| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

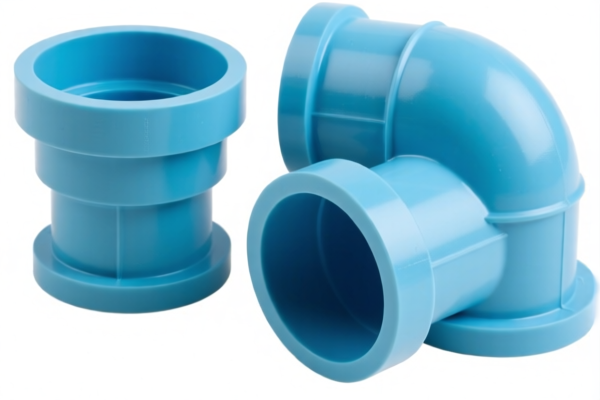

Product Classification: PVC Drain Elbow Fittings

HS CODEs and Tax Information Overview:

- HS CODE: 3917400060

- Description: PVC drainage elbow fittings made of polyvinyl chloride (PVC), classified under "Other Plastic Pipe Fittings."

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to general PVC elbow fittings not specifically categorized under other HS codes.

-

HS CODE: 3917400020

- Description: PVC drainage elbow fittings made of PVC, specifically for non-pressure drainage, waste, and ventilation (DWV) systems.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is more specific to DWV systems and may be more accurate if the product is used for drainage or ventilation.

-

HS CODE: 3917230000

- Description: PVC elbow fittings made of rigid plastic pipe fittings.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to rigid PVC fittings, which may be more suitable if the product is rigid or used in structural applications.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All three HS codes will see an increase in the additional tariff from 25.0% to 30.0% after April 11, 2025.

- This is a time-sensitive policy, so ensure your customs clearance is completed before this date if you want to avoid the higher rate.

🛠️ Proactive Advice for Importers:

- Verify Material: Confirm whether the product is made of rigid or flexible PVC, as this will determine the correct HS code.

- Check Unit Price: The tax rate is based on the declared value, so ensure the unit price is accurate.

- Certifications: Some countries may require specific certifications (e.g., fire resistance, pressure rating) for drainage fittings. Confirm if any are needed for your destination market.

- Documentation: Ensure proper documentation (e.g., commercial invoice, packing list) clearly describes the product to avoid misclassification.

✅ Recommendation:

If the product is used for drainage, waste, or ventilation (DWV) systems, HS CODE 3917400020 is likely the most accurate. If it is rigid, then HS CODE 3917230000 may be more appropriate. Always cross-check with customs authorities or a qualified customs broker for final confirmation.

Product Classification: PVC Drain Elbow Fittings

HS CODEs and Tax Information Overview:

- HS CODE: 3917400060

- Description: PVC drainage elbow fittings made of polyvinyl chloride (PVC), classified under "Other Plastic Pipe Fittings."

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to general PVC elbow fittings not specifically categorized under other HS codes.

-

HS CODE: 3917400020

- Description: PVC drainage elbow fittings made of PVC, specifically for non-pressure drainage, waste, and ventilation (DWV) systems.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is more specific to DWV systems and may be more accurate if the product is used for drainage or ventilation.

-

HS CODE: 3917230000

- Description: PVC elbow fittings made of rigid plastic pipe fittings.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to rigid PVC fittings, which may be more suitable if the product is rigid or used in structural applications.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All three HS codes will see an increase in the additional tariff from 25.0% to 30.0% after April 11, 2025.

- This is a time-sensitive policy, so ensure your customs clearance is completed before this date if you want to avoid the higher rate.

🛠️ Proactive Advice for Importers:

- Verify Material: Confirm whether the product is made of rigid or flexible PVC, as this will determine the correct HS code.

- Check Unit Price: The tax rate is based on the declared value, so ensure the unit price is accurate.

- Certifications: Some countries may require specific certifications (e.g., fire resistance, pressure rating) for drainage fittings. Confirm if any are needed for your destination market.

- Documentation: Ensure proper documentation (e.g., commercial invoice, packing list) clearly describes the product to avoid misclassification.

✅ Recommendation:

If the product is used for drainage, waste, or ventilation (DWV) systems, HS CODE 3917400020 is likely the most accurate. If it is rigid, then HS CODE 3917230000 may be more appropriate. Always cross-check with customs authorities or a qualified customs broker for final confirmation.

Customer Reviews

No reviews yet.