Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400020 | Doc | 60.3% | CN | US | 2025-05-12 |

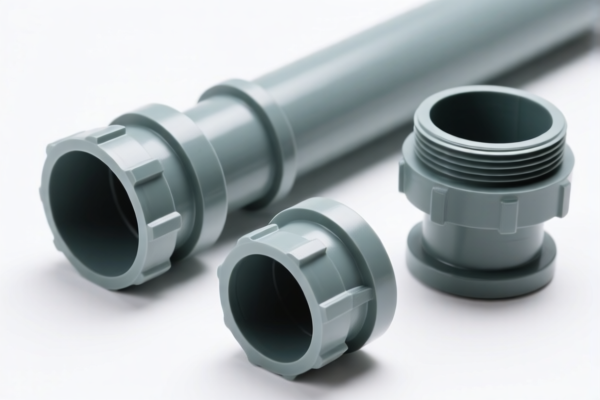

Product Classification: PVC Drain/Waste/Vent (DWV) Fittings

HS CODE: 3917400020, 3917400060, 3917400050 (all with the same tax structure)

🔍 Key Classification Details:

- Product Type: PVC (Polyvinyl Chloride) Drain/Waste/Vent (DWV) fittings, non-pressure grade.

- HS Code Options:

- 3917400020: Specifically for PVC DWV fittings.

- 3917400060: For other plastic fittings made of PVC.

- 3917400050: For non-pressure grade DWV fittings (plastic pipes and fittings).

- Note: Some codes may overlap in description, so material and function must be clearly defined for accurate classification.

💰 Tariff Structure (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 2, 2025): 30.0%

- Total Tax Rate: 60.3%

⏰ Time-Sensitive Policy Alert:

- April 2, 2025: Additional tariffs will increase from 25.0% to 30.0% for these HS codes.

- Impact: This will increase the total tax rate from 55.3% to 60.3%.

- Action Required: If your product will be imported after April 2, 2025, plan for higher costs and review your pricing strategy accordingly.

🛑 Anti-Dumping Duties:

- Not applicable for PVC DWV fittings (not iron or aluminum products).

- No specific anti-dumping duties are currently listed for this classification.

📌 Proactive Advice for Importers:

- Verify Material: Confirm that the product is indeed made of PVC and is non-pressure grade (DWV).

- Check Unit Price: The tax rate is based on the total value, so ensure accurate valuation of the product.

- Certifications: Confirm if any technical or safety certifications (e.g., ISO, CE, or local standards) are required for import.

- Consult Customs Broker: For complex classifications or large volumes, consider professional customs brokerage to avoid misclassification penalties.

✅ Summary Table:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|---|

| 3917400020 | PVC DWV fittings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917400060 | Other plastic fittings made of PVC | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917400050 | Non-pressure grade DWV fittings (plastic) | 5.3% | 25.0% | 30.0% | 60.3% |

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Product Classification: PVC Drain/Waste/Vent (DWV) Fittings

HS CODE: 3917400020, 3917400060, 3917400050 (all with the same tax structure)

🔍 Key Classification Details:

- Product Type: PVC (Polyvinyl Chloride) Drain/Waste/Vent (DWV) fittings, non-pressure grade.

- HS Code Options:

- 3917400020: Specifically for PVC DWV fittings.

- 3917400060: For other plastic fittings made of PVC.

- 3917400050: For non-pressure grade DWV fittings (plastic pipes and fittings).

- Note: Some codes may overlap in description, so material and function must be clearly defined for accurate classification.

💰 Tariff Structure (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 2, 2025): 30.0%

- Total Tax Rate: 60.3%

⏰ Time-Sensitive Policy Alert:

- April 2, 2025: Additional tariffs will increase from 25.0% to 30.0% for these HS codes.

- Impact: This will increase the total tax rate from 55.3% to 60.3%.

- Action Required: If your product will be imported after April 2, 2025, plan for higher costs and review your pricing strategy accordingly.

🛑 Anti-Dumping Duties:

- Not applicable for PVC DWV fittings (not iron or aluminum products).

- No specific anti-dumping duties are currently listed for this classification.

📌 Proactive Advice for Importers:

- Verify Material: Confirm that the product is indeed made of PVC and is non-pressure grade (DWV).

- Check Unit Price: The tax rate is based on the total value, so ensure accurate valuation of the product.

- Certifications: Confirm if any technical or safety certifications (e.g., ISO, CE, or local standards) are required for import.

- Consult Customs Broker: For complex classifications or large volumes, consider professional customs brokerage to avoid misclassification penalties.

✅ Summary Table:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|---|

| 3917400020 | PVC DWV fittings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917400060 | Other plastic fittings made of PVC | 5.3% | 25.0% | 30.0% | 60.3% |

| 3917400050 | Non-pressure grade DWV fittings (plastic) | 5.3% | 25.0% | 30.0% | 60.3% |

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.