| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

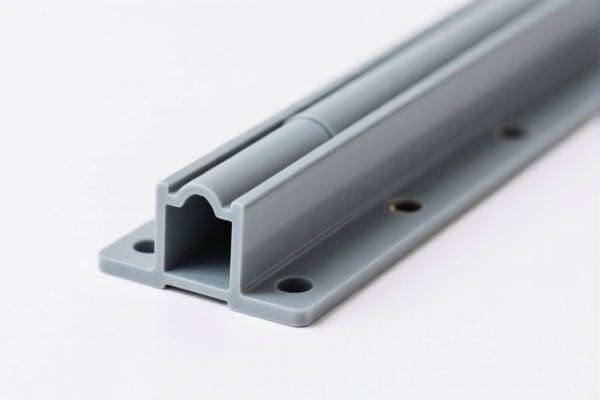

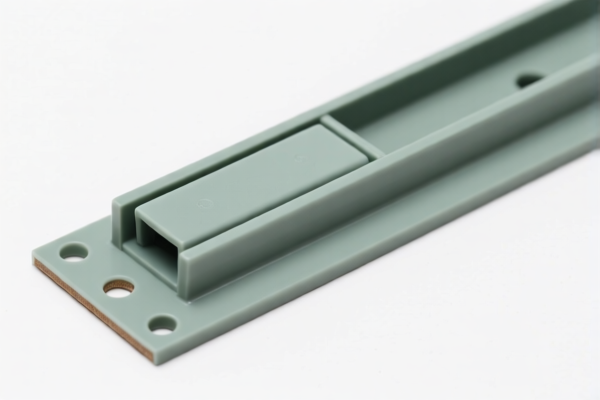

Product Classification: PVC Floor Lock

HS CODEs and Tax Details:

- HS CODE: 3918102000

- Description: PVC Floor Lock System

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to imports after this date)

-

HS CODE: 3904400000

- Description: PVC Lock

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to imports after this date)

-

HS CODE: 3918101040

- Description: PVC Floor Tile – Locking Type

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to imports after this date)

-

HS CODE: 3918101030

- Description: PVC Floor Tile (Locking Installation)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to imports after this date)

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered when planning import schedules. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for PVC floor locks or related products in the provided data. -

Material and Certification Requirements:

- Verify the material composition (e.g., PVC content, additives) to ensure correct classification.

- Confirm if certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

- Ensure product labeling and technical documentation are in compliance with local regulations.

✅ Proactive Advice:

- Double-check the HS code based on the exact product description and function (e.g., whether it is a lock system, tile, or component).

- Consult with customs brokers or local authorities for the most up-to-date tariff information, especially regarding the April 11, 2025, policy.

-

Keep records of product specifications, pricing, and origin to support customs declarations and avoid delays. Product Classification: PVC Floor Lock

HS CODEs and Tax Details: -

HS CODE: 3918102000

- Description: PVC Floor Lock System

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to imports after this date)

-

HS CODE: 3904400000

- Description: PVC Lock

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to imports after this date)

-

HS CODE: 3918101040

- Description: PVC Floor Tile – Locking Type

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to imports after this date)

-

HS CODE: 3918101030

- Description: PVC Floor Tile (Locking Installation)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to imports after this date)

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered when planning import schedules. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for PVC floor locks or related products in the provided data. -

Material and Certification Requirements:

- Verify the material composition (e.g., PVC content, additives) to ensure correct classification.

- Confirm if certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

- Ensure product labeling and technical documentation are in compliance with local regulations.

✅ Proactive Advice:

- Double-check the HS code based on the exact product description and function (e.g., whether it is a lock system, tile, or component).

- Consult with customs brokers or local authorities for the most up-to-date tariff information, especially regarding the April 11, 2025, policy.

- Keep records of product specifications, pricing, and origin to support customs declarations and avoid delays.

Customer Reviews

No reviews yet.