| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

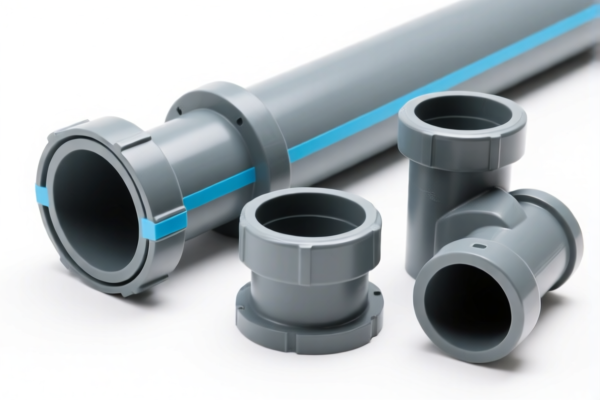

Product Classification: PVC Drain Straight Fittings

HS CODE: 3917400020, 3917400050, 3917400060, 3917330000

🔍 Classification Overview

PVC drain straight fittings and related components fall under Chapter 39 of the Harmonized System (HS), which covers "Plastics and articles thereof." Specifically, they are classified under Heading 3917, which includes "Plastics, in the form of tubes, pipes, or hoses, of plastics, whether or not fitted with fittings, and articles of plastics, in the form of tubes, pipes, or hoses, of plastics, whether or not fitted with fittings."

📊 Tariff Summary (as of now)

- Base Tariff Rate: 5.3% (for most codes) or 3.1% (for 3917330000)

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0% (applies to all listed HS codes)

- Anti-dumping duties: Not applicable for PVC products (unless specific to iron/aluminum, which is not the case here)

📌 Key Tax Rate Changes

- Before April 11, 2025:

-

Total tax rate = Base (5.3% or 3.1%) + Additional (25.0%) = 30.3% or 28.1%

-

After April 11, 2025:

- Total tax rate = Base (5.3% or 3.1%) + Additional (25.0%) + Special (30.0%) = 60.3% or 58.1%

⚠️ Time-Sensitive Policy Alert

- April 11, 2025: A special additional tariff of 30.0% will be imposed on all listed HS codes. This is a critical date for customs clearance and cost estimation.

📦 Proactive Advice for Importers

- Verify Material: Ensure the product is indeed made of PVC (polyvinyl chloride) and not a composite or mixed material, which may change the classification.

- Check Unit Price: The total tax rate is based on the declared value, so accurate pricing is essential.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH, or local import permits) are required for the product in the destination country.

- Consult Customs Broker: For complex cases, especially if the product is borderline between different HS codes.

📌 HS Code Comparison

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax |

|---|---|---|---|---|---|

| 3917400020 | PVC Drain Straight Fittings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917400050 | PVC Drain Fittings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917400060 | PVC Drain Fittings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917330000 | PVC Drain Straight Pipes | 3.1% | 0.0% | 30.0% | 33.1% |

If you have more details about the product (e.g., dimensions, usage, or country of origin), I can help further refine the classification and tax calculation.

Product Classification: PVC Drain Straight Fittings

HS CODE: 3917400020, 3917400050, 3917400060, 3917330000

🔍 Classification Overview

PVC drain straight fittings and related components fall under Chapter 39 of the Harmonized System (HS), which covers "Plastics and articles thereof." Specifically, they are classified under Heading 3917, which includes "Plastics, in the form of tubes, pipes, or hoses, of plastics, whether or not fitted with fittings, and articles of plastics, in the form of tubes, pipes, or hoses, of plastics, whether or not fitted with fittings."

📊 Tariff Summary (as of now)

- Base Tariff Rate: 5.3% (for most codes) or 3.1% (for 3917330000)

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0% (applies to all listed HS codes)

- Anti-dumping duties: Not applicable for PVC products (unless specific to iron/aluminum, which is not the case here)

📌 Key Tax Rate Changes

- Before April 11, 2025:

-

Total tax rate = Base (5.3% or 3.1%) + Additional (25.0%) = 30.3% or 28.1%

-

After April 11, 2025:

- Total tax rate = Base (5.3% or 3.1%) + Additional (25.0%) + Special (30.0%) = 60.3% or 58.1%

⚠️ Time-Sensitive Policy Alert

- April 11, 2025: A special additional tariff of 30.0% will be imposed on all listed HS codes. This is a critical date for customs clearance and cost estimation.

📦 Proactive Advice for Importers

- Verify Material: Ensure the product is indeed made of PVC (polyvinyl chloride) and not a composite or mixed material, which may change the classification.

- Check Unit Price: The total tax rate is based on the declared value, so accurate pricing is essential.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH, or local import permits) are required for the product in the destination country.

- Consult Customs Broker: For complex cases, especially if the product is borderline between different HS codes.

📌 HS Code Comparison

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax |

|---|---|---|---|---|---|

| 3917400020 | PVC Drain Straight Fittings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917400050 | PVC Drain Fittings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917400060 | PVC Drain Fittings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917330000 | PVC Drain Straight Pipes | 3.1% | 0.0% | 30.0% | 33.1% |

If you have more details about the product (e.g., dimensions, usage, or country of origin), I can help further refine the classification and tax calculation.

Customer Reviews

No reviews yet.