| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

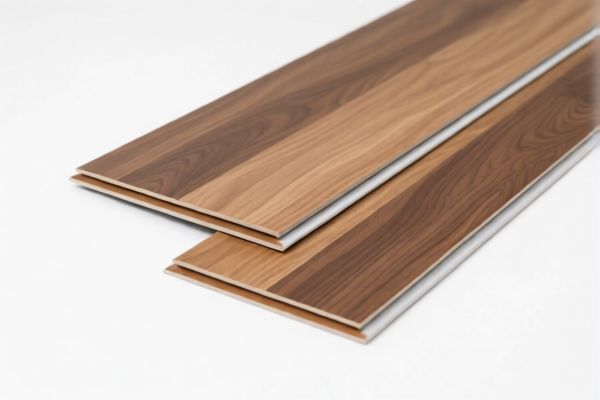

Here is the structured customs compliance analysis for PVC Floor Anti Static Treatment products, based on the provided HS codes and tax details:

📦 Product Classification Overview

The following HS codes are applicable for PVC anti-static floor tiles or panels:

🔢 HS Code Breakdown and Tax Rates

1. 3918102000 - PVC防静电地板 (PVC Anti-static Floor)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

2. 3918101020 - PVC地板砖-防静电型 (Anti-static PVC Floor Tiles)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

3. 3918101030 - PVC地板砖(防静电) (Anti-static PVC Floor Tiles)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

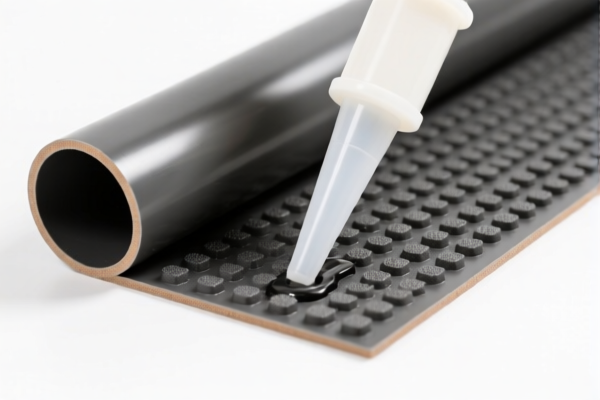

4. 3904220000 - PVC防静电板 (Anti-static PVC Panels)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

5. 3921125000 - PVC防静电板 (Anti-static PVC Panels)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

6. 3918101040 - 防静电PVC地板砖 (Anti-static PVC Floor Tiles)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

No Anti-dumping Duties Mentioned:

There are no specific anti-dumping duties listed for these products in the provided data. -

Material and Certification Requirements:

Ensure that the product is clearly labeled as anti-static and that the material composition (e.g., PVC content, additives for static control) is documented. Some countries may require certifications (e.g., ESD standards) for anti-static products.

✅ Proactive Advice for Importers

-

Verify Product Description:

Confirm that the product is classified under the correct HS code based on its form (floor tiles vs. panels) and function (anti-static). -

Check Unit Price and Material Composition:

The tax rate may vary depending on the PVC content and additives used for anti-static properties. -

Prepare Documentation:

Include technical specifications, certifications, and product labels to support the classification and avoid delays at customs. -

Monitor Tariff Changes:

Stay updated on any new trade policies or tariff adjustments, especially after April 11, 2025.

Let me know if you need help with customs declaration forms or certification requirements for anti-static PVC products. Here is the structured customs compliance analysis for PVC Floor Anti Static Treatment products, based on the provided HS codes and tax details:

📦 Product Classification Overview

The following HS codes are applicable for PVC anti-static floor tiles or panels:

🔢 HS Code Breakdown and Tax Rates

1. 3918102000 - PVC防静电地板 (PVC Anti-static Floor)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

2. 3918101020 - PVC地板砖-防静电型 (Anti-static PVC Floor Tiles)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

3. 3918101030 - PVC地板砖(防静电) (Anti-static PVC Floor Tiles)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

4. 3904220000 - PVC防静电板 (Anti-static PVC Panels)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

5. 3921125000 - PVC防静电板 (Anti-static PVC Panels)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

6. 3918101040 - 防静电PVC地板砖 (Anti-static PVC Floor Tiles)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

No Anti-dumping Duties Mentioned:

There are no specific anti-dumping duties listed for these products in the provided data. -

Material and Certification Requirements:

Ensure that the product is clearly labeled as anti-static and that the material composition (e.g., PVC content, additives for static control) is documented. Some countries may require certifications (e.g., ESD standards) for anti-static products.

✅ Proactive Advice for Importers

-

Verify Product Description:

Confirm that the product is classified under the correct HS code based on its form (floor tiles vs. panels) and function (anti-static). -

Check Unit Price and Material Composition:

The tax rate may vary depending on the PVC content and additives used for anti-static properties. -

Prepare Documentation:

Include technical specifications, certifications, and product labels to support the classification and avoid delays at customs. -

Monitor Tariff Changes:

Stay updated on any new trade policies or tariff adjustments, especially after April 11, 2025.

Let me know if you need help with customs declaration forms or certification requirements for anti-static PVC products.

Customer Reviews

No reviews yet.