Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400020 | Doc | 60.3% | CN | US | 2025-05-12 |

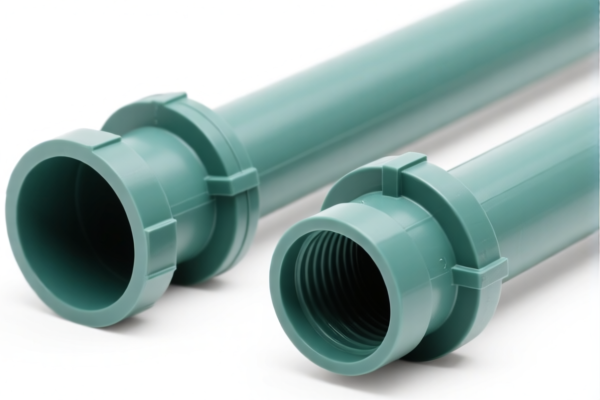

Product Classification: PVC DWV Drain Reducer Fittings

HS CODE: 3917400020 (most relevant for PVC DWV fittings)

🔍 Classification Summary:

- Product: Non-pressure PVC (Polyvinyl Chloride) Drain, Waste, and Vent (DWV) pipe fittings.

- HS Code: 3917400020

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 5.3% + 25.0% + 30.0% = 60.3%

⚠️ Important Notes:

- April 11 Special Tariff: Not directly applicable here, but the April 2, 2025 tariff increase is in effect. This is a key date to note for customs clearance and cost estimation.

- Anti-dumping duties: Not applicable for this product category (plastic fittings).

- Material Verification: Ensure the product is non-pressure grade PVC and used for DWV (Drain, Waste, Vent) systems, as this is critical for correct classification.

- Certifications: Confirm if any product certifications (e.g., ASTM, ISO, or local standards) are required for import.

📌 Proactive Advice:

- Verify Material: Confirm the product is made of PVC and is non-pressure grade.

- Check Unit Price: The high total tax rate (60.3%) may significantly impact the final cost. Consider this in pricing and compliance planning.

- Consult Customs Broker: For accurate classification and to avoid delays, especially with the upcoming tariff changes.

- Document Compliance: Maintain records of product specifications, material composition, and intended use for customs audits.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: PVC DWV Drain Reducer Fittings

HS CODE: 3917400020 (most relevant for PVC DWV fittings)

🔍 Classification Summary:

- Product: Non-pressure PVC (Polyvinyl Chloride) Drain, Waste, and Vent (DWV) pipe fittings.

- HS Code: 3917400020

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 5.3% + 25.0% + 30.0% = 60.3%

⚠️ Important Notes:

- April 11 Special Tariff: Not directly applicable here, but the April 2, 2025 tariff increase is in effect. This is a key date to note for customs clearance and cost estimation.

- Anti-dumping duties: Not applicable for this product category (plastic fittings).

- Material Verification: Ensure the product is non-pressure grade PVC and used for DWV (Drain, Waste, Vent) systems, as this is critical for correct classification.

- Certifications: Confirm if any product certifications (e.g., ASTM, ISO, or local standards) are required for import.

📌 Proactive Advice:

- Verify Material: Confirm the product is made of PVC and is non-pressure grade.

- Check Unit Price: The high total tax rate (60.3%) may significantly impact the final cost. Consider this in pricing and compliance planning.

- Consult Customs Broker: For accurate classification and to avoid delays, especially with the upcoming tariff changes.

- Document Compliance: Maintain records of product specifications, material composition, and intended use for customs audits.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.