| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

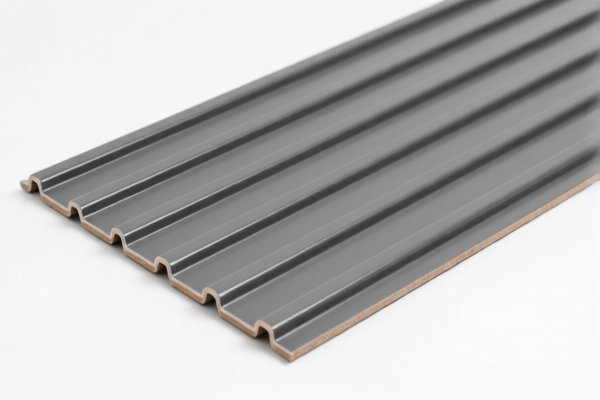

Here is the detailed customs compliance analysis for PVC Floor Tiles based on the provided HS codes and tax information:

📦 Product Classification Overview: PVC Floor Tiles

All the listed HS codes fall under Chapter 39 of the Harmonized System, which covers Plastics and articles thereof. Specifically, they are classified under Heading 3918, which includes Plastic floor coverings, whether or not with a backing, not elsewhere specified or included.

📊 Tariff Summary (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Note: The 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

📌 HS Code Breakdown

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3918102000 | PVC瓷砖地板 (PVC Floor Tiles) | 60.3% | General use, may include decorative patterns |

| 3918101030 | PVC地板砖 (Indoor, irregular, stone-patterned, etc.) | 60.3% | Includes various types of PVC floor tiles |

| 3918101020 | PVC地板砖 (General) | 60.3% | Standard PVC floor tiles |

| 3918901000 | PVC地板砖 (Other) | 60.3% | For other types not covered by specific codes |

| 3918101040 | PVC地板砖 (Other) | 60.3% | Additional classification for specific designs |

📌 Key Considerations for Importers

- Material Verification: Confirm that the product is indeed made of PVC (Polyvinyl Chloride) and not a composite or mixed material, as this can affect classification.

- Unit Price: The tax rate is based on the FOB (Free On Board) price, so ensure accurate pricing for customs valuation.

- Certifications: Some countries may require product certifications (e.g., fire resistance, environmental standards) for PVC flooring.

- Tariff Date: Be aware of the April 11, 2025 deadline for the special tariff increase. Plan your import schedule accordingly.

- Anti-Dumping Duties: While not explicitly mentioned here, anti-dumping duties may apply if the product is subject to such measures. Check with customs or a trade compliance expert.

📌 Proactive Advice

- Double-check the HS code based on the specific design, use (indoor/outdoor), and material composition of the PVC floor tiles.

- Consult a customs broker or trade compliance expert for accurate classification and to avoid delays or penalties.

- Keep records of product specifications, invoices, and certifications for customs audits.

If you provide more details about the specific design, thickness, or intended use of the PVC floor tiles, I can help you further refine the HS code and tax implications. Here is the detailed customs compliance analysis for PVC Floor Tiles based on the provided HS codes and tax information:

📦 Product Classification Overview: PVC Floor Tiles

All the listed HS codes fall under Chapter 39 of the Harmonized System, which covers Plastics and articles thereof. Specifically, they are classified under Heading 3918, which includes Plastic floor coverings, whether or not with a backing, not elsewhere specified or included.

📊 Tariff Summary (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Note: The 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

📌 HS Code Breakdown

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3918102000 | PVC瓷砖地板 (PVC Floor Tiles) | 60.3% | General use, may include decorative patterns |

| 3918101030 | PVC地板砖 (Indoor, irregular, stone-patterned, etc.) | 60.3% | Includes various types of PVC floor tiles |

| 3918101020 | PVC地板砖 (General) | 60.3% | Standard PVC floor tiles |

| 3918901000 | PVC地板砖 (Other) | 60.3% | For other types not covered by specific codes |

| 3918101040 | PVC地板砖 (Other) | 60.3% | Additional classification for specific designs |

📌 Key Considerations for Importers

- Material Verification: Confirm that the product is indeed made of PVC (Polyvinyl Chloride) and not a composite or mixed material, as this can affect classification.

- Unit Price: The tax rate is based on the FOB (Free On Board) price, so ensure accurate pricing for customs valuation.

- Certifications: Some countries may require product certifications (e.g., fire resistance, environmental standards) for PVC flooring.

- Tariff Date: Be aware of the April 11, 2025 deadline for the special tariff increase. Plan your import schedule accordingly.

- Anti-Dumping Duties: While not explicitly mentioned here, anti-dumping duties may apply if the product is subject to such measures. Check with customs or a trade compliance expert.

📌 Proactive Advice

- Double-check the HS code based on the specific design, use (indoor/outdoor), and material composition of the PVC floor tiles.

- Consult a customs broker or trade compliance expert for accurate classification and to avoid delays or penalties.

- Keep records of product specifications, invoices, and certifications for customs audits.

If you provide more details about the specific design, thickness, or intended use of the PVC floor tiles, I can help you further refine the HS code and tax implications.

Customer Reviews

No reviews yet.