| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

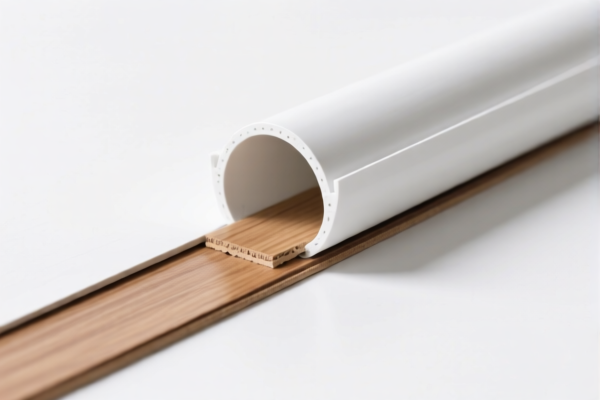

Here is the structured and professional classification and tariff information for the PVC Floor Repair Tool based on the provided HS codes and tax details:

✅ HS CODE: 3918102000

Product Description:

- PVC floor repair tools fall under this code, which covers flooring, carpets, or wall/ceiling coverings made of polyvinyl chloride (PVC) polymers.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

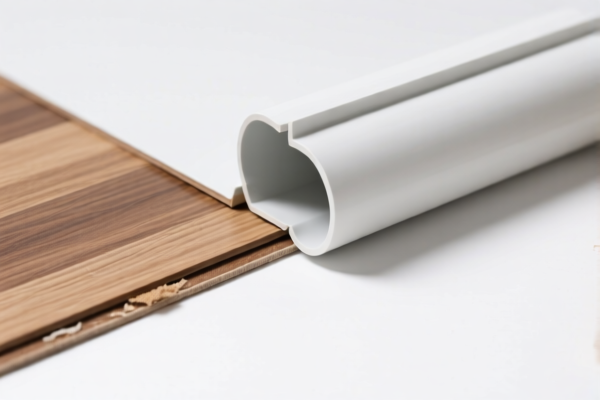

✅ HS CODE: 3918101030

Product Description:

- This code applies to floor coverings made of polyvinyl chloride (PVC) polymers.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

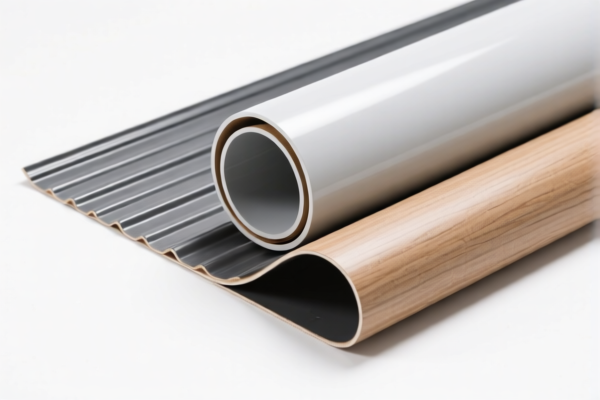

✅ HS CODE: 3904220000

Product Description:

- This code applies to other plastic products made of PVC (plasticized), which may include PVC floor repair tools if they are not classified under the more specific 391810 codes.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be applied after April 11, 2025. Ensure your customs clearance is completed before this date if you want to avoid the higher rate.

-

Material Verification:

-

Confirm the exact composition of the product (e.g., whether it is a floor covering or a general plastic tool) to ensure correct HS code classification.

-

Certifications Required:

-

Check if any certifications (e.g., RoHS, REACH, or product safety standards) are required for import into the destination country.

-

Unit Price and Classification:

- Verify the unit price and product description to ensure the correct HS code is applied, as misclassification can lead to delays or penalties.

🛑 Proactive Advice:

- If the product is a tool rather than a floor covering, it may be more appropriately classified under 3904220000.

- Always consult with a customs broker or classification expert for final confirmation, especially if the product is complex or has multiple components.

Let me know if you need help with a specific product description or customs documentation. Here is the structured and professional classification and tariff information for the PVC Floor Repair Tool based on the provided HS codes and tax details:

✅ HS CODE: 3918102000

Product Description:

- PVC floor repair tools fall under this code, which covers flooring, carpets, or wall/ceiling coverings made of polyvinyl chloride (PVC) polymers.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3918101030

Product Description:

- This code applies to floor coverings made of polyvinyl chloride (PVC) polymers.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3904220000

Product Description:

- This code applies to other plastic products made of PVC (plasticized), which may include PVC floor repair tools if they are not classified under the more specific 391810 codes.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be applied after April 11, 2025. Ensure your customs clearance is completed before this date if you want to avoid the higher rate.

-

Material Verification:

-

Confirm the exact composition of the product (e.g., whether it is a floor covering or a general plastic tool) to ensure correct HS code classification.

-

Certifications Required:

-

Check if any certifications (e.g., RoHS, REACH, or product safety standards) are required for import into the destination country.

-

Unit Price and Classification:

- Verify the unit price and product description to ensure the correct HS code is applied, as misclassification can lead to delays or penalties.

🛑 Proactive Advice:

- If the product is a tool rather than a floor covering, it may be more appropriately classified under 3904220000.

- Always consult with a customs broker or classification expert for final confirmation, especially if the product is complex or has multiple components.

Let me know if you need help with a specific product description or customs documentation.

Customer Reviews

No reviews yet.