| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 4008115000 | Doc | 58.3% | CN | US | 2025-05-12 |

| 3921135000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3901909000 | Doc | 61.5% | CN | US | 2025-05-12 |

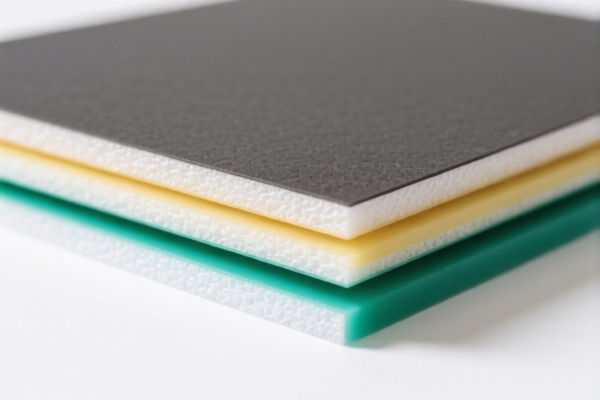

Here is the structured classification and tariff information for PVC Foam Board for Advertising, based on the provided HS codes and tax details:

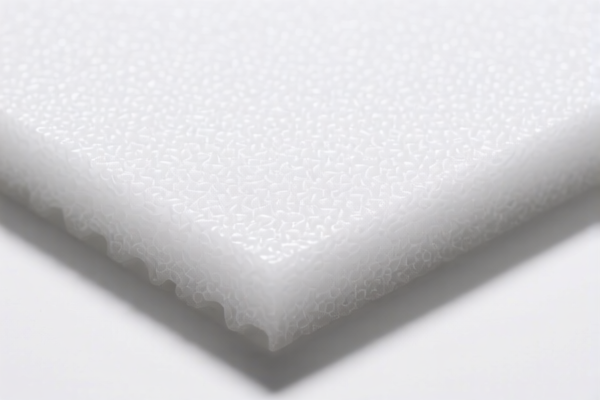

✅ HS CODE: 3921110000

Product Description:

- Other plastic sheets, plates, films, foils, and strips: honeycomb structure: made of polystyrene polymers.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes: - This code is suitable if the PVC foam board is made of polystyrene and has a honeycomb structure. - April 11 Special Tariff applies after April 11, 2025.

✅ HS CODE: 3918901000

Product Description:

- Plastic floor coverings, whether self-adhesive or not, in rolls or tiles; plastic wall or ceiling coverings.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes: - This code is more suitable for decorative or covering materials rather than structural foam boards. - Not ideal for advertising foam boards unless used as wall coverings.

✅ HS CODE: 4008115000

Product Description:

- Other honeycomb rubber sheets, plates, and strips.

Tariff Breakdown:

- Base Tariff Rate: 3.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.3%

Notes: - This is for rubber-based honeycomb materials, not PVC. - Not applicable for PVC foam boards.

✅ HS CODE: 3921135000

Product Description:

- Honeycomb polyurethane plastic sheets, plates, films, foils, and strips.

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Notes: - This code is for polyurethane-based honeycomb materials, not PVC. - Not applicable for PVC foam boards.

✅ HS CODE: 3901909000

Product Description:

- Polyethylene (ethylene polymer) products.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes: - This is for polyethylene products, not PVC foam boards. - Not applicable for PVC foam boards.

📌 Recommendation for PVC Foam Board for Advertising:

- Best Fit: HS CODE 3921110000 (if the board is made of polystyrene and has a honeycomb structure).

- Alternative: If the board is not honeycomb and is made of PVC, consider checking if it falls under a different category (e.g., 3921120000 or 3921190000), but these were not listed in your input.

🛑 Important Actions to Take:

- Verify Material Composition: Confirm whether the board is made of PVC, polystyrene, or polyurethane.

- Check Unit Price and Specifications: This will help determine the correct HS code and whether any special tariffs apply.

- Confirm Certification Requirements: Some products may require import licenses or certifications (e.g., RoHS, REACH).

- Monitor Tariff Changes: The April 11, 2025 special tariff will increase the total tax by 5% for all listed codes.

Let me know if you need help determining the exact HS code based on your product's specifications. Here is the structured classification and tariff information for PVC Foam Board for Advertising, based on the provided HS codes and tax details:

✅ HS CODE: 3921110000

Product Description:

- Other plastic sheets, plates, films, foils, and strips: honeycomb structure: made of polystyrene polymers.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes: - This code is suitable if the PVC foam board is made of polystyrene and has a honeycomb structure. - April 11 Special Tariff applies after April 11, 2025.

✅ HS CODE: 3918901000

Product Description:

- Plastic floor coverings, whether self-adhesive or not, in rolls or tiles; plastic wall or ceiling coverings.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes: - This code is more suitable for decorative or covering materials rather than structural foam boards. - Not ideal for advertising foam boards unless used as wall coverings.

✅ HS CODE: 4008115000

Product Description:

- Other honeycomb rubber sheets, plates, and strips.

Tariff Breakdown:

- Base Tariff Rate: 3.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.3%

Notes: - This is for rubber-based honeycomb materials, not PVC. - Not applicable for PVC foam boards.

✅ HS CODE: 3921135000

Product Description:

- Honeycomb polyurethane plastic sheets, plates, films, foils, and strips.

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Notes: - This code is for polyurethane-based honeycomb materials, not PVC. - Not applicable for PVC foam boards.

✅ HS CODE: 3901909000

Product Description:

- Polyethylene (ethylene polymer) products.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes: - This is for polyethylene products, not PVC foam boards. - Not applicable for PVC foam boards.

📌 Recommendation for PVC Foam Board for Advertising:

- Best Fit: HS CODE 3921110000 (if the board is made of polystyrene and has a honeycomb structure).

- Alternative: If the board is not honeycomb and is made of PVC, consider checking if it falls under a different category (e.g., 3921120000 or 3921190000), but these were not listed in your input.

🛑 Important Actions to Take:

- Verify Material Composition: Confirm whether the board is made of PVC, polystyrene, or polyurethane.

- Check Unit Price and Specifications: This will help determine the correct HS code and whether any special tariffs apply.

- Confirm Certification Requirements: Some products may require import licenses or certifications (e.g., RoHS, REACH).

- Monitor Tariff Changes: The April 11, 2025 special tariff will increase the total tax by 5% for all listed codes.

Let me know if you need help determining the exact HS code based on your product's specifications.

Customer Reviews

No reviews yet.