| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

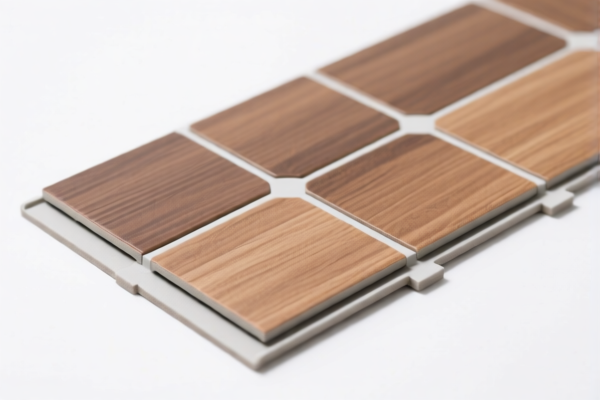

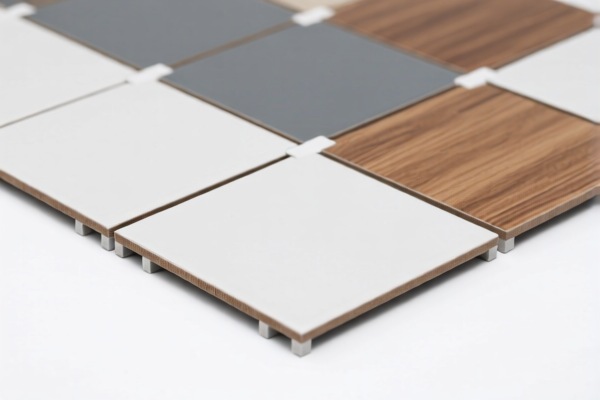

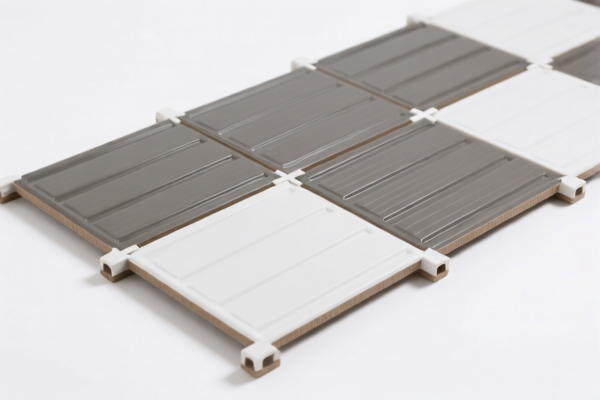

Product Name: PVC Flooring Tiles

Classification: Plastic Floor Coverings (HS Code: 3918.10.10.20, 3918.10.10.30, 3918.90.10.00, 3918.10.20.00)

🔍 HS CODE Overview and Tax Details

- HS CODE: 3918.10.10.20

- Description: Plastic floor coverings made of polyvinyl chloride (PVC) polymer, vinyl tiles made of rigid solid polymer core.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918.10.10.30

- Description: Plastic floor coverings, including those made of polyvinyl chloride (PVC) polymer.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918.90.10.00

- Description: Plastic floor coverings (not otherwise specified).

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918.10.20.00

- Description: PVC floor pads.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: The term "eco-friendly" or "environmentally friendly" is a product attribute and does not affect the HS CODE classification.

⚠️ Important Policy Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are currently listed for PVC flooring tiles. However, it is advisable to check the latest customs announcements or consult a customs broker for any updates.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC and not a composite or mixed material, as this can affect HS CODE classification.

- Check Unit Price: The tax rate is based on the declared value, so accurate pricing is essential for correct duty calculation.

- Certifications Required: Some countries may require certifications (e.g., CE, ISO, or fire safety standards) for PVC flooring tiles. Confirm the required documentation for the destination market.

- Consult a Customs Broker: For complex or high-value shipments, professional assistance can help avoid misclassification and penalties.

Let me know if you need help with customs documentation or tariff calculation for a specific shipment.

Product Name: PVC Flooring Tiles

Classification: Plastic Floor Coverings (HS Code: 3918.10.10.20, 3918.10.10.30, 3918.90.10.00, 3918.10.20.00)

🔍 HS CODE Overview and Tax Details

- HS CODE: 3918.10.10.20

- Description: Plastic floor coverings made of polyvinyl chloride (PVC) polymer, vinyl tiles made of rigid solid polymer core.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918.10.10.30

- Description: Plastic floor coverings, including those made of polyvinyl chloride (PVC) polymer.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918.90.10.00

- Description: Plastic floor coverings (not otherwise specified).

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918.10.20.00

- Description: PVC floor pads.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: The term "eco-friendly" or "environmentally friendly" is a product attribute and does not affect the HS CODE classification.

⚠️ Important Policy Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are currently listed for PVC flooring tiles. However, it is advisable to check the latest customs announcements or consult a customs broker for any updates.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC and not a composite or mixed material, as this can affect HS CODE classification.

- Check Unit Price: The tax rate is based on the declared value, so accurate pricing is essential for correct duty calculation.

- Certifications Required: Some countries may require certifications (e.g., CE, ISO, or fire safety standards) for PVC flooring tiles. Confirm the required documentation for the destination market.

- Consult a Customs Broker: For complex or high-value shipments, professional assistance can help avoid misclassification and penalties.

Let me know if you need help with customs documentation or tariff calculation for a specific shipment.

Customer Reviews

No reviews yet.