Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

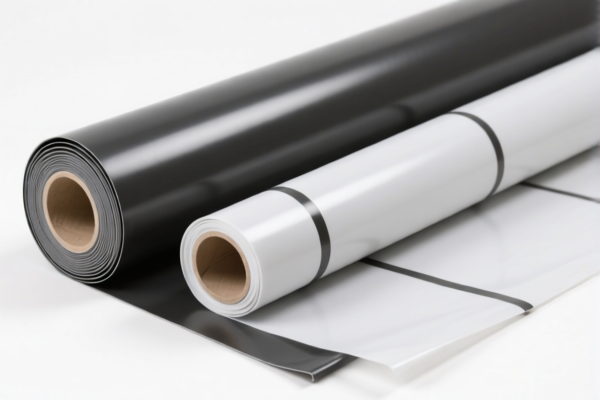

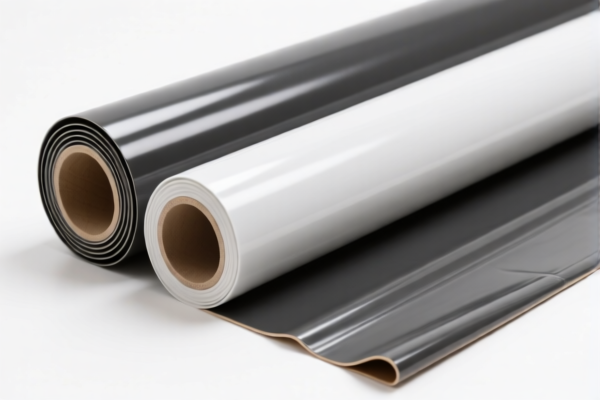

Product Classification: PVC Floor Covering Rolls

HS CODE: 3918101040, 3918102000, 3918101020, 3918901000 (all with the same tax structure)

🔍 Classification Summary:

- These HS codes classify PVC (Polyvinyl Chloride) floor covering rolls and other plastic floor coverings, whether self-adhesive or not, in sheet or tile form.

- The product is not carpet, but floor covering made of plastic, specifically PVC.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a new policy and may affect your import costs significantly.

✅ Action Required: Monitor the exact date of import and consider adjusting your import schedule accordingly.

🛑 Anti-Dumping Duties (if applicable):

- Not applicable for PVC floor coverings under these HS codes.

However, if the product contains iron or aluminum components, check for anti-dumping duties separately.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is 100% PVC or PVC-based to avoid misclassification.

- Check Unit Price: Tariff rates may vary based on value or quantity, so confirm the unit price and total value of the shipment.

- Certifications Required: Some countries may require product certifications (e.g., fire resistance, environmental standards). Confirm the import regulations of the destination country.

- Consult Customs Broker: For complex classifications or large shipments, it's advisable to seek professional customs advice to avoid delays or penalties.

🧾 Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tax |

|---|---|---|---|---|---|

| 3918101040 | PVC floor covering rolls | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918102000 | PVC carpets (other) | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101020 | Plastic floor coverings (sheet/tile) | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918901000 | Plastic floor coverings (sheet/tile) | 5.3% | 25.0% | 30.0% | 60.3% |

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Product Classification: PVC Floor Covering Rolls

HS CODE: 3918101040, 3918102000, 3918101020, 3918901000 (all with the same tax structure)

🔍 Classification Summary:

- These HS codes classify PVC (Polyvinyl Chloride) floor covering rolls and other plastic floor coverings, whether self-adhesive or not, in sheet or tile form.

- The product is not carpet, but floor covering made of plastic, specifically PVC.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a new policy and may affect your import costs significantly.

✅ Action Required: Monitor the exact date of import and consider adjusting your import schedule accordingly.

🛑 Anti-Dumping Duties (if applicable):

- Not applicable for PVC floor coverings under these HS codes.

However, if the product contains iron or aluminum components, check for anti-dumping duties separately.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is 100% PVC or PVC-based to avoid misclassification.

- Check Unit Price: Tariff rates may vary based on value or quantity, so confirm the unit price and total value of the shipment.

- Certifications Required: Some countries may require product certifications (e.g., fire resistance, environmental standards). Confirm the import regulations of the destination country.

- Consult Customs Broker: For complex classifications or large shipments, it's advisable to seek professional customs advice to avoid delays or penalties.

🧾 Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tax |

|---|---|---|---|---|---|

| 3918101040 | PVC floor covering rolls | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918102000 | PVC carpets (other) | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101020 | Plastic floor coverings (sheet/tile) | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918901000 | Plastic floor coverings (sheet/tile) | 5.3% | 25.0% | 30.0% | 60.3% |

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.