| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

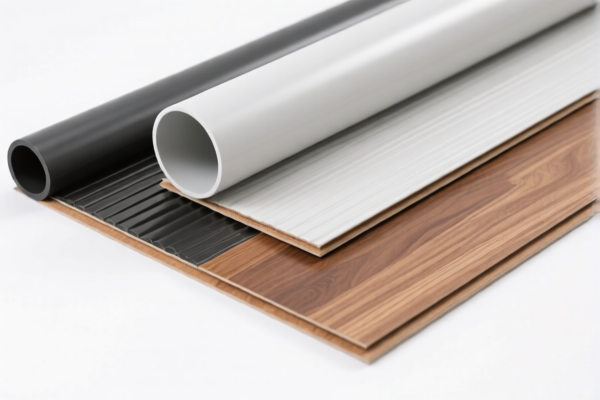

Here is the detailed classification and tariff information for the PVC Floor Installation Tool and related products, based on the provided HS codes and tax details:

📦 Product Classification Overview

✅ HS CODE: 3918102000

Product Name: PVC Floor Repair Kit

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3918101030

Product Name: PVC Floor

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3918101020

Product Name: PVC Floor Tiles

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3918901000

Product Name: PVC Floor Tiles (Alternative Classification)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3917400060

Product Name: PVC Pipe Installation Accessories

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📌 Key Notes and Recommendations

-

Tariff Increase Alert:

A 30.0% additional tariff will be applied to all these products after April 11, 2025. This is a significant increase from the current 25.0% additional tariff. Ensure your import timeline accounts for this change. -

Material Verification:

Confirm the exact composition of the product (e.g., whether it's 100% PVC or contains other materials). This can affect classification and tax rates. -

Certifications Required:

Some products may require import certifications or compliance documentation (e.g., CE, RoHS, or other relevant standards), depending on the destination country. -

Unit Price Consideration:

The total tax rate is 60.3%, which can significantly impact the final cost. Be sure to factor this into your pricing strategy and profit margin. -

Classification Accuracy:

The HS codes for PVC floor tiles (e.g., 3918101020 vs. 3918901000) may vary slightly depending on product specifics. Double-check with customs or a classification expert if the product is borderline between categories.

🛑 Proactive Action Steps

- Review the product description and technical specifications to ensure correct HS code assignment.

- Check the import date to determine if the April 11, 2025, tariff applies.

- Consult with a customs broker or tax authority for the most up-to-date and accurate classification and duty calculation.

Let me know if you need help with customs documentation or tariff calculation tools. Here is the detailed classification and tariff information for the PVC Floor Installation Tool and related products, based on the provided HS codes and tax details:

📦 Product Classification Overview

✅ HS CODE: 3918102000

Product Name: PVC Floor Repair Kit

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3918101030

Product Name: PVC Floor

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3918101020

Product Name: PVC Floor Tiles

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3918901000

Product Name: PVC Floor Tiles (Alternative Classification)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3917400060

Product Name: PVC Pipe Installation Accessories

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📌 Key Notes and Recommendations

-

Tariff Increase Alert:

A 30.0% additional tariff will be applied to all these products after April 11, 2025. This is a significant increase from the current 25.0% additional tariff. Ensure your import timeline accounts for this change. -

Material Verification:

Confirm the exact composition of the product (e.g., whether it's 100% PVC or contains other materials). This can affect classification and tax rates. -

Certifications Required:

Some products may require import certifications or compliance documentation (e.g., CE, RoHS, or other relevant standards), depending on the destination country. -

Unit Price Consideration:

The total tax rate is 60.3%, which can significantly impact the final cost. Be sure to factor this into your pricing strategy and profit margin. -

Classification Accuracy:

The HS codes for PVC floor tiles (e.g., 3918101020 vs. 3918901000) may vary slightly depending on product specifics. Double-check with customs or a classification expert if the product is borderline between categories.

🛑 Proactive Action Steps

- Review the product description and technical specifications to ensure correct HS code assignment.

- Check the import date to determine if the April 11, 2025, tariff applies.

- Consult with a customs broker or tax authority for the most up-to-date and accurate classification and duty calculation.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.