| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4409290655 | Doc | 58.2% | CN | US | 2025-05-12 |

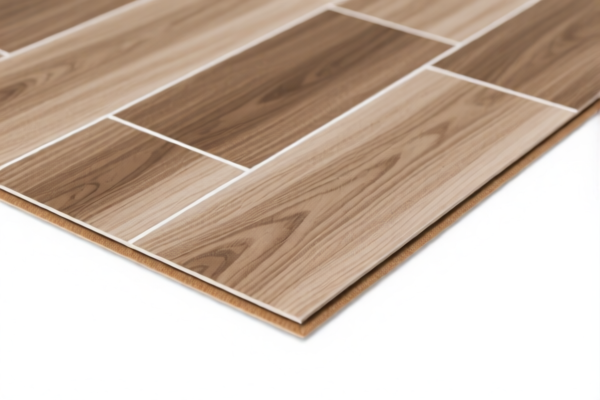

Product Classification: PVC Floor Texture

HS CODEs and Tax Information Summary:

✅ HS CODE: 3918101020

Description:

- PVC floor tiles with textured surface.

- Classified under "Vinyl tiles made of rigid solid polymer core."

- Applies to both tiles and rolls (as both are forms of floor coverings).

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 60.3%

Notes:

- This code is commonly used for PVC floor tiles or rolls with a textured surface.

- Ensure the product is not made with a flexible foam core (which would fall under a different code).

✅ HS CODE: 3918101030

Description:

- PVC floor coverings made of polyvinyl chloride (PVC).

- Specifically includes PVC floor tiles or rolls.

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 60.3%

Notes:

- This code is more general and includes all PVC-based floor coverings.

- Confirm the material composition (must be PVC) and form (tile or roll) to ensure correct classification.

✅ HS CODE: 3904220000

Description:

- PVC floor coverings made of plasticized polyvinyl chloride (PVC).

- This code is for plastic products made of PVC, including flooring.

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 61.5%

Notes:

- This code is not specific to floor coverings, but may apply if the product is plasticized PVC.

- Higher tax rate compared to 3918101020.

- Confirm if the product is plasticized (softened with plasticizers) or rigid.

✅ HS CODE: 4409290655

Description:

- Textured wooden floor with continuous shaping (e.g., tongue and groove).

- Applies to wooden floorboards with a textured surface.

Tariff Breakdown:

- Base Tariff: 3.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 58.2%

Notes:

- This is a wood-based classification, not PVC.

- Only applicable if the product is wooden and textured.

- Lower tax rate compared to PVC options.

📌 Proactive Advice for Importers:

- Verify Material: Confirm whether the product is PVC-based or wooden.

- Check Form: Determine if it is in tile, roll, or wooden board form.

- Confirm Plasticization: For PVC products, check if it is plasticized or rigid.

- Review Certifications: Some countries may require product certifications (e.g., fire resistance, environmental standards).

- Watch for Tariff Changes: The special tariff after April 11, 2025 will increase the total tax by 5%.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is borderline between categories.

Let me know if you need help with certification requirements or customs documentation.

Product Classification: PVC Floor Texture

HS CODEs and Tax Information Summary:

✅ HS CODE: 3918101020

Description:

- PVC floor tiles with textured surface.

- Classified under "Vinyl tiles made of rigid solid polymer core."

- Applies to both tiles and rolls (as both are forms of floor coverings).

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 60.3%

Notes:

- This code is commonly used for PVC floor tiles or rolls with a textured surface.

- Ensure the product is not made with a flexible foam core (which would fall under a different code).

✅ HS CODE: 3918101030

Description:

- PVC floor coverings made of polyvinyl chloride (PVC).

- Specifically includes PVC floor tiles or rolls.

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 60.3%

Notes:

- This code is more general and includes all PVC-based floor coverings.

- Confirm the material composition (must be PVC) and form (tile or roll) to ensure correct classification.

✅ HS CODE: 3904220000

Description:

- PVC floor coverings made of plasticized polyvinyl chloride (PVC).

- This code is for plastic products made of PVC, including flooring.

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 61.5%

Notes:

- This code is not specific to floor coverings, but may apply if the product is plasticized PVC.

- Higher tax rate compared to 3918101020.

- Confirm if the product is plasticized (softened with plasticizers) or rigid.

✅ HS CODE: 4409290655

Description:

- Textured wooden floor with continuous shaping (e.g., tongue and groove).

- Applies to wooden floorboards with a textured surface.

Tariff Breakdown:

- Base Tariff: 3.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 58.2%

Notes:

- This is a wood-based classification, not PVC.

- Only applicable if the product is wooden and textured.

- Lower tax rate compared to PVC options.

📌 Proactive Advice for Importers:

- Verify Material: Confirm whether the product is PVC-based or wooden.

- Check Form: Determine if it is in tile, roll, or wooden board form.

- Confirm Plasticization: For PVC products, check if it is plasticized or rigid.

- Review Certifications: Some countries may require product certifications (e.g., fire resistance, environmental standards).

- Watch for Tariff Changes: The special tariff after April 11, 2025 will increase the total tax by 5%.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is borderline between categories.

Let me know if you need help with certification requirements or customs documentation.

Customer Reviews

No reviews yet.