| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

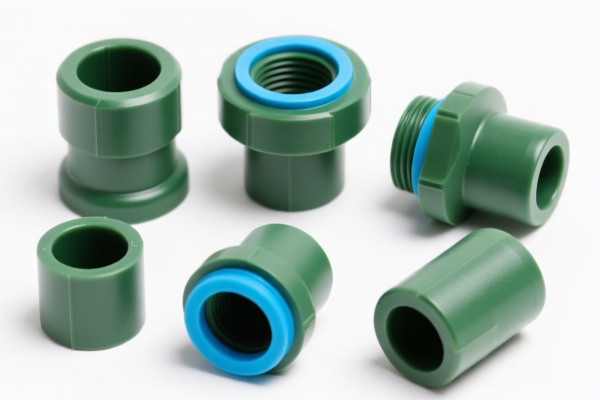

Product Classification: PVC Fittings

HS CODEs and Tax Information Overview:

- HS CODE: 3904400000

- Description: PVC fittings fall under the category of polyvinyl chloride (PVC) or other halogenated ethylene polymers, which aligns with the description of HS CODE 3904.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for general PVC fittings.

-

HS CODE: 3917400095

- Description: PVC fittings are classified under HS CODE 3917400095, which covers plastic pipes, fittings, and flexible hoses.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for general plastic fittings, including PVC.

-

HS CODE: 3917320010

- Description: PVC fittings match the description of HS CODE 3917320010, which refers to plastic pipes and fittings made of polyvinyl chloride.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code may be more favorable for PVC fittings due to the lower base tariff.

-

HS CODE: 3904220000

- Description: PVC pipes are classified under HS CODE 3904, as PVC is a halogenated ethylene polymer. This code is for primary forms, including plasticized PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC pipes, not fittings.

-

HS CODE: 3921125000

- Description: PVC pipes are also classified under HS CODE 3921, which includes other plastic sheets, films, foams, etc., including those made of PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic sheets, films, etc., not for pipes or fittings.

✅ Proactive Advice:

- Verify Material and Unit Price: Ensure the product is indeed made of PVC and not a composite or mixed material, as this can affect classification.

- Check Required Certifications: Some countries may require specific certifications (e.g., RoHS, REACH) for PVC products.

- Confirm Product Type: Distinguish clearly between PVC pipes and PVC fittings, as they fall under different HS codes.

- Monitor Tariff Changes: The special tariff after April 11, 2025, is a critical date to be aware of, as it significantly increases the total tax rate.

- Consider Using HS CODE 3917320010: If applicable, this code may offer a lower base tariff for PVC fittings.

Let me know if you need help determining the most accurate HS code for your specific product.

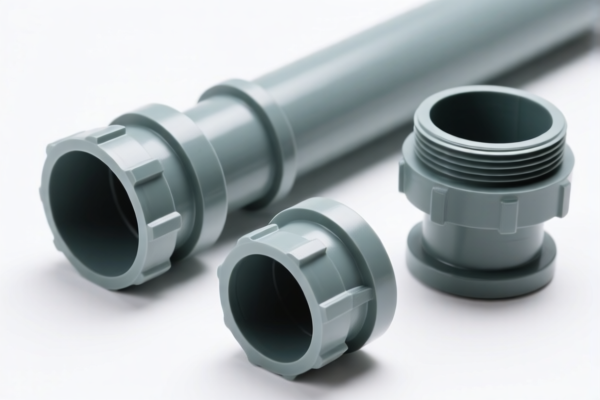

Product Classification: PVC Fittings

HS CODEs and Tax Information Overview:

- HS CODE: 3904400000

- Description: PVC fittings fall under the category of polyvinyl chloride (PVC) or other halogenated ethylene polymers, which aligns with the description of HS CODE 3904.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for general PVC fittings.

-

HS CODE: 3917400095

- Description: PVC fittings are classified under HS CODE 3917400095, which covers plastic pipes, fittings, and flexible hoses.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for general plastic fittings, including PVC.

-

HS CODE: 3917320010

- Description: PVC fittings match the description of HS CODE 3917320010, which refers to plastic pipes and fittings made of polyvinyl chloride.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code may be more favorable for PVC fittings due to the lower base tariff.

-

HS CODE: 3904220000

- Description: PVC pipes are classified under HS CODE 3904, as PVC is a halogenated ethylene polymer. This code is for primary forms, including plasticized PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC pipes, not fittings.

-

HS CODE: 3921125000

- Description: PVC pipes are also classified under HS CODE 3921, which includes other plastic sheets, films, foams, etc., including those made of PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for plastic sheets, films, etc., not for pipes or fittings.

✅ Proactive Advice:

- Verify Material and Unit Price: Ensure the product is indeed made of PVC and not a composite or mixed material, as this can affect classification.

- Check Required Certifications: Some countries may require specific certifications (e.g., RoHS, REACH) for PVC products.

- Confirm Product Type: Distinguish clearly between PVC pipes and PVC fittings, as they fall under different HS codes.

- Monitor Tariff Changes: The special tariff after April 11, 2025, is a critical date to be aware of, as it significantly increases the total tax rate.

- Consider Using HS CODE 3917320010: If applicable, this code may offer a lower base tariff for PVC fittings.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.