| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the customs classification and tariff information for PVC Floor Cutting products, based on the provided HS codes and tax details:

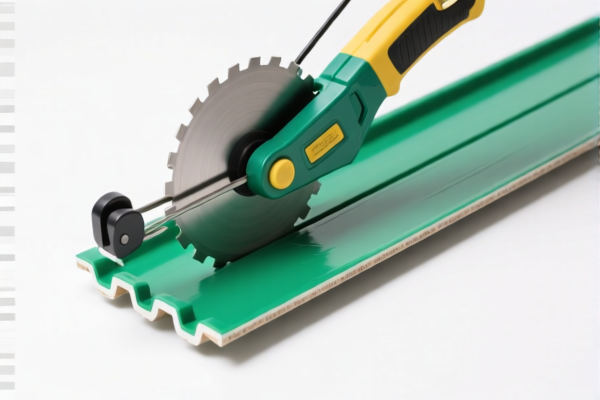

📦 Product Classification Overview: PVC Floor Cutting Tools and Components

✅ HS Code: 3918102000

- Description: PVC floor cutting strips, cutting blades, and other tools or components related to PVC flooring.

- Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code includes PVC-based carpets, floor coverings, and wall/ceiling coverings.

- Applicable to tools and components used in PVC flooring.

✅ HS Code: 3904220000

- Description: PVC floor products made from plasticized polyvinyl chloride (PVC).

- Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for finished PVC flooring products, not tools or components.

- Higher base tariff compared to 3918102000.

✅ HS Code: 3918101030

- Description: PVC floor coverings made from polyvinyl chloride polymer.

- Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is for finished PVC floor coverings, not tools or components.

- Similar to 3918102000 but more specific to floor coverings.

✅ HS Code: 3918102000 (Duplicate Entry)

- Description: PVC floor sheets, strips, tiles, etc.

- Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This is a duplicate of the first entry. Ensure correct product description to avoid misclassification.

⚠️ Important Alerts and Recommendations

- Time-Sensitive Policy:

-

Additional tariffs of 30.0% will be applied after April 11, 2025. Ensure your import timeline is aligned with this.

-

Anti-Dumping Duties:

-

Not explicitly mentioned for PVC products, but always verify if your product is subject to anti-dumping or countervailing duties based on the country of origin.

-

Certifications and Documentation:

- Confirm if certifications (e.g., CE, ISO, or specific import permits) are required for your product.

-

Verify material composition and unit price to ensure correct HS code classification.

-

Proactive Actions:

- Double-check the product description to avoid misclassification (e.g., tools vs. finished flooring).

- Consult with a customs broker or local customs authority for real-time updates on tariff changes.

📌 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|---|

| 3918102000 | PVC floor cutting tools/components | 5.3% | 25.0% | 30.0% | 60.3% |

| 3904220000 | PVC floor products | 6.5% | 25.0% | 30.0% | 61.5% |

| 3918101030 | PVC floor coverings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918102000 | PVC floor sheets, strips, tiles (duplicate) | 5.3% | 25.0% | 30.0% | 60.3% |

If you need further clarification on the difference between 3918101030 and 3918102000, or help with certification requirements, feel free to ask. Here is the structured and professional breakdown of the customs classification and tariff information for PVC Floor Cutting products, based on the provided HS codes and tax details:

📦 Product Classification Overview: PVC Floor Cutting Tools and Components

✅ HS Code: 3918102000

- Description: PVC floor cutting strips, cutting blades, and other tools or components related to PVC flooring.

- Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code includes PVC-based carpets, floor coverings, and wall/ceiling coverings.

- Applicable to tools and components used in PVC flooring.

✅ HS Code: 3904220000

- Description: PVC floor products made from plasticized polyvinyl chloride (PVC).

- Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for finished PVC flooring products, not tools or components.

- Higher base tariff compared to 3918102000.

✅ HS Code: 3918101030

- Description: PVC floor coverings made from polyvinyl chloride polymer.

- Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is for finished PVC floor coverings, not tools or components.

- Similar to 3918102000 but more specific to floor coverings.

✅ HS Code: 3918102000 (Duplicate Entry)

- Description: PVC floor sheets, strips, tiles, etc.

- Tariff Summary:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This is a duplicate of the first entry. Ensure correct product description to avoid misclassification.

⚠️ Important Alerts and Recommendations

- Time-Sensitive Policy:

-

Additional tariffs of 30.0% will be applied after April 11, 2025. Ensure your import timeline is aligned with this.

-

Anti-Dumping Duties:

-

Not explicitly mentioned for PVC products, but always verify if your product is subject to anti-dumping or countervailing duties based on the country of origin.

-

Certifications and Documentation:

- Confirm if certifications (e.g., CE, ISO, or specific import permits) are required for your product.

-

Verify material composition and unit price to ensure correct HS code classification.

-

Proactive Actions:

- Double-check the product description to avoid misclassification (e.g., tools vs. finished flooring).

- Consult with a customs broker or local customs authority for real-time updates on tariff changes.

📌 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|---|

| 3918102000 | PVC floor cutting tools/components | 5.3% | 25.0% | 30.0% | 60.3% |

| 3904220000 | PVC floor products | 6.5% | 25.0% | 30.0% | 61.5% |

| 3918101030 | PVC floor coverings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918102000 | PVC floor sheets, strips, tiles (duplicate) | 5.3% | 25.0% | 30.0% | 60.3% |

If you need further clarification on the difference between 3918101030 and 3918102000, or help with certification requirements, feel free to ask.

Customer Reviews

No reviews yet.