Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

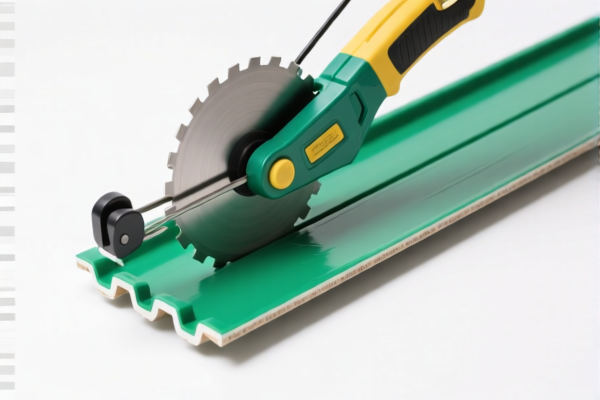

Product Name: PVC Floor Cutting Knife

HS CODE: 3918102000

✅ Classification Summary

- The product "PVC Floor Cutting Knife" is classified under HS CODE 3918102000, which covers flooring, carpets, or wall/ceiling coverings made of polyvinyl chloride (PVC) polymer.

- This classification is consistent with the product description, as the cutting knife is made of PVC and is used for PVC flooring.

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 60.3%

⚠️ Note: The additional tariffs (25.0%) and the special tariff (30.0%) after April 11, 2025, are not included in the base rate and must be applied separately.

📌 Key Considerations

- Material Verification: Ensure the product is indeed made of PVC polymer and not a composite or mixed material, which could affect classification.

- Product Use: The HS code is based on the material, not the function. Even if the product is a cutting tool, its material composition determines the classification.

- Certifications: Confirm if any import certifications or compliance documents are required for PVC products, especially if being imported into specific markets (e.g., EU, US, etc.).

- Unit Price: Be aware that tariff calculations may depend on the unit price and classification of the product.

📌 Proactive Advice

- Double-check the product composition to ensure it is made of PVC polymer and not a different polymer or composite.

- Review the latest customs regulations for any updates on tariff rates or classification changes.

- Consult a customs broker if the product is part of a larger kit or bundle, as this may affect the classification.

📌 Alternative HS Code Mentioned

- HS CODE 3904220000 was also mentioned, which covers other polyvinyl chloride (PVC) products, specifically those that are plasticized.

- However, 3918102000 is the correct and more specific classification for PVC flooring-related products, including cutting tools.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: PVC Floor Cutting Knife

HS CODE: 3918102000

✅ Classification Summary

- The product "PVC Floor Cutting Knife" is classified under HS CODE 3918102000, which covers flooring, carpets, or wall/ceiling coverings made of polyvinyl chloride (PVC) polymer.

- This classification is consistent with the product description, as the cutting knife is made of PVC and is used for PVC flooring.

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 60.3%

⚠️ Note: The additional tariffs (25.0%) and the special tariff (30.0%) after April 11, 2025, are not included in the base rate and must be applied separately.

📌 Key Considerations

- Material Verification: Ensure the product is indeed made of PVC polymer and not a composite or mixed material, which could affect classification.

- Product Use: The HS code is based on the material, not the function. Even if the product is a cutting tool, its material composition determines the classification.

- Certifications: Confirm if any import certifications or compliance documents are required for PVC products, especially if being imported into specific markets (e.g., EU, US, etc.).

- Unit Price: Be aware that tariff calculations may depend on the unit price and classification of the product.

📌 Proactive Advice

- Double-check the product composition to ensure it is made of PVC polymer and not a different polymer or composite.

- Review the latest customs regulations for any updates on tariff rates or classification changes.

- Consult a customs broker if the product is part of a larger kit or bundle, as this may affect the classification.

📌 Alternative HS Code Mentioned

- HS CODE 3904220000 was also mentioned, which covers other polyvinyl chloride (PVC) products, specifically those that are plasticized.

- However, 3918102000 is the correct and more specific classification for PVC flooring-related products, including cutting tools.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.