced or combined with other materials.

- Certifications: Check if any certifications (e.g., CE, UL, RoHS) are required for import or local compliance.

- Unit Price: Verify the unit price and quantity to ensure correct classification and tax calculation.

- Customs Declaration: Ensure the product description in the customs declaration matches the HS code selected.

Pro Tip: If the conduit is reinforced with metal or combined with other materials, it may fall under a different HS code (e.g., 7306 for metal conduit). Always confirm the product's exact composition and structure.

Customer Reviews

No reviews yet.