| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

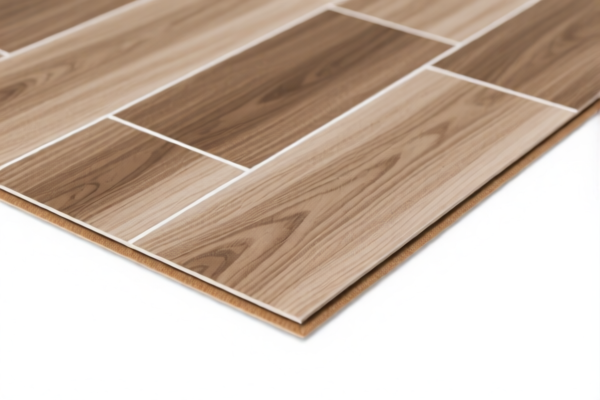

Product Name: PVC Floor

Classification: Plastic Floor Coverings Made of Polyvinyl Chloride (PVC)

✅ HS CODE Classification Overview

Below are the relevant HS codes and their associated tariff details for PVC floor products:

🔢 HS CODE: 3918101030

- Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles; plastic wall or ceiling coverings, as defined in Note 9 of this chapter: made of polyvinyl chloride polymer: floor coverings: vinyl tiles made of rigid solid polymer core.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC floor tiles with a rigid core.

🔢 HS CODE: 3904220000

- Description: Other polyvinyl chloride (PVC), plasticized.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more general and applies to PVC products that are plasticized, including PVC floor materials that have undergone plasticization.

🔢 HS CODE: 3921125000

- Description: Other plastic sheets, plates, films, foils and strips, of polyvinyl chloride polymer.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC floor boards or sheets that are not specifically classified under 3918.

🔢 HS CODE: 3918102000

- Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles; plastic wall or ceiling coverings, as defined in Note 9 of this chapter: made of polyvinyl chloride polymer: floor coverings.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC floor tiles or sheets made of PVC polymer.

🔢 HS CODE: 3918101020

- Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles; plastic wall or ceiling coverings, as defined in Note 9 of this chapter: made of polyvinyl chloride polymer: floor coverings: vinyl tiles made of rigid solid polymer core.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for rigid PVC floor tiles.

⚠️ Important Notes and Recommendations

- Tariff Increase Alert:

-

After April 11, 2025, an additional 30.0% tariff will be applied to all the above HS codes. Ensure your import timeline is planned accordingly.

-

Material Verification:

-

Confirm the material composition (e.g., whether it is plasticized, rigid, or flexible) and product form (sheet, tile, etc.) to ensure correct HS code classification.

-

Certifications Required:

-

Check if certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

-

Unit Price and Classification:

- Verify the unit price and product description to avoid misclassification and potential penalties.

📌 Proactive Advice

- Consult a customs broker or classification expert if the product has mixed materials or special features (e.g., anti-slip, soundproofing).

- Keep documentation such as product specifications, material certificates, and invoices ready for customs inspection.

- Monitor policy updates for any changes in tariff rates or classification rules after April 11, 2025.

Product Name: PVC Floor

Classification: Plastic Floor Coverings Made of Polyvinyl Chloride (PVC)

✅ HS CODE Classification Overview

Below are the relevant HS codes and their associated tariff details for PVC floor products:

🔢 HS CODE: 3918101030

- Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles; plastic wall or ceiling coverings, as defined in Note 9 of this chapter: made of polyvinyl chloride polymer: floor coverings: vinyl tiles made of rigid solid polymer core.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC floor tiles with a rigid core.

🔢 HS CODE: 3904220000

- Description: Other polyvinyl chloride (PVC), plasticized.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more general and applies to PVC products that are plasticized, including PVC floor materials that have undergone plasticization.

🔢 HS CODE: 3921125000

- Description: Other plastic sheets, plates, films, foils and strips, of polyvinyl chloride polymer.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC floor boards or sheets that are not specifically classified under 3918.

🔢 HS CODE: 3918102000

- Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles; plastic wall or ceiling coverings, as defined in Note 9 of this chapter: made of polyvinyl chloride polymer: floor coverings.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC floor tiles or sheets made of PVC polymer.

🔢 HS CODE: 3918101020

- Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles; plastic wall or ceiling coverings, as defined in Note 9 of this chapter: made of polyvinyl chloride polymer: floor coverings: vinyl tiles made of rigid solid polymer core.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for rigid PVC floor tiles.

⚠️ Important Notes and Recommendations

- Tariff Increase Alert:

-

After April 11, 2025, an additional 30.0% tariff will be applied to all the above HS codes. Ensure your import timeline is planned accordingly.

-

Material Verification:

-

Confirm the material composition (e.g., whether it is plasticized, rigid, or flexible) and product form (sheet, tile, etc.) to ensure correct HS code classification.

-

Certifications Required:

-

Check if certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

-

Unit Price and Classification:

- Verify the unit price and product description to avoid misclassification and potential penalties.

📌 Proactive Advice

- Consult a customs broker or classification expert if the product has mixed materials or special features (e.g., anti-slip, soundproofing).

- Keep documentation such as product specifications, material certificates, and invoices ready for customs inspection.

- Monitor policy updates for any changes in tariff rates or classification rules after April 11, 2025.

Customer Reviews

No reviews yet.