Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

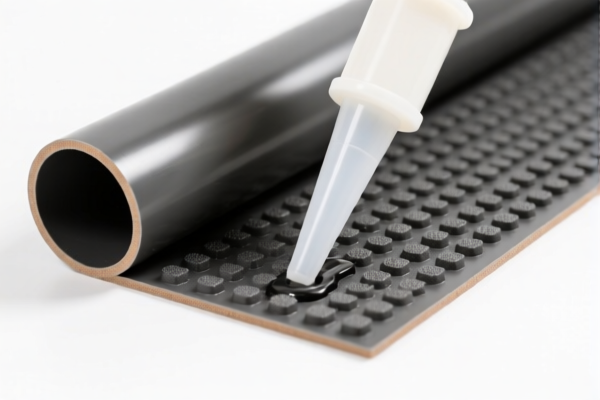

Product Classification: PVC Floor Anti-Slip Treatment

HS CODE: 3918102000, 3918101030, 3918101020

🔍 Classification Overview

- 3918102000: Covers PVC anti-slip floor mats, anti-vibration pads, moisture-proof films, and protective films for PVC flooring.

- 3918101030 & 3918101020: Specifically for anti-slip PVC floor tiles.

📊 Tariff Summary (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3% (5.3% + 25.0% + 30.0%)

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after this date. Ensure your customs clearance is completed before this date to avoid higher costs.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently reported for this product category.

- Material and Certification Verification: Confirm the exact material composition and whether any certifications (e.g., fire resistance, environmental standards) are required for import.

📌 Proactive Advice

- Check Product Description: Ensure the product is correctly classified under the appropriate HS code (e.g., floor tiles vs. floor mats).

- Review Unit Price: Tariff calculations depend on the declared value, so verify the unit price and total value.

- Consult Customs Broker: For complex cases, especially if the product has multiple functions or is part of a larger kit.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Classification: PVC Floor Anti-Slip Treatment

HS CODE: 3918102000, 3918101030, 3918101020

🔍 Classification Overview

- 3918102000: Covers PVC anti-slip floor mats, anti-vibration pads, moisture-proof films, and protective films for PVC flooring.

- 3918101030 & 3918101020: Specifically for anti-slip PVC floor tiles.

📊 Tariff Summary (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3% (5.3% + 25.0% + 30.0%)

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after this date. Ensure your customs clearance is completed before this date to avoid higher costs.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently reported for this product category.

- Material and Certification Verification: Confirm the exact material composition and whether any certifications (e.g., fire resistance, environmental standards) are required for import.

📌 Proactive Advice

- Check Product Description: Ensure the product is correctly classified under the appropriate HS code (e.g., floor tiles vs. floor mats).

- Review Unit Price: Tariff calculations depend on the declared value, so verify the unit price and total value.

- Consult Customs Broker: For complex cases, especially if the product has multiple functions or is part of a larger kit.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.