Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

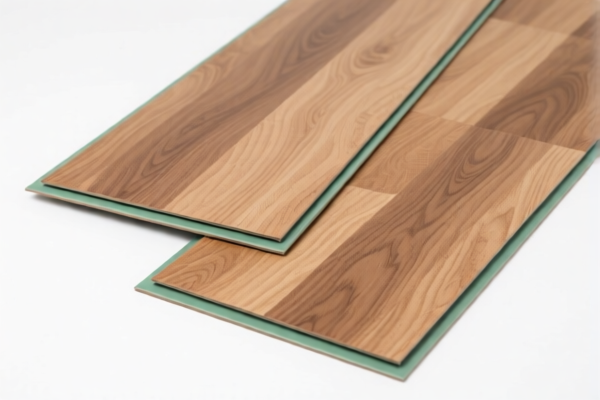

Product Classification: PVC Floor Wear Layer

HS CODE: 3918102000

🔍 Classification Summary

- The product "PVC Floor Wear Layer" is classified under HS CODE 3918102000, which falls under Chapter 39 (Plastics and articles thereof).

- This code specifically covers plastic floor coverings made of polyvinyl chloride (PVC), including sheets, tiles, or other forms used for flooring.

- The product description "PVC Floor Wear Layer" aligns with the definition of floor coverings made of PVC, making this the correct classification.

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 60.3%

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed made of PVC (polyvinyl chloride) and not a composite or blended material.

- Product Form: Ensure the product is in the form of floor coverings, such as sheets, tiles, or similar formats.

- Unit Price and Packaging: Provide accurate unit price and packaging details for customs valuation.

- Certifications: Check if any certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

- Documentation: Maintain proper commercial invoice, bill of lading, and product specifications to support the HS code classification.

🛑 Proactive Advice

- Double-check the product description to ensure it does not fall under a different HS code (e.g., 3921.90.39 for plastic sheets or 3918.10.10 for specific types of tiles).

- Consult a customs broker if the product has mixed materials or special features (e.g., anti-slip, fireproof).

- Monitor policy updates after April 11, 2025, as the special tariff may change or be extended.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: PVC Floor Wear Layer

HS CODE: 3918102000

🔍 Classification Summary

- The product "PVC Floor Wear Layer" is classified under HS CODE 3918102000, which falls under Chapter 39 (Plastics and articles thereof).

- This code specifically covers plastic floor coverings made of polyvinyl chloride (PVC), including sheets, tiles, or other forms used for flooring.

- The product description "PVC Floor Wear Layer" aligns with the definition of floor coverings made of PVC, making this the correct classification.

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 60.3%

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed made of PVC (polyvinyl chloride) and not a composite or blended material.

- Product Form: Ensure the product is in the form of floor coverings, such as sheets, tiles, or similar formats.

- Unit Price and Packaging: Provide accurate unit price and packaging details for customs valuation.

- Certifications: Check if any certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

- Documentation: Maintain proper commercial invoice, bill of lading, and product specifications to support the HS code classification.

🛑 Proactive Advice

- Double-check the product description to ensure it does not fall under a different HS code (e.g., 3921.90.39 for plastic sheets or 3918.10.10 for specific types of tiles).

- Consult a customs broker if the product has mixed materials or special features (e.g., anti-slip, fireproof).

- Monitor policy updates after April 11, 2025, as the special tariff may change or be extended.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.