| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the customs classification and tariff details for PVC Floor Installation products, based on the provided HS codes and tax information:

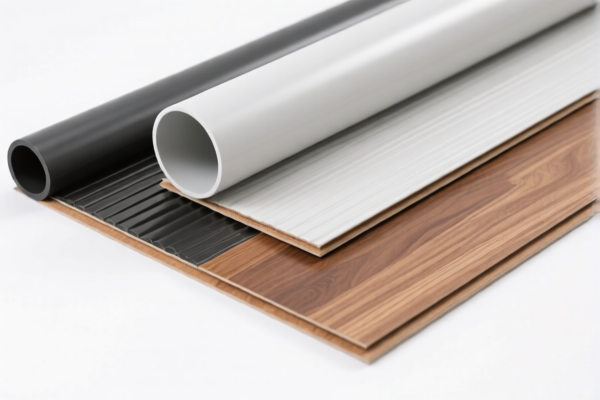

📦 Product Classification Overview: PVC Floor Installation

🔢 HS CODE: 3918101030

Product Description: PVC Floor

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to standard PVC flooring.

🔢 HS CODE: 3904220000

Product Description: PVC Floor

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to PVC flooring with specific additives or formulations.

🔢 HS CODE: 3918102000

Product Description: PVC Floor Pad

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC underlay or padding used with flooring.

🔢 HS CODE: 3918101030

Product Description: PVC Floor Tile (Click Installation)

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to interlocking or click-fit PVC floor tiles.

🔢 HS CODE: 3918102000

Product Description: PVC Waterproof Floor

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to PVC flooring with waterproofing features.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above products after April 11, 2025. Ensure your import timeline aligns with this policy.

- Anti-dumping duties: Not explicitly mentioned for PVC flooring, but always verify if your product is subject to any anti-dumping or countervailing duties.

- Material and Certification: Confirm the exact composition of the PVC (e.g., additives, thickness, installation method) to ensure correct HS code classification.

- Unit Price and Documentation: Provide accurate unit pricing and proper documentation (e.g., commercial invoice, packing list) to avoid delays or additional scrutiny at customs.

✅ Proactive Advice:

- Verify HS Code: Double-check the HS code based on the product's exact description and specifications.

- Check for Certifications: Some PVC flooring may require certifications (e.g., fire resistance, environmental standards) depending on the destination country.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and minimize risks.

Let me know if you need help determining the correct HS code for a specific product variant or if you need assistance with customs documentation. Here is the structured and professional breakdown of the customs classification and tariff details for PVC Floor Installation products, based on the provided HS codes and tax information:

📦 Product Classification Overview: PVC Floor Installation

🔢 HS CODE: 3918101030

Product Description: PVC Floor

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to standard PVC flooring.

🔢 HS CODE: 3904220000

Product Description: PVC Floor

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to PVC flooring with specific additives or formulations.

🔢 HS CODE: 3918102000

Product Description: PVC Floor Pad

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC underlay or padding used with flooring.

🔢 HS CODE: 3918101030

Product Description: PVC Floor Tile (Click Installation)

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to interlocking or click-fit PVC floor tiles.

🔢 HS CODE: 3918102000

Product Description: PVC Waterproof Floor

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to PVC flooring with waterproofing features.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above products after April 11, 2025. Ensure your import timeline aligns with this policy.

- Anti-dumping duties: Not explicitly mentioned for PVC flooring, but always verify if your product is subject to any anti-dumping or countervailing duties.

- Material and Certification: Confirm the exact composition of the PVC (e.g., additives, thickness, installation method) to ensure correct HS code classification.

- Unit Price and Documentation: Provide accurate unit pricing and proper documentation (e.g., commercial invoice, packing list) to avoid delays or additional scrutiny at customs.

✅ Proactive Advice:

- Verify HS Code: Double-check the HS code based on the product's exact description and specifications.

- Check for Certifications: Some PVC flooring may require certifications (e.g., fire resistance, environmental standards) depending on the destination country.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and minimize risks.

Let me know if you need help determining the correct HS code for a specific product variant or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.