| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

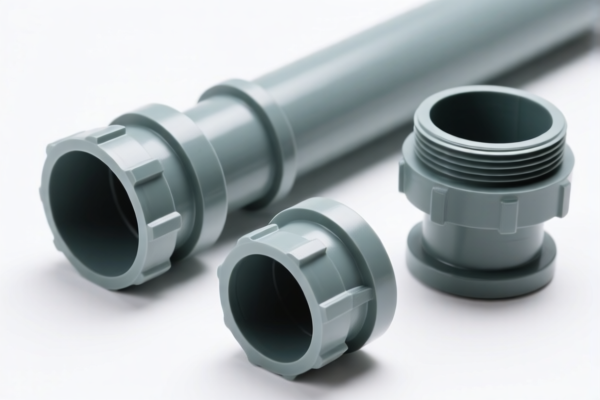

Product Classification: PVC Drain Fittings

HS CODE: 3917400060, 3917400050, 3917320010, 3904400000, 3917390020

🔍 Classification Overview

PVC drain fittings fall under Chapter 39 of the HS code, which covers "Plastics and articles thereof." Specifically, they are classified under Heading 3917, which includes "Plastics, articles of plastics, and articles of plasticized materials, other than those of heading 3915:

- 3917.40 – Other plastic fittings (e.g., PVC drain fittings)

- 3917.32 – PVC plastic pipes

- 3917.39 – Other plastic pipes and fittings (PVC)

- 3904.40 – Unworked tubes (not further processed)

📊 Tariff Summary (as of now)

1. HS CODE: 3917400060 – Other plastic fittings made of polyvinyl chloride (PVC)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

2. HS CODE: 3917400050 – Plastic pipes, fittings, and tubes, especially non-pressure drainage (DWV) fittings

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

3. HS CODE: 3917320010 – PVC plastic pipes

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

4. HS CODE: 3904400000 – Unworked tubes

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

5. HS CODE: 3917390020 – PVC plastic pipes and fittings

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-dumping duties:

Not applicable for PVC drain fittings, as these are not typically subject to anti-dumping duties on iron or aluminum. -

Material and Certification Requirements:

- Confirm the material composition (e.g., is it 100% PVC? Are there additives or other materials?)

- Verify if certifications (e.g., ISO, CE, or local regulatory approvals) are required for import into the destination country.

- Ensure unit price and product description align with the HS code classification to avoid misclassification penalties.

✅ Proactive Advice for Importers

- Double-check the HS code based on the exact product description and material (e.g., whether it's a fitting, pipe, or unprocessed tube).

- Review the April 11, 2025 tariff change and factor it into your import cost calculations.

- Consult with customs brokers or classification experts if the product is borderline between multiple HS codes.

- Keep documentation ready (e.g., material certificates, product specifications) to support the declared HS code and avoid delays at customs.

Let me know if you need help with HS code verification or tariff calculation for a specific product.

Product Classification: PVC Drain Fittings

HS CODE: 3917400060, 3917400050, 3917320010, 3904400000, 3917390020

🔍 Classification Overview

PVC drain fittings fall under Chapter 39 of the HS code, which covers "Plastics and articles thereof." Specifically, they are classified under Heading 3917, which includes "Plastics, articles of plastics, and articles of plasticized materials, other than those of heading 3915:

- 3917.40 – Other plastic fittings (e.g., PVC drain fittings)

- 3917.32 – PVC plastic pipes

- 3917.39 – Other plastic pipes and fittings (PVC)

- 3904.40 – Unworked tubes (not further processed)

📊 Tariff Summary (as of now)

1. HS CODE: 3917400060 – Other plastic fittings made of polyvinyl chloride (PVC)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

2. HS CODE: 3917400050 – Plastic pipes, fittings, and tubes, especially non-pressure drainage (DWV) fittings

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

3. HS CODE: 3917320010 – PVC plastic pipes

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

4. HS CODE: 3904400000 – Unworked tubes

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

5. HS CODE: 3917390020 – PVC plastic pipes and fittings

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-dumping duties:

Not applicable for PVC drain fittings, as these are not typically subject to anti-dumping duties on iron or aluminum. -

Material and Certification Requirements:

- Confirm the material composition (e.g., is it 100% PVC? Are there additives or other materials?)

- Verify if certifications (e.g., ISO, CE, or local regulatory approvals) are required for import into the destination country.

- Ensure unit price and product description align with the HS code classification to avoid misclassification penalties.

✅ Proactive Advice for Importers

- Double-check the HS code based on the exact product description and material (e.g., whether it's a fitting, pipe, or unprocessed tube).

- Review the April 11, 2025 tariff change and factor it into your import cost calculations.

- Consult with customs brokers or classification experts if the product is borderline between multiple HS codes.

- Keep documentation ready (e.g., material certificates, product specifications) to support the declared HS code and avoid delays at customs.

Let me know if you need help with HS code verification or tariff calculation for a specific product.

Customer Reviews

No reviews yet.