| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

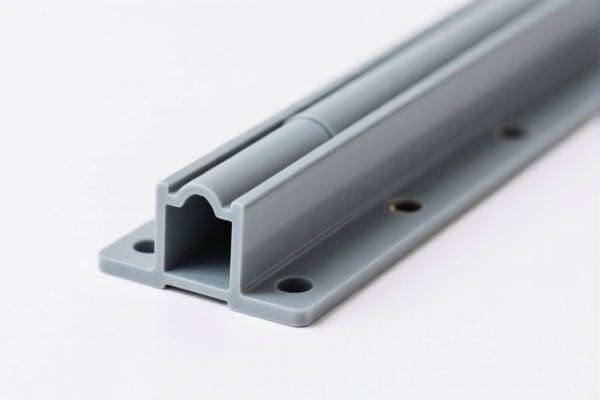

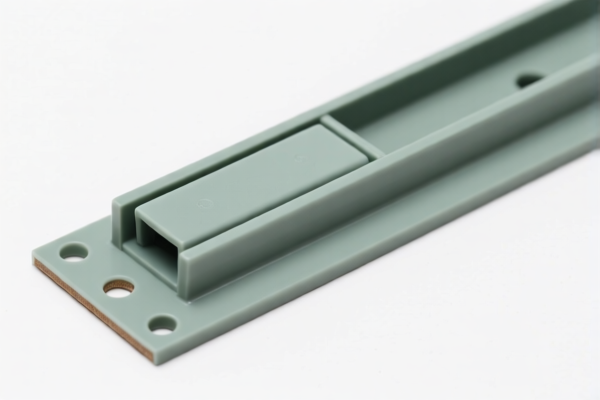

Product Name: PVC Floor Click

Classification: Plastic Floor Covering (PVC-based)

✅ HS CODE Classification Overview

Below are the relevant HS codes and their associated tariff details for PVC Floor Click products:

🔢 HS CODE: 3904220000

Description: Other polyvinyl chloride (PVC), plasticized

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Notes:

- Applicable for PVC floors that are plasticized (common in PVC flooring).

- Ensure the product is not classified under a more specific code (e.g., 3918101030 or 3918102000).

🔢 HS CODE: 3918101030

Description: Floor coverings of polyvinyl chloride (PVC) polymer

Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.3%

Notes:

- Specifically for PVC floor coverings.

- This is a more specific code than 3904220000 and may be more accurate for PVC floor tiles or sheets.

🔢 HS CODE: 3921125000

Description: Other plastic sheets, plates, etc., of polyvinyl chloride (PVC)

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Notes:

- Applicable for PVC floor boards or panels.

- May be used if the product is more accurately described as a "board" or "panel" rather than a "floor covering."

🔢 HS CODE: 3918102000

Description: Floor coverings of polyvinyl chloride (PVC) polymer, in sheets or tiles

Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.3%

Notes:

- Specifically for PVC floor tiles or sheets.

- Ideal for "PVC Tile Floor" products.

🔢 HS CODE: 3918101020

Description: Vinyl tiles, rigid solid polymer core, for floor coverings

Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.3%

Notes:

- Designed for rigid PVC floor tiles.

- Best for products with a solid core and rigid structure.

⚠️ Important Notes and Recommendations

- Tariff Changes After April 11, 2025:

- Additional tariffs of 30.0% will be applied to all the above HS codes.

-

This is a time-sensitive policy and may significantly increase import costs.

-

Anti-Dumping Duties:

-

Not applicable for PVC flooring products (no known anti-dumping duties on PVC floor coverings as of now).

-

Certifications Required:

-

Verify if any product certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

-

Material and Unit Price:

-

Confirm the material composition (e.g., whether it is plasticized PVC or rigid PVC) and unit price to ensure correct HS code classification.

-

Customs Declaration:

- Provide detailed product descriptions, including type of PVC, form (tile, sheet, board), and intended use (e.g., residential, commercial).

📌 Proactive Advice

- Double-check the product form (tile, sheet, board) and material type (plasticized or rigid) to select the most accurate HS code.

- Consult with customs brokers or classification experts if the product is borderline between multiple HS codes.

- Keep updated records of product specifications and tariff changes to avoid unexpected costs at customs.

Let me know if you need help with HS code selection or tariff calculation for a specific product variant.

Product Name: PVC Floor Click

Classification: Plastic Floor Covering (PVC-based)

✅ HS CODE Classification Overview

Below are the relevant HS codes and their associated tariff details for PVC Floor Click products:

🔢 HS CODE: 3904220000

Description: Other polyvinyl chloride (PVC), plasticized

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Notes:

- Applicable for PVC floors that are plasticized (common in PVC flooring).

- Ensure the product is not classified under a more specific code (e.g., 3918101030 or 3918102000).

🔢 HS CODE: 3918101030

Description: Floor coverings of polyvinyl chloride (PVC) polymer

Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.3%

Notes:

- Specifically for PVC floor coverings.

- This is a more specific code than 3904220000 and may be more accurate for PVC floor tiles or sheets.

🔢 HS CODE: 3921125000

Description: Other plastic sheets, plates, etc., of polyvinyl chloride (PVC)

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Notes:

- Applicable for PVC floor boards or panels.

- May be used if the product is more accurately described as a "board" or "panel" rather than a "floor covering."

🔢 HS CODE: 3918102000

Description: Floor coverings of polyvinyl chloride (PVC) polymer, in sheets or tiles

Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.3%

Notes:

- Specifically for PVC floor tiles or sheets.

- Ideal for "PVC Tile Floor" products.

🔢 HS CODE: 3918101020

Description: Vinyl tiles, rigid solid polymer core, for floor coverings

Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 60.3%

Notes:

- Designed for rigid PVC floor tiles.

- Best for products with a solid core and rigid structure.

⚠️ Important Notes and Recommendations

- Tariff Changes After April 11, 2025:

- Additional tariffs of 30.0% will be applied to all the above HS codes.

-

This is a time-sensitive policy and may significantly increase import costs.

-

Anti-Dumping Duties:

-

Not applicable for PVC flooring products (no known anti-dumping duties on PVC floor coverings as of now).

-

Certifications Required:

-

Verify if any product certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

-

Material and Unit Price:

-

Confirm the material composition (e.g., whether it is plasticized PVC or rigid PVC) and unit price to ensure correct HS code classification.

-

Customs Declaration:

- Provide detailed product descriptions, including type of PVC, form (tile, sheet, board), and intended use (e.g., residential, commercial).

📌 Proactive Advice

- Double-check the product form (tile, sheet, board) and material type (plasticized or rigid) to select the most accurate HS code.

- Consult with customs brokers or classification experts if the product is borderline between multiple HS codes.

- Keep updated records of product specifications and tariff changes to avoid unexpected costs at customs.

Let me know if you need help with HS code selection or tariff calculation for a specific product variant.

Customer Reviews

No reviews yet.