Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

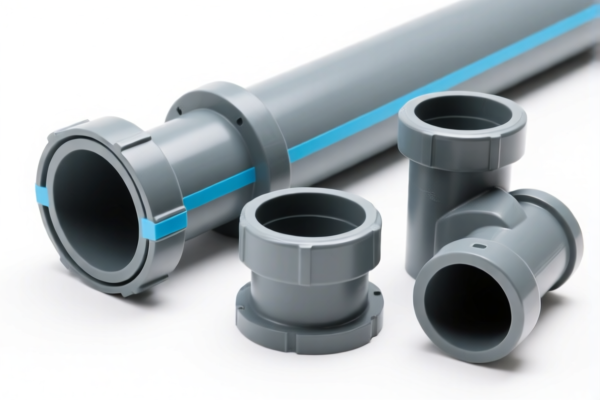

Product Classification: PVC DWV Drain Straight Fittings

HS CODE: 3917400050

🔍 Classification Summary

- Product: Non-pressure (DWV) drainage, waste, and vent (DWV) fittings made of PVC

- HS Code: 3917400050

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 5.3% + 25.0% + 30.0% = 60.3%

⚠️ Important Notes

- April 11 Special Tariff: A 30.0% additional tariff is imposed after April 11, 2025. This is a time-sensitive policy and may affect your customs costs significantly.

- No Anti-Dumping Duties: No specific anti-dumping duties are listed for this product category.

- Material Verification: Ensure the product is PVC and non-pressure (DWV) fittings, as misclassification could lead to higher tariffs or delays.

- Certifications: Confirm if any certifications (e.g., ISO, CE, or local regulatory approvals) are required for import.

📌 Proactive Advice

- Check Material: Confirm the product is made of PVC and not another plastic (e.g., HDPE or PP), as this could change the HS code.

- Unit Price: Be aware of the unit price for customs valuation, as this may affect the total duty.

- Documentation: Ensure proper documentation (e.g., commercial invoice, packing list, and product specifications) is prepared to support the classification.

- Consult Customs Broker: For high-value or complex shipments, consider consulting a customs broker to ensure compliance and avoid penalties.

📋 Alternative HS Codes for Reference

- 3917400060: Other plastic fittings (PVC) – same tax rate (60.3%)

- 3917320010: PVC plastic pipes – 58.1% total tax

- 3917330000: Non-reinforced plastic pipes – 33.1% total tax

- 3904400000: Unprocessed tubes – 60.3% total tax

Let me know if you need help determining the correct HS code based on specific product details or documentation.

Product Classification: PVC DWV Drain Straight Fittings

HS CODE: 3917400050

🔍 Classification Summary

- Product: Non-pressure (DWV) drainage, waste, and vent (DWV) fittings made of PVC

- HS Code: 3917400050

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 5.3% + 25.0% + 30.0% = 60.3%

⚠️ Important Notes

- April 11 Special Tariff: A 30.0% additional tariff is imposed after April 11, 2025. This is a time-sensitive policy and may affect your customs costs significantly.

- No Anti-Dumping Duties: No specific anti-dumping duties are listed for this product category.

- Material Verification: Ensure the product is PVC and non-pressure (DWV) fittings, as misclassification could lead to higher tariffs or delays.

- Certifications: Confirm if any certifications (e.g., ISO, CE, or local regulatory approvals) are required for import.

📌 Proactive Advice

- Check Material: Confirm the product is made of PVC and not another plastic (e.g., HDPE or PP), as this could change the HS code.

- Unit Price: Be aware of the unit price for customs valuation, as this may affect the total duty.

- Documentation: Ensure proper documentation (e.g., commercial invoice, packing list, and product specifications) is prepared to support the classification.

- Consult Customs Broker: For high-value or complex shipments, consider consulting a customs broker to ensure compliance and avoid penalties.

📋 Alternative HS Codes for Reference

- 3917400060: Other plastic fittings (PVC) – same tax rate (60.3%)

- 3917320010: PVC plastic pipes – 58.1% total tax

- 3917330000: Non-reinforced plastic pipes – 33.1% total tax

- 3904400000: Unprocessed tubes – 60.3% total tax

Let me know if you need help determining the correct HS code based on specific product details or documentation.

Customer Reviews

No reviews yet.