| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

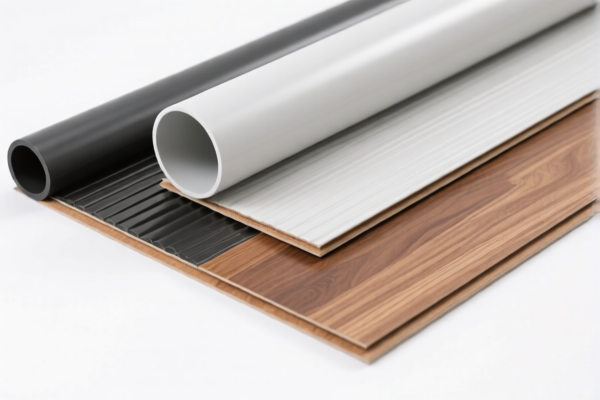

Here is the structured and professional breakdown of the PVC Floor Production product classification under the Harmonized System (HS) codes, including tax details and compliance considerations:

📦 Product Classification Overview: PVC Floor Production

✅ HS CODE: 3904220000

- Description: PVC Floor (Plasticized Polyvinyl Chloride Products)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for plasticized PVC products, which are commonly used in flooring.

✅ HS CODE: 3918101030

- Description: PVC Floor (Floor Covering Made of Polyvinyl Chloride Polymer)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for floor coverings made of PVC polymer, including tiles or sheets.

✅ HS CODE: 3921125000

- Description: PVC Floor Board (Other Plastic Sheets, Films, Foils, Strips)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for plastic sheets or boards, including PVC floor boards.

✅ HS CODE: 3918102000

- Description: PVC Tile Floor (Roll or Tile Form Floor Covering Made of Polyvinyl Chloride Polymer)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for PVC tiles or rolls used as floor coverings.

✅ HS CODE: 3918101020

- Description: PVC Floor Tile (Vinyl Tiles Made of Polyvinyl Chloride Polymer)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for vinyl tiles made of PVC polymer.

⚠️ Important Notes and Compliance Actions:

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be applied after April 11, 2025 for all the above HS codes.

-

This is a time-sensitive policy—ensure your import timeline is aligned accordingly.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are listed for PVC flooring in this context, but always verify with the latest customs updates or consult a customs broker for confirmation.

-

Certifications and Documentation:

- Verify the material composition and unit price to ensure correct classification.

-

Confirm if certifications (e.g., fire safety, environmental compliance) are required for import into the destination country.

-

Customs Clearance:

- Ensure all product specifications, packaging, and origin documentation are accurate to avoid delays or reclassification.

📌 Proactive Advice:

- Double-check the HS code based on the exact product type (e.g., tiles vs. sheets, PVC vs. other plastics).

- Monitor policy updates after April 11, 2025, as the special tariff may change.

- Consult a customs expert if your product includes mixed materials or special coatings.

Let me know if you need help with customs documentation templates or tariff calculation tools. Here is the structured and professional breakdown of the PVC Floor Production product classification under the Harmonized System (HS) codes, including tax details and compliance considerations:

📦 Product Classification Overview: PVC Floor Production

✅ HS CODE: 3904220000

- Description: PVC Floor (Plasticized Polyvinyl Chloride Products)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for plasticized PVC products, which are commonly used in flooring.

✅ HS CODE: 3918101030

- Description: PVC Floor (Floor Covering Made of Polyvinyl Chloride Polymer)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for floor coverings made of PVC polymer, including tiles or sheets.

✅ HS CODE: 3921125000

- Description: PVC Floor Board (Other Plastic Sheets, Films, Foils, Strips)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for plastic sheets or boards, including PVC floor boards.

✅ HS CODE: 3918102000

- Description: PVC Tile Floor (Roll or Tile Form Floor Covering Made of Polyvinyl Chloride Polymer)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for PVC tiles or rolls used as floor coverings.

✅ HS CODE: 3918101020

- Description: PVC Floor Tile (Vinyl Tiles Made of Polyvinyl Chloride Polymer)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is for vinyl tiles made of PVC polymer.

⚠️ Important Notes and Compliance Actions:

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be applied after April 11, 2025 for all the above HS codes.

-

This is a time-sensitive policy—ensure your import timeline is aligned accordingly.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are listed for PVC flooring in this context, but always verify with the latest customs updates or consult a customs broker for confirmation.

-

Certifications and Documentation:

- Verify the material composition and unit price to ensure correct classification.

-

Confirm if certifications (e.g., fire safety, environmental compliance) are required for import into the destination country.

-

Customs Clearance:

- Ensure all product specifications, packaging, and origin documentation are accurate to avoid delays or reclassification.

📌 Proactive Advice:

- Double-check the HS code based on the exact product type (e.g., tiles vs. sheets, PVC vs. other plastics).

- Monitor policy updates after April 11, 2025, as the special tariff may change.

- Consult a customs expert if your product includes mixed materials or special coatings.

Let me know if you need help with customs documentation templates or tariff calculation tools.

Customer Reviews

No reviews yet.