| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

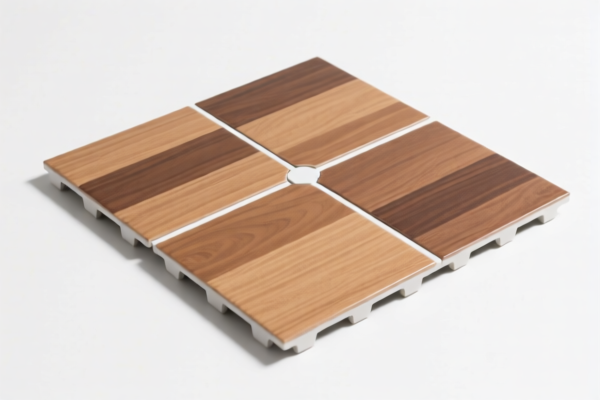

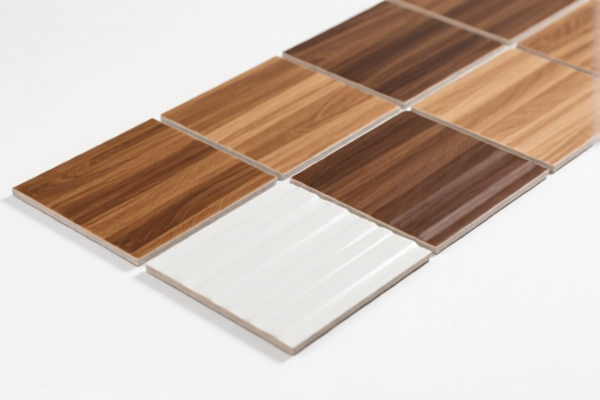

Product Name: PVC Floor Tile

Classification: Plastic Floor Covering (PVC-based)

✅ HS CODEs and Tax Details (as of current regulations):

- HS CODE: 3918101020

- Description: Plastic floor coverings made of polyvinyl chloride polymer, vinyl tiles made of rigid solid polymer core

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918901000

- Description: Plastic floor coverings

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101030

- Description: Plastic floor coverings, including those made of polyvinyl chloride polymer

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918102000

- Description: Plastic floor coverings

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101040

- Description: As per HS CODE 3918.10.10.40

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

⚠️ Key Notes and Alerts:

-

April 11, 2025 Tariff Increase:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning and import scheduling. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for PVC floor tiles under these HS codes. -

No Special Tariffs on Iron or Aluminum:

These products are not classified under iron or aluminum, so no related anti-dumping duties apply.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of PVC and not a composite or mixed material, as this may affect classification.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., fire resistance, environmental standards) are required for import.

- Monitor Tariff Updates: Keep track of any changes in customs policies, especially around April 11, 2025, to avoid unexpected costs.

- Consult Local Customs Authority: For the most accurate and up-to-date classification and tariff information, always verify with local customs or a qualified customs broker.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Name: PVC Floor Tile

Classification: Plastic Floor Covering (PVC-based)

✅ HS CODEs and Tax Details (as of current regulations):

- HS CODE: 3918101020

- Description: Plastic floor coverings made of polyvinyl chloride polymer, vinyl tiles made of rigid solid polymer core

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918901000

- Description: Plastic floor coverings

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101030

- Description: Plastic floor coverings, including those made of polyvinyl chloride polymer

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918102000

- Description: Plastic floor coverings

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101040

- Description: As per HS CODE 3918.10.10.40

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

⚠️ Key Notes and Alerts:

-

April 11, 2025 Tariff Increase:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning and import scheduling. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for PVC floor tiles under these HS codes. -

No Special Tariffs on Iron or Aluminum:

These products are not classified under iron or aluminum, so no related anti-dumping duties apply.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of PVC and not a composite or mixed material, as this may affect classification.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., fire resistance, environmental standards) are required for import.

- Monitor Tariff Updates: Keep track of any changes in customs policies, especially around April 11, 2025, to avoid unexpected costs.

- Consult Local Customs Authority: For the most accurate and up-to-date classification and tariff information, always verify with local customs or a qualified customs broker.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.