| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured analysis and customs compliance information for the PVC Floor Strip product based on the provided HS codes and tax details:

✅ Product Classification Overview: PVC Floor Strip

Below are the possible HS codes and associated tariff details for PVC floor strips:

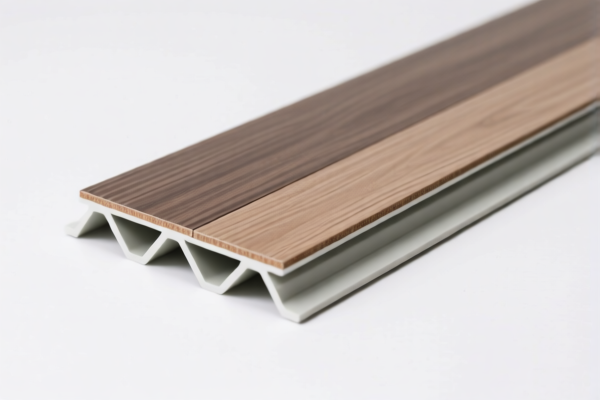

🔢 HS Code: 3918102000

Description: PVC floor strips, PVC floor cut strips, PVC floor sheets, etc.

Classification: Floor coverings made of polyvinyl chloride (PVC) polymer.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔢 HS Code: 3916200020

Description: PVC floor decorative strips, PVC plastic balcony floor strips, etc.

Classification: Rods, sticks, and profiles made of plastic.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

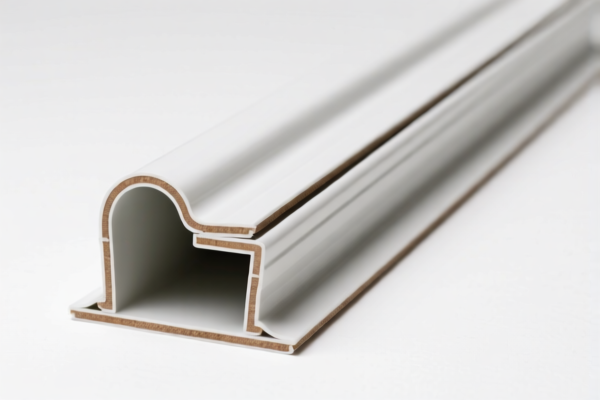

🔢 HS Code: 3921125000

Description: PVC floor boards

Classification: Other plastic sheets, plates, films, foils, and strips.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

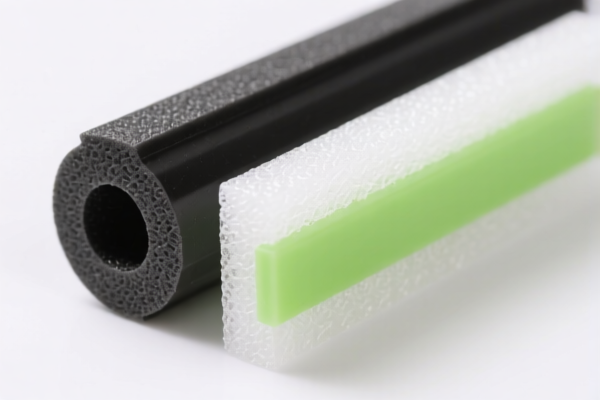

🔢 HS Code: 3904220000

Description: PVC strips

Classification: Plasticized polyvinyl chloride (PVC) in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes and Recommendations:

- Tariff Increase Alert: A 30% additional tariff will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the PVC floor strip (e.g., whether it is a finished product or raw material) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., CE, RoHS, or fire safety) are required for import into the destination country.

- Unit Price: Be aware that tariff calculations are often based on unit price, so ensure accurate pricing and product description for customs declarations.

📌 Proactive Advice:

- Double-check the product's final use (e.g., for flooring, decoration, or industrial use) to determine the most accurate HS code.

- Consult a customs broker or import compliance expert if the product is complex or if you're unsure about the classification.

- Keep records of product specifications, material composition, and intended use to support customs declarations.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured analysis and customs compliance information for the PVC Floor Strip product based on the provided HS codes and tax details:

✅ Product Classification Overview: PVC Floor Strip

Below are the possible HS codes and associated tariff details for PVC floor strips:

🔢 HS Code: 3918102000

Description: PVC floor strips, PVC floor cut strips, PVC floor sheets, etc.

Classification: Floor coverings made of polyvinyl chloride (PVC) polymer.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔢 HS Code: 3916200020

Description: PVC floor decorative strips, PVC plastic balcony floor strips, etc.

Classification: Rods, sticks, and profiles made of plastic.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

🔢 HS Code: 3921125000

Description: PVC floor boards

Classification: Other plastic sheets, plates, films, foils, and strips.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

🔢 HS Code: 3904220000

Description: PVC strips

Classification: Plasticized polyvinyl chloride (PVC) in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes and Recommendations:

- Tariff Increase Alert: A 30% additional tariff will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the PVC floor strip (e.g., whether it is a finished product or raw material) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., CE, RoHS, or fire safety) are required for import into the destination country.

- Unit Price: Be aware that tariff calculations are often based on unit price, so ensure accurate pricing and product description for customs declarations.

📌 Proactive Advice:

- Double-check the product's final use (e.g., for flooring, decoration, or industrial use) to determine the most accurate HS code.

- Consult a customs broker or import compliance expert if the product is complex or if you're unsure about the classification.

- Keep records of product specifications, material composition, and intended use to support customs declarations.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.